EX-99.2

Published on March 31, 2023

ROSIE TARGETCO LLC AND SUBSIDIARIES Consolidated Financial Statements December 31, 2022 and 2021 (With Report of Independent Auditors)

ROSIE TARGETCO LLC AND SUBSIDIARIES Table of Contents Page Report of Independent Auditors 1 Consolidated Balance Sheets — December 31, 2022 and 2021 3 Consolidated Statements of Operations and Comprehensive Income — Years ended December 31, 2022 and 2021 4 Consolidated Statements of Equity — Years ended December 31, 2022 and 2021 5 Consolidated Statements of Cash Flows — Years ended December 31, 2022 and 2021 6 Notes to Consolidated Financial Statements 7

Ernst & Young LLP One Commerce Square 2005 Market Street, Suite 700 Philadelphia, PA 19103 Tel: +1 215 448 5000 Fax: +1 215 448 4069 ey.com

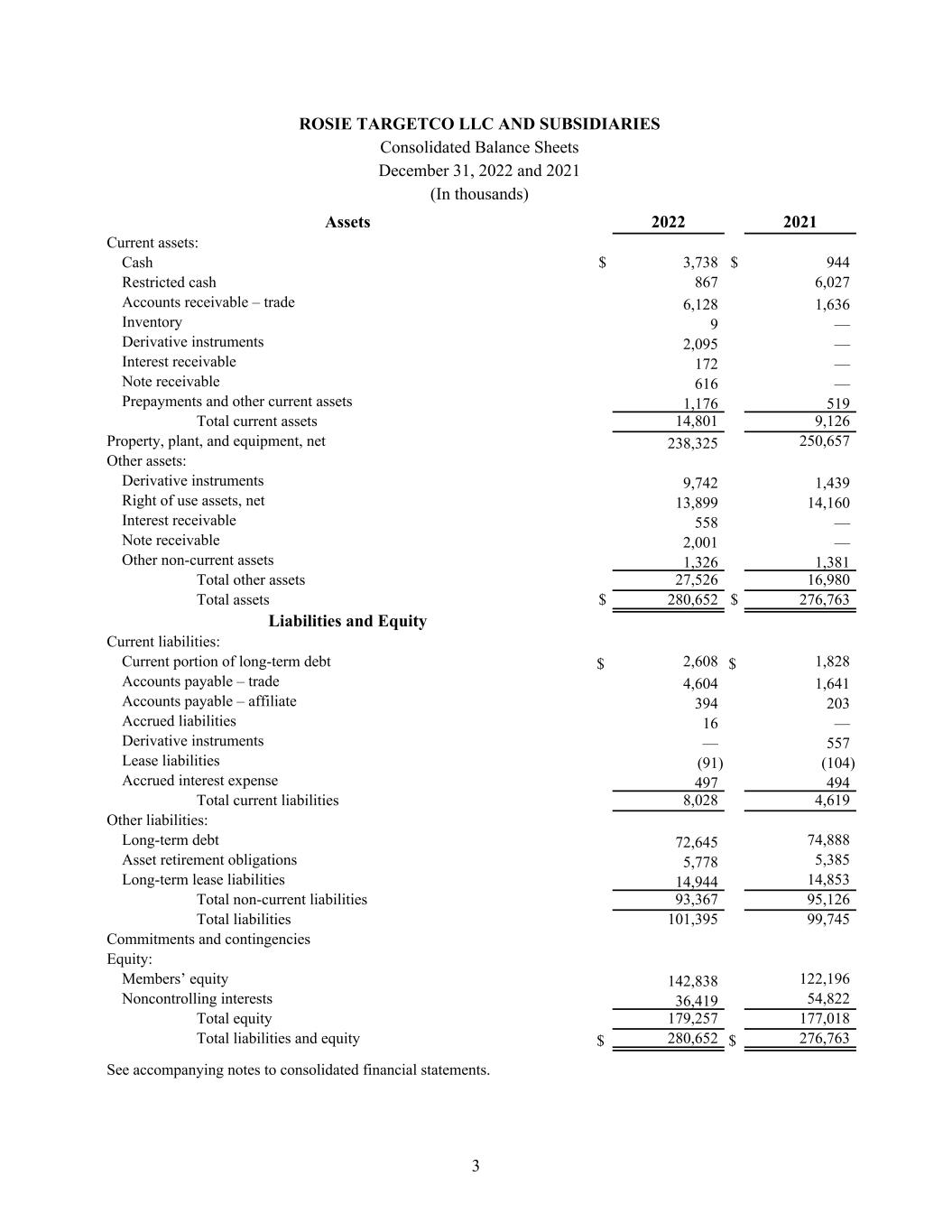

ROSIE TARGETCO LLC AND SUBSIDIARIES Consolidated Balance Sheets December 31, 2022 and 2021 (In thousands) Assets 2022 2021 Current assets: Cash $ 3,738 $ 944 Restricted cash 867 6,027 Accounts receivable – trade 6,128 1,636 Inventory 9 — Derivative instruments 2,095 — Interest receivable 172 — Note receivable 616 — Prepayments and other current assets 1,176 519 Total current assets 14,801 9,126 Property, plant, and equipment, net 238,325 250,657 Other assets: Derivative instruments 9,742 1,439 Right of use assets, net 13,899 14,160 Interest receivable 558 — Note receivable 2,001 — Other non-current assets 1,326 1,381 Total other assets 27,526 16,980 Total assets $ 280,652 $ 276,763 Liabilities and Equity Current liabilities: Current portion of long-term debt $ 2,608 $ 1,828 Accounts payable – trade 4,604 1,641 Accounts payable – affiliate 394 203 Accrued liabilities 16 — Derivative instruments — 557 Lease liabilities (91) (104) Accrued interest expense 497 494 Total current liabilities 8,028 4,619 Other liabilities: Long-term debt 72,645 74,888 Asset retirement obligations 5,778 5,385 Long-term lease liabilities 14,944 14,853 Total non-current liabilities 93,367 95,126 Total liabilities 101,395 99,745 Commitments and contingencies Equity: Members’ equity 142,838 122,196 Noncontrolling interests 36,419 54,822 Total equity 179,257 177,018 Total liabilities and equity $ 280,652 $ 276,763 See accompanying notes to consolidated financial statements. 3

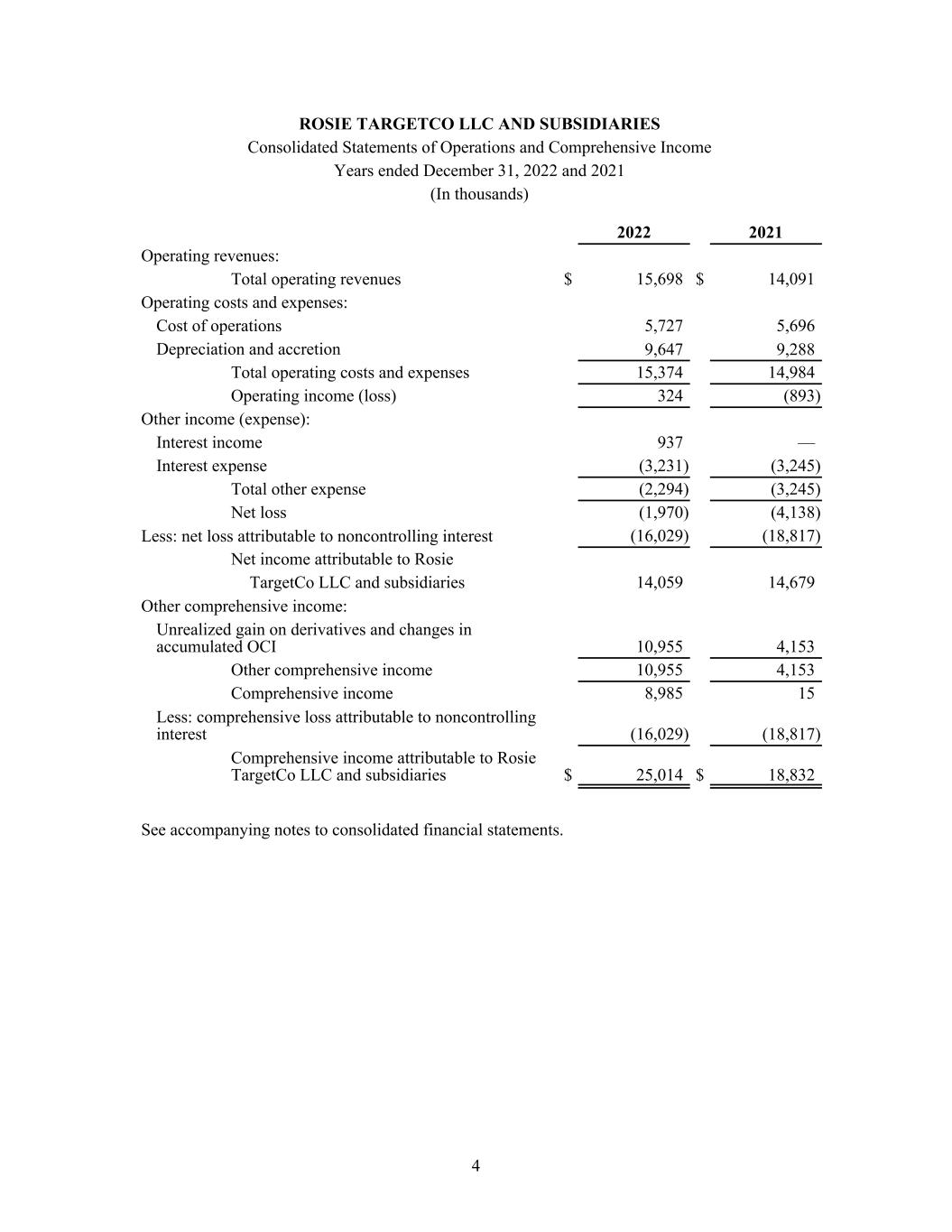

ROSIE TARGETCO LLC AND SUBSIDIARIES Consolidated Statements of Operations and Comprehensive Income Years ended December 31, 2022 and 2021 (In thousands) 2022 2021 Operating revenues: Total operating revenues $ 15,698 $ 14,091 Operating costs and expenses: Cost of operations 5,727 5,696 Depreciation and accretion 9,647 9,288 Total operating costs and expenses 15,374 14,984 Operating income (loss) 324 (893) Other income (expense): Interest income 937 — Interest expense (3,231) (3,245) Total other expense (2,294) (3,245) Net loss (1,970) (4,138) Less: net loss attributable to noncontrolling interest (16,029) (18,817) Net income attributable to Rosie TargetCo LLC and subsidiaries 14,059 14,679 Other comprehensive income: Unrealized gain on derivatives and changes in accumulated OCI 10,955 4,153 Other comprehensive income 10,955 4,153 Comprehensive income 8,985 15 Less: comprehensive loss attributable to noncontrolling interest (16,029) (18,817) Comprehensive income attributable to Rosie TargetCo LLC and subsidiaries $ 25,014 $ 18,832 See accompanying notes to consolidated financial statements. 4

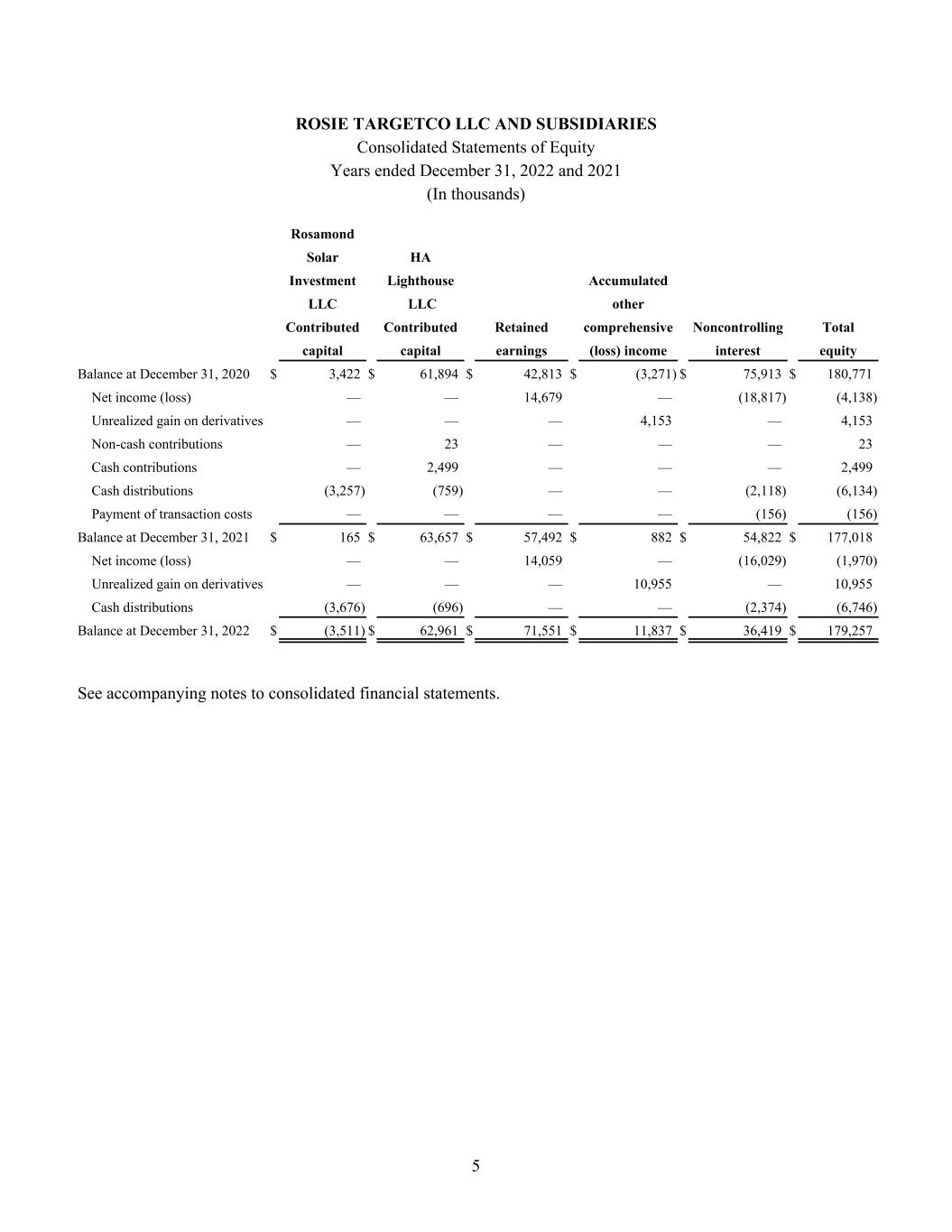

ROSIE TARGETCO LLC AND SUBSIDIARIES Consolidated Statements of Equity Years ended December 31, 2022 and 2021 (In thousands) Rosamond Solar HA Investment Lighthouse Accumulated LLC LLC other Contributed Contributed Retained comprehensive Noncontrolling Total capital capital earnings (loss) income interest equity Balance at December 31, 2020 $ 3,422 $ 61,894 $ 42,813 $ (3,271) $ 75,913 $ 180,771 Net income (loss) — — 14,679 — (18,817) (4,138) Unrealized gain on derivatives — — — 4,153 — 4,153 Non-cash contributions — 23 — — — 23 Cash contributions — 2,499 — — — 2,499 Cash distributions (3,257) (759) — — (2,118) (6,134) Payment of transaction costs — — — — (156) (156) Balance at December 31, 2021 $ 165 $ 63,657 $ 57,492 $ 882 $ 54,822 $ 177,018 Net income (loss) — — 14,059 — (16,029) (1,970) Unrealized gain on derivatives — — — 10,955 — 10,955 Cash distributions (3,676) (696) — — (2,374) (6,746) Balance at December 31, 2022 $ (3,511) $ 62,961 $ 71,551 $ 11,837 $ 36,419 $ 179,257 See accompanying notes to consolidated financial statements. 5

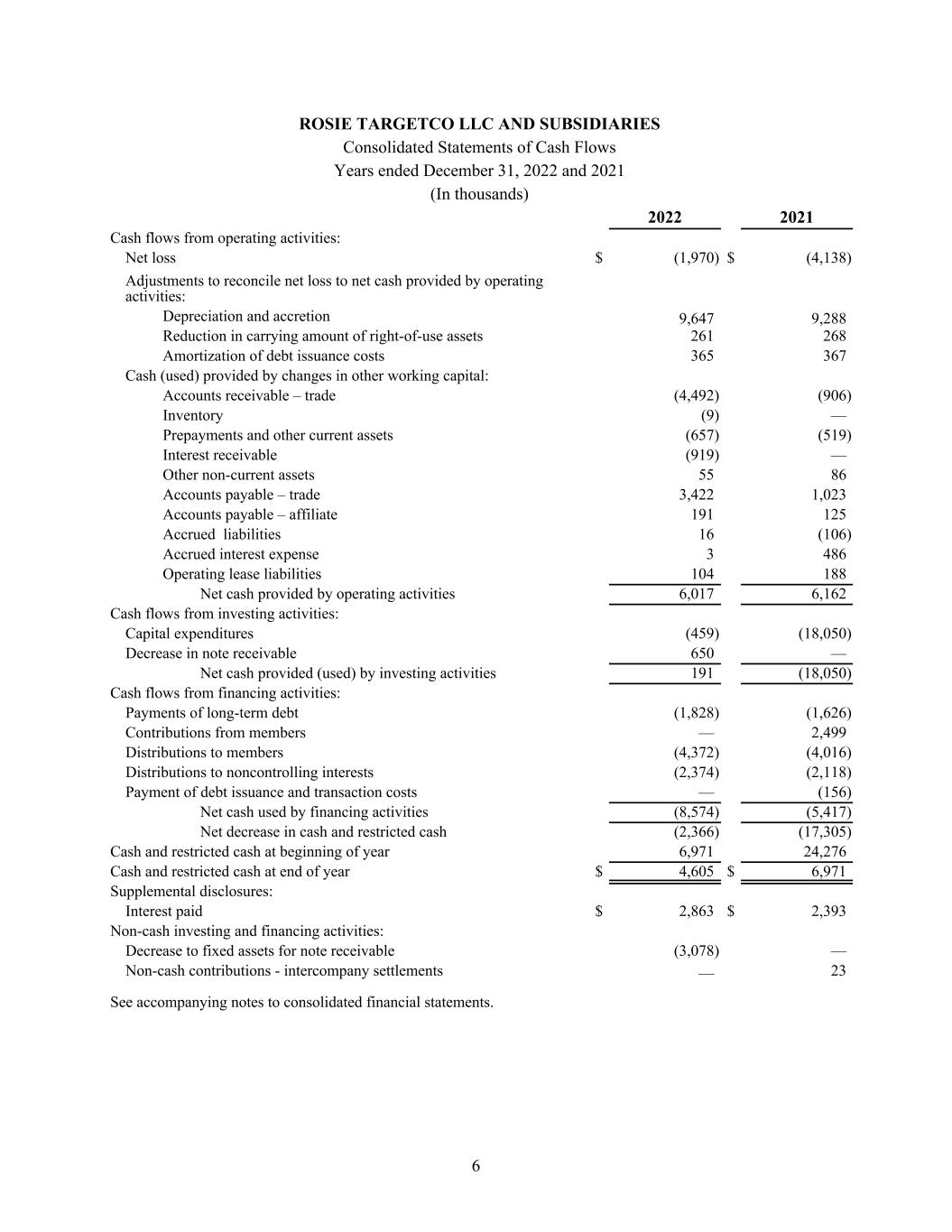

ROSIE TARGETCO LLC AND SUBSIDIARIES Consolidated Statements of Cash Flows Years ended December 31, 2022 and 2021 (In thousands) 2022 2021 Cash flows from operating activities: Net loss $ (1,970) $ (4,138) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and accretion 9,647 9,288 Reduction in carrying amount of right-of-use assets 261 268 Amortization of debt issuance costs 365 367 Cash (used) provided by changes in other working capital: Accounts receivable – trade (4,492) (906) Inventory (9) — Prepayments and other current assets (657) (519) Interest receivable (919) — Other non-current assets 55 86 Accounts payable – trade 3,422 1,023 Accounts payable – affiliate 191 125 Accrued liabilities 16 (106) Accrued interest expense 3 486 Operating lease liabilities 104 188 Net cash provided by operating activities 6,017 6,162 Cash flows from investing activities: Capital expenditures (459) (18,050) Decrease in note receivable 650 — Net cash provided (used) by investing activities 191 (18,050) Cash flows from financing activities: Payments of long-term debt (1,828) (1,626) Contributions from members — 2,499 Distributions to members (4,372) (4,016) Distributions to noncontrolling interests (2,374) (2,118) Payment of debt issuance and transaction costs — (156) Net cash used by financing activities (8,574) (5,417) Net decrease in cash and restricted cash (2,366) (17,305) Cash and restricted cash at beginning of year 6,971 24,276 Cash and restricted cash at end of year $ 4,605 $ 6,971 Supplemental disclosures: Interest paid $ 2,863 $ 2,393 Non-cash investing and financing activities: Decrease to fixed assets for note receivable (3,078) — Non-cash contributions - intercompany settlements — 23 See accompanying notes to consolidated financial statements. 6

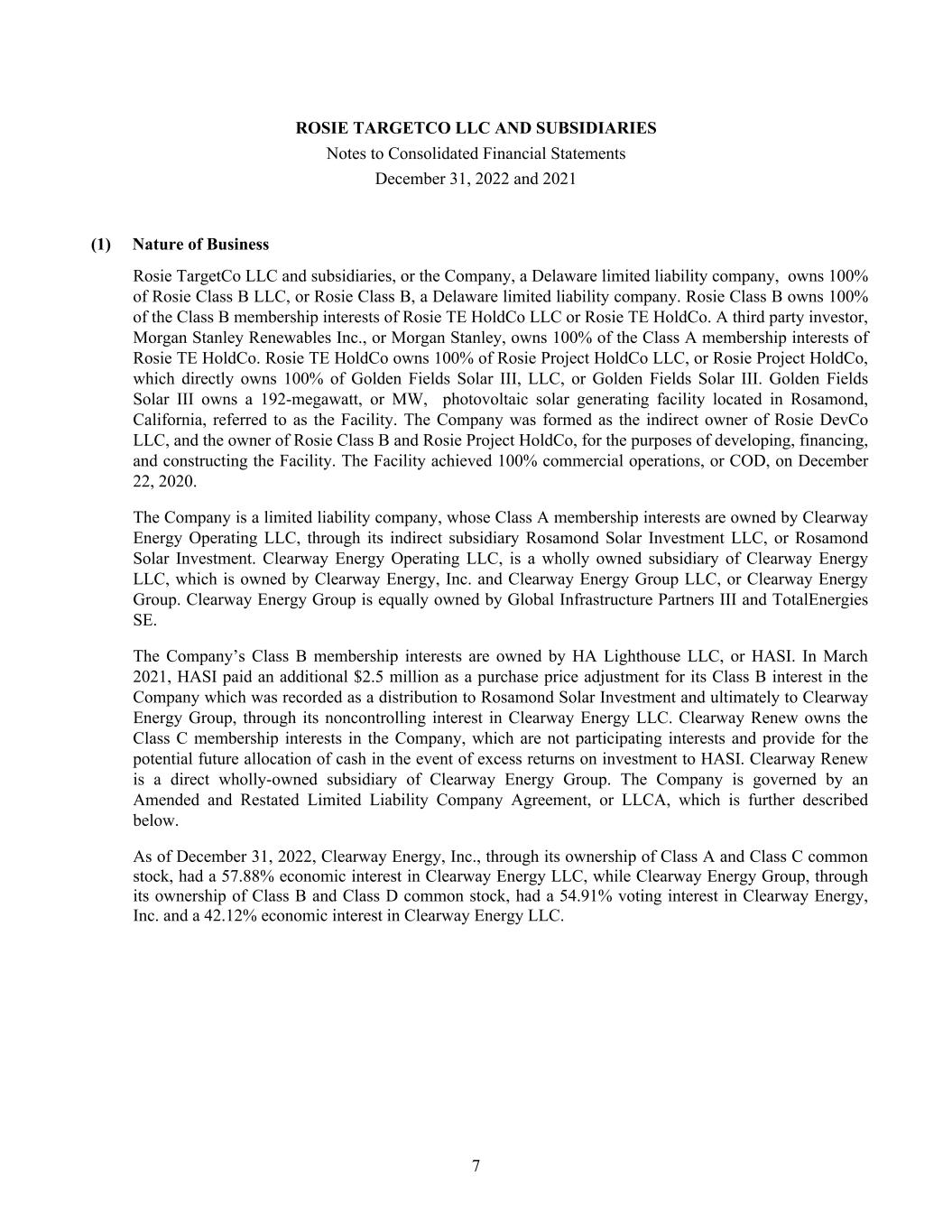

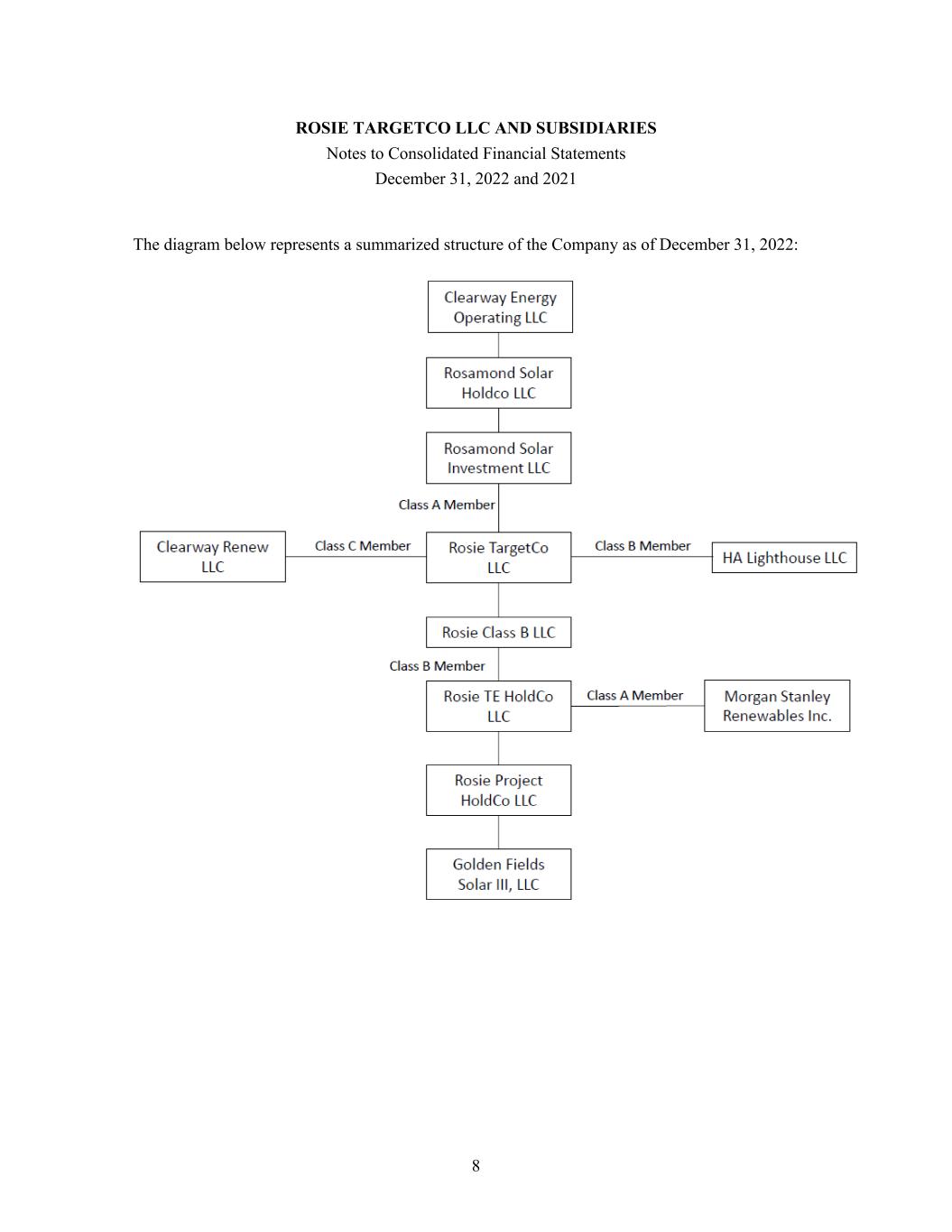

(1) Nature of Business Rosie TargetCo LLC and subsidiaries, or the Company, a Delaware limited liability company, owns 100% of Rosie Class B LLC, or Rosie Class B, a Delaware limited liability company. Rosie Class B owns 100% of the Class B membership interests of Rosie TE HoldCo LLC or Rosie TE HoldCo. A third party investor, Morgan Stanley Renewables Inc., or Morgan Stanley, owns 100% of the Class A membership interests of Rosie TE HoldCo. Rosie TE HoldCo owns 100% of Rosie Project HoldCo LLC, or Rosie Project HoldCo, which directly owns 100% of Golden Fields Solar III, LLC, or Golden Fields Solar III. Golden Fields Solar III owns a 192-megawatt, or MW, photovoltaic solar generating facility located in Rosamond, California, referred to as the Facility. The Company was formed as the indirect owner of Rosie DevCo LLC, and the owner of Rosie Class B and Rosie Project HoldCo, for the purposes of developing, financing, and constructing the Facility. The Facility achieved 100% commercial operations, or COD, on December 22, 2020. The Company is a limited liability company, whose Class A membership interests are owned by Clearway Energy Operating LLC, through its indirect subsidiary Rosamond Solar Investment LLC, or Rosamond Solar Investment. Clearway Energy Operating LLC, is a wholly owned subsidiary of Clearway Energy LLC, which is owned by Clearway Energy, Inc. and Clearway Energy Group LLC, or Clearway Energy Group. Clearway Energy Group is equally owned by Global Infrastructure Partners III and TotalEnergies SE. The Company’s Class B membership interests are owned by HA Lighthouse LLC, or HASI. In March 2021, HASI paid an additional $2.5 million as a purchase price adjustment for its Class B interest in the Company which was recorded as a distribution to Rosamond Solar Investment and ultimately to Clearway Energy Group, through its noncontrolling interest in Clearway Energy LLC. Clearway Renew owns the Class C membership interests in the Company, which are not participating interests and provide for the potential future allocation of cash in the event of excess returns on investment to HASI. Clearway Renew is a direct wholly-owned subsidiary of Clearway Energy Group. The Company is governed by an Amended and Restated Limited Liability Company Agreement, or LLCA, which is further described below. As of December 31, 2022, Clearway Energy, Inc., through its ownership of Class A and Class C common stock, had a 57.88% economic interest in Clearway Energy LLC, while Clearway Energy Group, through its ownership of Class B and Class D common stock, had a 54.91% voting interest in Clearway Energy, Inc. and a 42.12% economic interest in Clearway Energy LLC. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 7

The diagram below represents a summarized structure of the Company as of December 31, 2022: ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 8

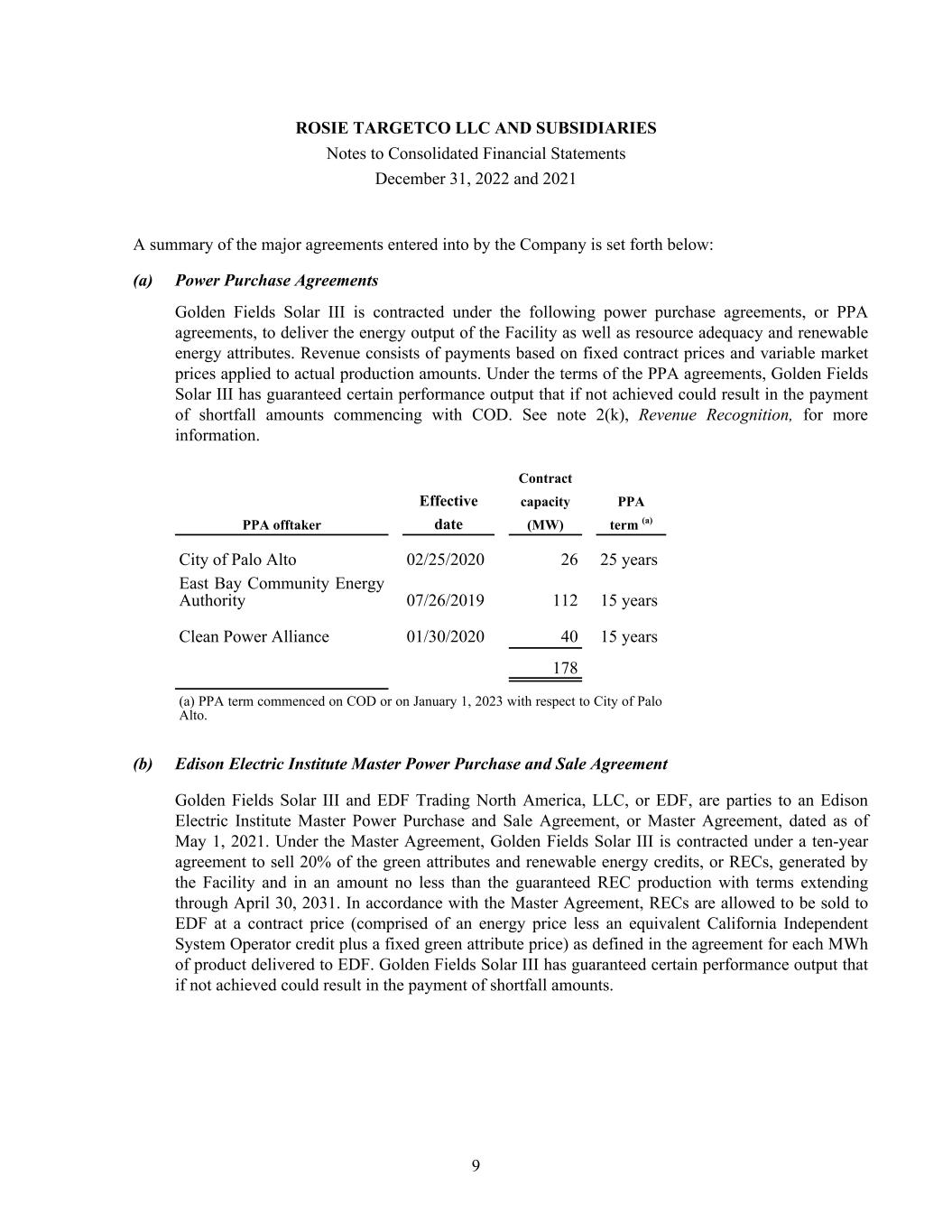

A summary of the major agreements entered into by the Company is set forth below: (a) Power Purchase Agreements Golden Fields Solar III is contracted under the following power purchase agreements, or PPA agreements, to deliver the energy output of the Facility as well as resource adequacy and renewable energy attributes. Revenue consists of payments based on fixed contract prices and variable market prices applied to actual production amounts. Under the terms of the PPA agreements, Golden Fields Solar III has guaranteed certain performance output that if not achieved could result in the payment of shortfall amounts commencing with COD. See note 2(k), Revenue Recognition, for more information. Contract Effective capacity PPA PPA offtaker date (MW) term (a) City of Palo Alto 02/25/2020 26 25 years East Bay Community Energy Authority 07/26/2019 112 15 years Clean Power Alliance 01/30/2020 40 15 years 178 (a) PPA term commenced on COD or on January 1, 2023 with respect to City of Palo Alto. (b) Edison Electric Institute Master Power Purchase and Sale Agreement Golden Fields Solar III and EDF Trading North America, LLC, or EDF, are parties to an Edison Electric Institute Master Power Purchase and Sale Agreement, or Master Agreement, dated as of May 1, 2021. Under the Master Agreement, Golden Fields Solar III is contracted under a ten-year agreement to sell 20% of the green attributes and renewable energy credits, or RECs, generated by the Facility and in an amount no less than the guaranteed REC production with terms extending through April 30, 2031. In accordance with the Master Agreement, RECs are allowed to be sold to EDF at a contract price (comprised of an energy price less an equivalent California Independent System Operator credit plus a fixed green attribute price) as defined in the agreement for each MWh of product delivered to EDF. Golden Fields Solar III has guaranteed certain performance output that if not achieved could result in the payment of shortfall amounts. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 9

(c) Facility Engineering, Procurement and Construction, or EPC, Agreement Golden Fields Solar III was party to a fixed-price contract with McCarthy Building Companies, Inc., or McCarthy, for the design, engineering, construction, and commissioning of the Facility for $130.0 million, that was subject to price adjustments as defined in the agreement. During the year ended December 31, 2021, the Company incurred costs under this agreement of $0.6 million, all of which were reflected in property, plant, and equipment, net on the accompanying consolidated balance sheet. Amounts due to McCarthy of $16.4 million were included in accounts payable – trade as of December 31, 2020 and were paid during 2021. Amounts due to McCarthy of $330 thousand included in accounts payable – trade as of December 31, 2021 were paid in January 2022. The Company’s obligations have been fulfilled under the agreement. (d) Limited Liability Company Agreement The Company is governed by the LLCA. The LLCA provides for allocations of income, taxable items and available cash, which are 50.0% to the Class A Member and 50.0% to the Class B Member, except that allocations of available cash are first utilized to pay back member loans, if any. In addition, subsequent to November 20, 2035, up to 80% of the Class A Member’s cash may be allocated to the Class B Member under the provisions of a related agreement, which provides a reallocation of cash in order to ensure that the Class B Member achieves its target return on investment. If the Class B Member achieves a return above a specified threshold, certain amounts may be allocated to Clearway Renew, through its ownership of the Class C membership interests. In accordance with the provision of the LLCA, the Class A Member is the Manager, as defined, and conducts the activities of the Company on behalf of the members. The Manager has engaged Clearway Asset Services LLC to perform certain of its duties as Manager. All management services provided are at the direction of the Manager, and the Manager retains its obligations with respect to its duties and responsibilities. See note 8, Related Party Transactions, for additional information regarding the management services agreement. In addition, the LLCA establishes both a review committee, which is responsible for material decisions that protect the interests of both the Class A Member and Class B Member, and is comprised of two members appointed by each of the Class A Member and Class B Member, and an operations committee, which is responsible for advising the Company and the review committee with respect to the Company’s operations. (2) Summary of Significant Accounting Policies (a) Basis of Presentation and Principles of Consolidation The Company’s consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. The Accounting Standards Codification, or ASC, established by the Financial Accounting Standards Board, or FASB, is the source of authoritative U.S. GAAP to be applied by nongovernmental entities. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 10

The consolidated financial statements include the Company’s accounts and operations and those of its subsidiaries in which the Company has a controlling financial interest. All significant intercompany transactions and balances have been eliminated in the consolidated financial statements. The usual condition for a controlling financial interest is ownership of a majority of the voting interests of an entity. However, a controlling financial interest may also exist through arrangements that do not involve controlling voting interests. As such, the Company applies the guidance of ASC 810, Consolidations, to determine when an entity that is not controlled through its voting interests should be consolidated. (b) Restricted Cash The following table provides a reconciliation of cash and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the consolidated statements of cash flows as of December 31, 2022 and 2021 (in thousands): 2022 2021 Cash $ 3,738 $ 944 Restricted cash 867 6,027 Cash and restricted cash shown in the consolidated statements of cash flows $ 4,605 $ 6,971 Restricted cash consists of funds held in reserves primarily to meet debt service reserve requirements per the terms of the Rosie Class B’s debt agreement. The decrease in restricted cash from December 31, 2021 to December 31, 2022 also reflects $330 thousand paid to McCarthy pursuant to the EPC Agreement in January 2022 and $3.0 million distributed to Clearway Renew in February 2022 for reimbursement of construction payments. (c) Accounts Receivable – Trade Trade accounts receivable are recorded at the invoiced amount and do not bear interest. There was no allowance for credit losses as of December 31, 2022 and 2021. (d) Inventory Inventory consists of spare parts and is valued at weighted average cost, unless evidence indicates that the weighted average cost will not be recovered with a normal profit in the ordinary course of business. Spare parts inventory is removed when used for repairs, maintenance, or capital projects. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 11

(e) Property, Plant, and Equipment Property, plant, and equipment are stated at cost; however, impairment adjustments are recorded whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Significant additions or improvements extending asset lives are capitalized as incurred, while repairs and maintenance that do not improve or extend the life of the respective asset are charged to expense as incurred. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Certain assets and their related accumulated depreciation amounts are adjusted for asset retirements and disposals with the resulting gain or loss included in cost of operations in the consolidated statement of operations and comprehensive income. See note 4, Property, Plant, and Equipment, for additional information. (f) Asset Impairments Long-lived assets that are held and used are reviewed for impairment whenever events or changes in circumstances indicate their carrying amounts may not be recoverable. Such reviews are performed in accordance with ASC 360, Property, Plant, and Equipment. An impairment loss is indicated if the total future estimated undiscounted cash flows expected from an asset are less than its carrying amount. An impairment charge is measured as the excess of an asset’s carrying amount over its fair value with the difference recorded in operating costs and expenses in the consolidated statement of operations and comprehensive income. Fair values are determined by a variety of valuation methods, including third-party appraisals, sales prices of similar assets, and present value techniques. There were no indicators of impairment loss as of December 31, 2022 and 2021. (g) Debt Issuance Costs Debt issuance costs consist of legal fees and closing costs incurred by the Company in obtaining its financing. These costs are capitalized and amortized as interest expense using the effective interest method over the term of the financing obligation and are presented on the consolidated balance sheets as a direct deduction from the carrying amount of the related debt. Amortization expense, included in interest expense in the consolidated statement of operations and comprehensive income, was $365 thousand and $367 thousand for the years ended December 31, 2022 and 2021, respectively. (h) Leases The Company accounts for its leases under ASC 842 Leases, or Topic 842. Topic 842 requires the establishment of a lease liability and related right-of-use asset for all leases with a term longer than 12 months. The Company evaluates each arrangement at inception to determine if it contains a lease. The Company records its operating lease liabilities at the present value of the lease payments over the lease term at lease commencement date. Lease payments include fixed payment amounts. The Company determines the relevant lease term by evaluating whether renewal and termination options are reasonably certain to be exercised. The Company uses its incremental borrowing rate to calculate the present value of the lease payments, based on information available at the lease commencement date. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 12

All of the Company’s leases are operating leases. See note 9, Leases for information on the Company’s leases. (i) Note Receivable As part of the Company’s obligations under its interconnection agreements, the Company paid Southern California Edison Company to construct certain interconnection facilities to allow the Facility to connect to the power grid. A portion of the transmission and interconnection costs plus interest are directly reimbursable to the Company on a quarterly basis over a five-year period. In 2022, the Company recorded a $3.1 million note receivable and a corresponding reduction to property, plant, and equipment. At December 31, 2022, the current and non-current note receivable balance was $616 thousand and $2.0 million, respectively. The note accrues interest at a variable rate based on Federal Energy Regulatory Commission’s regulation at 18 C.F.R.§35.19a(a)(2)(iii), which was 4.91% at December 31, 2022. (j) Income Taxes The Company is classified as a partnership for federal and state income tax purposes. Therefore, federal and state income taxes are assessed at the partner level. Accordingly, no provision has been made for federal or state income taxes in the accompanying consolidated financial statements. The Company has determined that, based on a more-likely-than not evaluation of the tax positions taken, there are no material uncertain tax positions to be recognized as of December 31, 2022 and 2021 by the Company. (k) Revenue Recognition Revenue from Contracts with Customers The Company applies the guidance in ASC 606, Revenue from Contracts with Customers, or ASC 606, when recognizing revenue associated with its contracts with customers. The Company’s policies with respect to its various revenue streams are detailed below. In general, the Company applies the invoicing practical expedient to recognize revenue for the revenue streams detailed below, except in circumstances where the invoiced amount does not represent the value transferred to the customer. Power Purchase Agreements Operating revenues consist of revenue from electricity sales obtained through PPAs, of which 152 MWs were effective during 2022 and 2021. The Company sells power as described in note 1(a), Power Purchase Agreements. The PPAs are derivative financial instruments that qualify for the normal purchase normal sale exception and as such, the PPAs are accounted for under the revenue recognition guidance in ASC 606, and revenue is recognized when the underlying power is delivered. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 13

For the years ended December 31, 2022 and 2021, the Company recorded revenue of $6.8 million (net of losses under the PPAs of $19.4 million) and $8.0 million (net of losses under the PPAs of $7.6 million), respectively, included in operating revenues in the consolidated statements of operations and comprehensive income. During 2022 and 2021, the losses under the PPAs were primarily due to unfavorable market prices as the Company’s PPAs with counterparties provide for adjustments to the contract price per contract for realized locational marginal price. Merchant Revenue For the years ended December 31, 2022 and 2021, the Company recorded $6.8 million and $4.1 million, respectively, of merchant revenue included in operating revenues in the consolidated statements of operations and comprehensive income for power sold to Tenaska Power Services Co., a qualified scheduling entity for the Facility. This merchant revenue is accounted for in accordance with ASC 606, utilizing the invoicing practical expedient, which represents the electricity delivered. Congestion Revenue Rights, or CRRs Golden Fields Solar III manages its exposure to congestion costs that affect locational marginal pricing associated with its PPAs through the use of CRRs which are financial instruments made available through the CRR auction that enable CRR holders to manage variability. On October 14, 2022, Golden Fields Solar III executed into a First Amendment to the Scheduling Coordinator Agreement with Tenaska Power Services. Pursuant to this agreement, Tenaska Power Services will participate in the California Independent System Operator Corporation, or CAISO, monthly and annual CRR auctions on behalf of Golden Fields Solar III. The agreement requires Golden Fields Solar III to pay a monthly service fee, with an annual escalation of 2.00%, and a base sharing fee as defined in the agreement. In connection with Tenaska Power Services participating in the auction on Golden Fields Solar III’s behalf, the Company posted cash collateral of approximately $1.0 million to allow Tenaska Power Services to pay the CAISO. The cash collateral is returned to Golden Fields Solar III by Tenaska Power Services through energy settlement payments. As of December 31, 2022, the remaining cash collateral was $29 thousand included in prepayments and other current assets, which was repaid during January 2023. During 2022, Golden Fields Solar III was awarded bid volumes for on-peak CRRs for the fourth quarter of 2022 and certain periods in 2023. Total bid costs incurred related to the December 2022 auction and the 2023 auction totaled $919 thousand, of which $23 thousand related to the December 2022 auction and $896 thousand related to the 2023 auction, which will be amortized on a straight-line basis as a reduction to operating revenues over thirteen months. As of December 31, 2022, $827 thousand was included in prepayments and other current assets on the Company’s consolidated balance sheet. For the year ended December 31, 2022, settlements totaled $44 thousand offset by amortization expense of $92 thousand, included in operating revenues in the consolidated statement of operations and comprehensive income. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 14

Renewable Energy Certificates/Credits, or RECs Golden Fields Solar III has an agreement with EDF to sell RECs generated by the Facility as described in note 1(b), Edison Electric Institute Master Power Purchase and Sale Agreement. Effective June 1, 2021, Golden Fields Solar III contracted with Verdant Energy Services LLC to sell RECS generated by the Facility in accordance with the quantities and contract prices in the agreement through August 2021. The REC agreements are derivative financial instruments that qualify for the normal purchase normal sale exception and as such, the REC agreements are accounted for under the revenue recognition guidance in ASC 606. Revenue is recognized as the REC is generated based on actual production multiplied by the contract price. REC revenue is accrued and billed on a monthly basis. For each of the years ended December 31, 2022 and 2021, the Company recorded $1.7 million, of REC revenues under these agreements included in operating revenues in the consolidated statements of operations and comprehensive income. Resource Adequacy The Company’s PPAs provide for the sale of resource adequacy for 178 MW to the Company’s PPA counterparties. In 2021, Golden Fields Solar III entered into resource adequacy agreements for previously uncontracted MWs governed by the Master Agreement. Golden Fields Solar III contracted with Direct Energy Business Marketing, LLC to sell 67.71 MW of resource adequacy at a fixed price commencing on June 1, 2021 and delivered through December 31, 2022. Golden Fields Solar III also contracted with Valley Electric Association, Inc. to sell 3.03 MW of resource adequacy at a fixed price for May 1, 2021 through May 31, 2021. On November 16, 2022, Golden Fields Solar III contracted with East Bay Community Energy Authority to sell 13.6 MW of resource adequacy at a fixed price for January 1, 2023 through December 31, 2023. For the years ended December 31, 2022 and 2021, the Company recorded $488 thousand and $338 thousand of revenues under these agreements included in operating revenues in the consolidated statements of operations and comprehensive income. (l) Derivative Financial Instruments The Company accounts for derivative financial instruments in accordance with ASC 815, Derivatives and Hedging, which requires the Company to recognize all derivative instruments on the balance sheet as either assets or liabilities and to measure them at fair value each reporting period unless they qualify for a normal purchase normal sale exception. Changes in the fair value of non- hedge derivatives are immediately recognized in earnings. The Company uses interest rate swaps to manage its interest rate exposure on long-term debt, which have been designated as cash flow hedges, if certain conditions are met. Changes in the fair value of derivatives accounted for as cash flow hedges are deferred and recorded as a component of accumulated other comprehensive income, or OCI, until the hedged transactions occur and are recognized in earnings. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 15

On an ongoing basis, the Company qualitatively assesses the effectiveness of its derivatives that are designated as cash flow hedges for accounting purposes in order to determine that each derivative continues to be highly effective in offsetting changes in cash flows of hedged items. If necessary, the Company will perform an analysis to measure the statistical correlation between the derivative and the associated hedged item to determine the effectiveness of such an interest rate swap designated as a hedge. The Company will discontinue hedge accounting if it is determined that the hedge is no longer effective. In this case, the gain or loss previously deferred in accumulated OCI would be frozen until the underlying hedged instrument is delivered, unless the transactions being hedged are no longer probable of occurring in which case the amount in OCI would be immediately reclassified into earnings. See note 3, Accounting for Derivative Instruments and Hedging Activities, for more information. (m) Risks and Uncertainties Financial instruments which potentially subject the Company to concentrations of credit risk consist primarily of accounts receivable – trade and derivative instruments. Accounts receivable are concentrated with a small group of customers. The concentration with these customers may impact the Company’s overall exposure to credit risk, either positively or negatively, in that the customers may be similarly affected by changes in the economic, industry, or other conditions. The Company is also exposed to credit losses in the event of noncompliance by counterparties to its derivative financial instruments. Due to the concentration of sales to a small group of customers, the Company is exposed to credit risk of potential nonperformance by its customers, which could impact liquidity if a customer was to experience financial difficulties. The maximum amount of loss due to credit risk, should the customers fail to perform, is the amount of the outstanding receivable and any losses associated with replacing these customers. Risks associated with the Company’s operations include the performance of Golden Fields Solar III below expected levels of efficiency and output, shutdowns due to the breakdown or failure of equipment, which could be further impacted by the inability to obtain replacement parts, or catastrophic events such as extreme weather, fires, earthquakes, floods, explosions, pandemics, or other similar occurrences affecting a power generation facility or its energy purchaser. (n) Fair Value of Financial Instruments The Company accounts for the fair value of financial instruments in accordance with ASC 820, Fair Value Measurement, or ASC 820. The Company does not hold or issue financial instruments for trading purposes. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 16

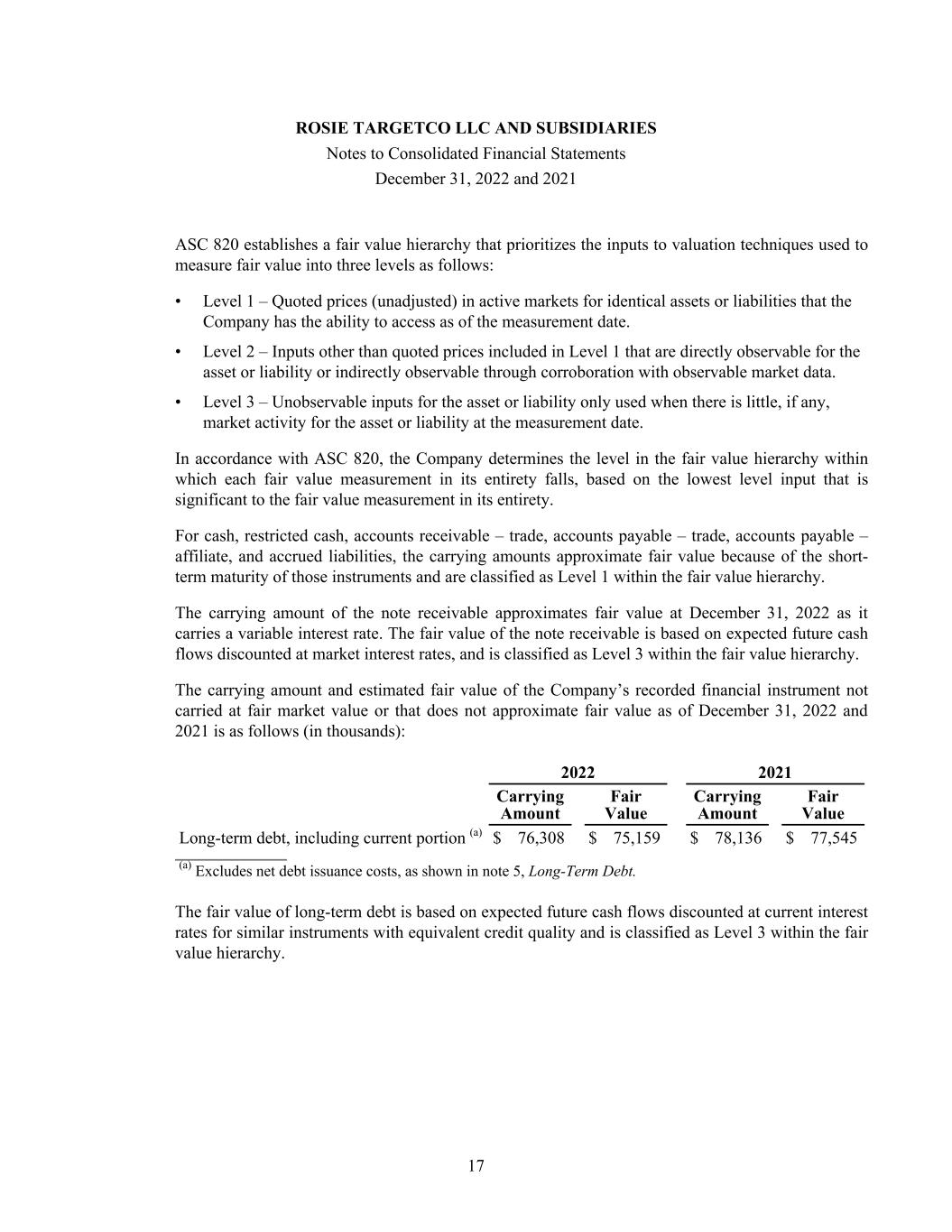

ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows: • Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access as of the measurement date. • Level 2 – Inputs other than quoted prices included in Level 1 that are directly observable for the asset or liability or indirectly observable through corroboration with observable market data. • Level 3 – Unobservable inputs for the asset or liability only used when there is little, if any, market activity for the asset or liability at the measurement date. In accordance with ASC 820, the Company determines the level in the fair value hierarchy within which each fair value measurement in its entirety falls, based on the lowest level input that is significant to the fair value measurement in its entirety. For cash, restricted cash, accounts receivable – trade, accounts payable – trade, accounts payable – affiliate, and accrued liabilities, the carrying amounts approximate fair value because of the short- term maturity of those instruments and are classified as Level 1 within the fair value hierarchy. The carrying amount of the note receivable approximates fair value at December 31, 2022 as it carries a variable interest rate. The fair value of the note receivable is based on expected future cash flows discounted at market interest rates, and is classified as Level 3 within the fair value hierarchy. The carrying amount and estimated fair value of the Company’s recorded financial instrument not carried at fair market value or that does not approximate fair value as of December 31, 2022 and 2021 is as follows (in thousands): 2022 2021 Carrying Amount Fair Value Carrying Amount Fair Value Long-term debt, including current portion (a) $ 76,308 $ 75,159 $ 78,136 $ 77,545 (a) Excludes net debt issuance costs, as shown in note 5, Long-Term Debt. The fair value of long-term debt is based on expected future cash flows discounted at current interest rates for similar instruments with equivalent credit quality and is classified as Level 3 within the fair value hierarchy. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 17

Derivative instruments, consisting of interest rate swaps, are recorded at fair value on the Company’s consolidated balance sheets on a recurring basis and are classified as Level 2 within the fair value hierarchy as the fair value is determined using an income approach, which use readily observable inputs, such as forward interest rates and contractual terms to estimate fair value. The fair value of each contract is discounted using a risk free interest rate. In addition, the Company applies a credit reserve to reflect credit risk, which for interest rate swaps is calculated using the bilateral method based on published default probabilities. The credit reserve is added to the discounted fair value to reflect the exit price that a market participant would be willing to receive to assume the Company’s liabilities or that a market participant would be willing to pay for the Company’s assets. For further discussion of interest rate swaps, see note 3, Accounting for Derivative Instruments and Hedging Activities. (o) Commitments and Contingencies In the normal course of business, the Company is subject to various claims and litigation. Management of the Company expects that these various litigation items will not have a material adverse effect on the results of operations, cash flows, or financial position of the Company. (p) Asset Retirement Obligations The Company accounts for its asset retirement obligations, or AROs, in accordance with ASC 410-20, Asset Retirement Obligations, or ASC 410-20. Retirement obligations associated with long- lived assets included within the scope of ASC 410-20 are those for which a legal obligation exists under enacted laws, statutes, and written or oral contracts, including obligations arising under the doctrine of promissory estoppel, and for which the timing and/or method of settlement may be conditional on a future event. ASC 410-20 requires the Company to recognize the fair value of a liability for an ARO in the period in which it is incurred and a reasonable estimate of fair value can be made. Upon initial recognition of a liability for an ARO, other than when an ARO is assumed in an acquisition of the related long-lived asset, the Company capitalizes the asset retirement cost by increasing the carrying amount of the related long-lived asset by the same amount. Over time, the liability is accreted to its future value, while the capitalized cost is depreciated over the useful life of the related asset. See note 6, Asset Retirement Obligations, for further information. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 18

(q) Tax Equity Arrangements The Company’s noncontrolling interest in subsidiaries represents the Class A Member’s interest in the net assets of Rosie TE HoldCo under a tax equity arrangement, which is consolidated by the Company. The Company has determined that the provisions in the contractual agreements of this structure represents a substantive profit sharing arrangement. Further, the Company has determined that the appropriate methodology for calculating the noncontrolling interest that reflects the substantive profit sharing arrangements is a balance sheet approach utilizing the hypothetical liquidation at book value, or HLBV, method. Under the HLBV method, the amounts reported as noncontrolling interests represent the amounts the Class A Member would hypothetically receive at each balance sheet date under the liquidation provisions of the contractual agreements, assuming the net assets of the funding structures were liquidated at their recorded amounts determined in accordance with U.S. GAAP. The Class A Member’s interests in the results of operations of the funding structure are determined as the difference in noncontrolling interests at the start and end of each reporting period, after taking into account any capital transactions between the structure and its investors. The calculations utilized to apply the HLBV method include estimated calculations of taxable income or losses for each reporting period. (r) Use of Estimates The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements, and reported amounts of expenses during the reporting period. Actual results may differ from those estimates. (3) Accounting for Derivative Instruments and Hedging Activities (a) Interest Rate Swaps In accordance with the credit agreement, as described in note 5, Long-Term Debt, the Company has a series of fixed for floating interest rate swaps for 95% of the outstanding term loan amount, intended to hedge the risks associated with floating interest rates. The interest rate swap agreements were entered into on February 25, 2020, became effective on December 31, 2020, amortize through July 31, 2044, and have a mandatory early termination date of January 31, 2028. The Company pays its counterparties quarterly the equivalent of a weighted average rate of 1.446% fixed interest payment on a predetermined notional amount, and the Company receives quarterly the equivalent of a floating interest payment based on three-month London Interbank Offered Rate, or LIBOR, calculated on the same notional amount. (b) Volumetric Underlying Derivative Transactions The total notional amount of the forward-starting interest rate swaps was $72.5 million and $74.2 million at December 31, 2022 and 2021, respectively. The notional amount of the interest rate swaps will decrease in proportion to the principal balance of the loan. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 19

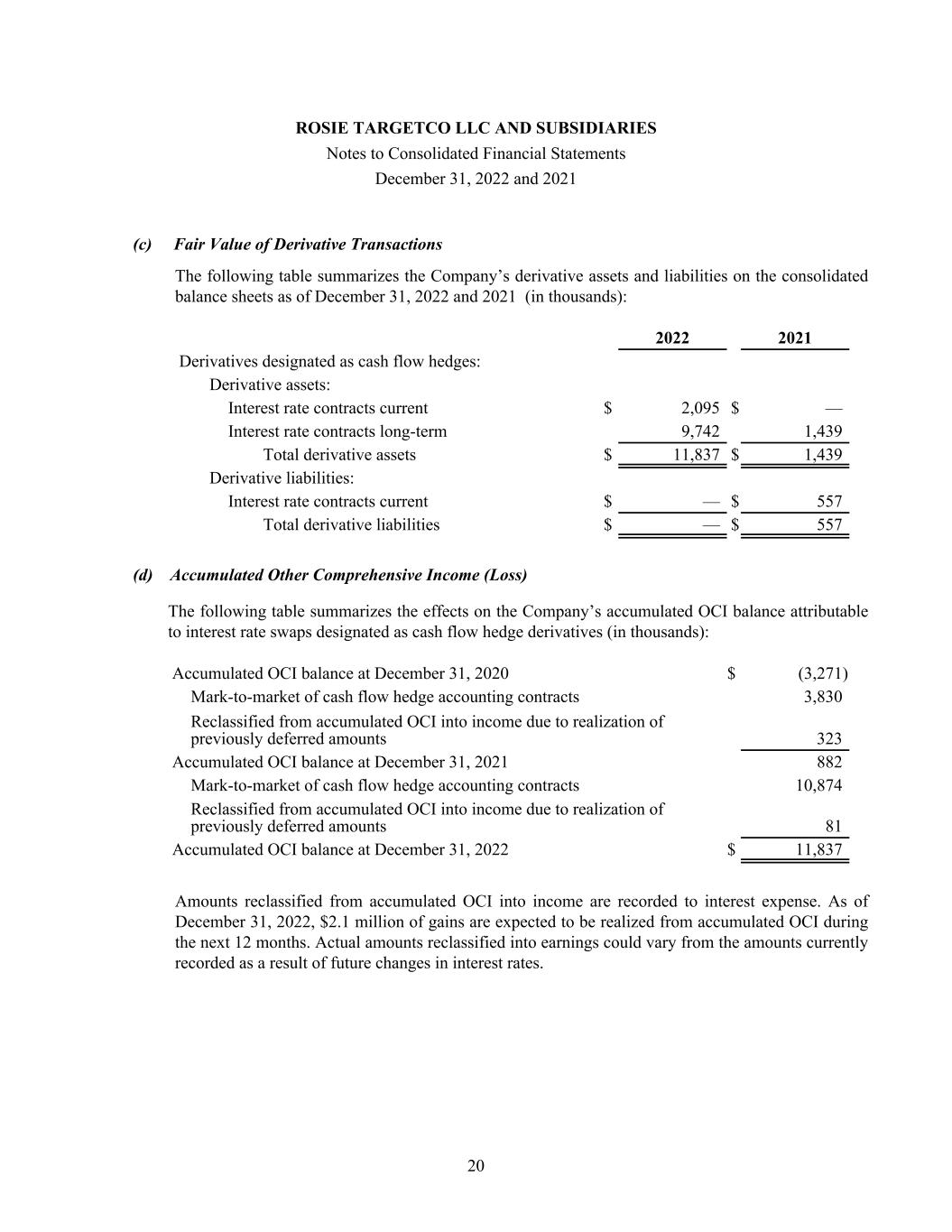

(c) Fair Value of Derivative Transactions The following table summarizes the Company’s derivative assets and liabilities on the consolidated balance sheets as of December 31, 2022 and 2021 (in thousands): 2022 2021 Derivatives designated as cash flow hedges: Derivative assets: Interest rate contracts current $ 2,095 $ — Interest rate contracts long-term 9,742 1,439 Total derivative assets $ 11,837 $ 1,439 Derivative liabilities: Interest rate contracts current $ — $ 557 Total derivative liabilities $ — $ 557 (d) Accumulated Other Comprehensive Income (Loss) The following table summarizes the effects on the Company’s accumulated OCI balance attributable to interest rate swaps designated as cash flow hedge derivatives (in thousands): Accumulated OCI balance at December 31, 2020 $ (3,271) Mark-to-market of cash flow hedge accounting contracts 3,830 Reclassified from accumulated OCI into income due to realization of previously deferred amounts 323 Accumulated OCI balance at December 31, 2021 882 Mark-to-market of cash flow hedge accounting contracts 10,874 Reclassified from accumulated OCI into income due to realization of previously deferred amounts 81 Accumulated OCI balance at December 31, 2022 $ 11,837 Amounts reclassified from accumulated OCI into income are recorded to interest expense. As of December 31, 2022, $2.1 million of gains are expected to be realized from accumulated OCI during the next 12 months. Actual amounts reclassified into earnings could vary from the amounts currently recorded as a result of future changes in interest rates. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 20

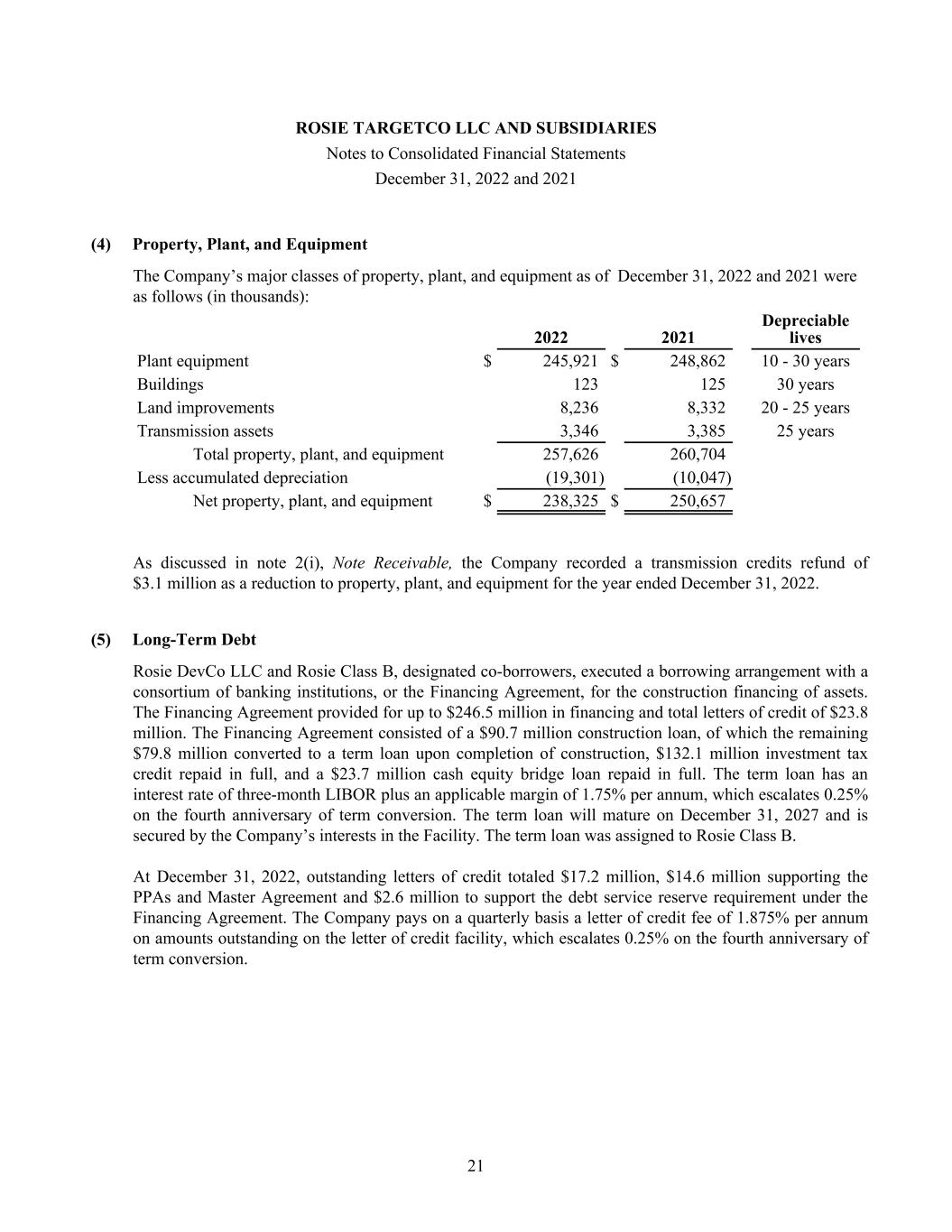

(4) Property, Plant, and Equipment The Company’s major classes of property, plant, and equipment as of December 31, 2022 and 2021 were as follows (in thousands): 2022 2021 Depreciable lives Plant equipment $ 245,921 $ 248,862 10 - 30 years Buildings 123 125 30 years Land improvements 8,236 8,332 20 - 25 years Transmission assets 3,346 3,385 25 years Total property, plant, and equipment 257,626 260,704 Less accumulated depreciation (19,301) (10,047) Net property, plant, and equipment $ 238,325 $ 250,657 As discussed in note 2(i), Note Receivable, the Company recorded a transmission credits refund of $3.1 million as a reduction to property, plant, and equipment for the year ended December 31, 2022. (5) Long-Term Debt Rosie DevCo LLC and Rosie Class B, designated co-borrowers, executed a borrowing arrangement with a consortium of banking institutions, or the Financing Agreement, for the construction financing of assets. The Financing Agreement provided for up to $246.5 million in financing and total letters of credit of $23.8 million. The Financing Agreement consisted of a $90.7 million construction loan, of which the remaining $79.8 million converted to a term loan upon completion of construction, $132.1 million investment tax credit repaid in full, and a $23.7 million cash equity bridge loan repaid in full. The term loan has an interest rate of three-month LIBOR plus an applicable margin of 1.75% per annum, which escalates 0.25% on the fourth anniversary of term conversion. The term loan will mature on December 31, 2027 and is secured by the Company’s interests in the Facility. The term loan was assigned to Rosie Class B. At December 31, 2022, outstanding letters of credit totaled $17.2 million, $14.6 million supporting the PPAs and Master Agreement and $2.6 million to support the debt service reserve requirement under the Financing Agreement. The Company pays on a quarterly basis a letter of credit fee of 1.875% per annum on amounts outstanding on the letter of credit facility, which escalates 0.25% on the fourth anniversary of term conversion. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 21

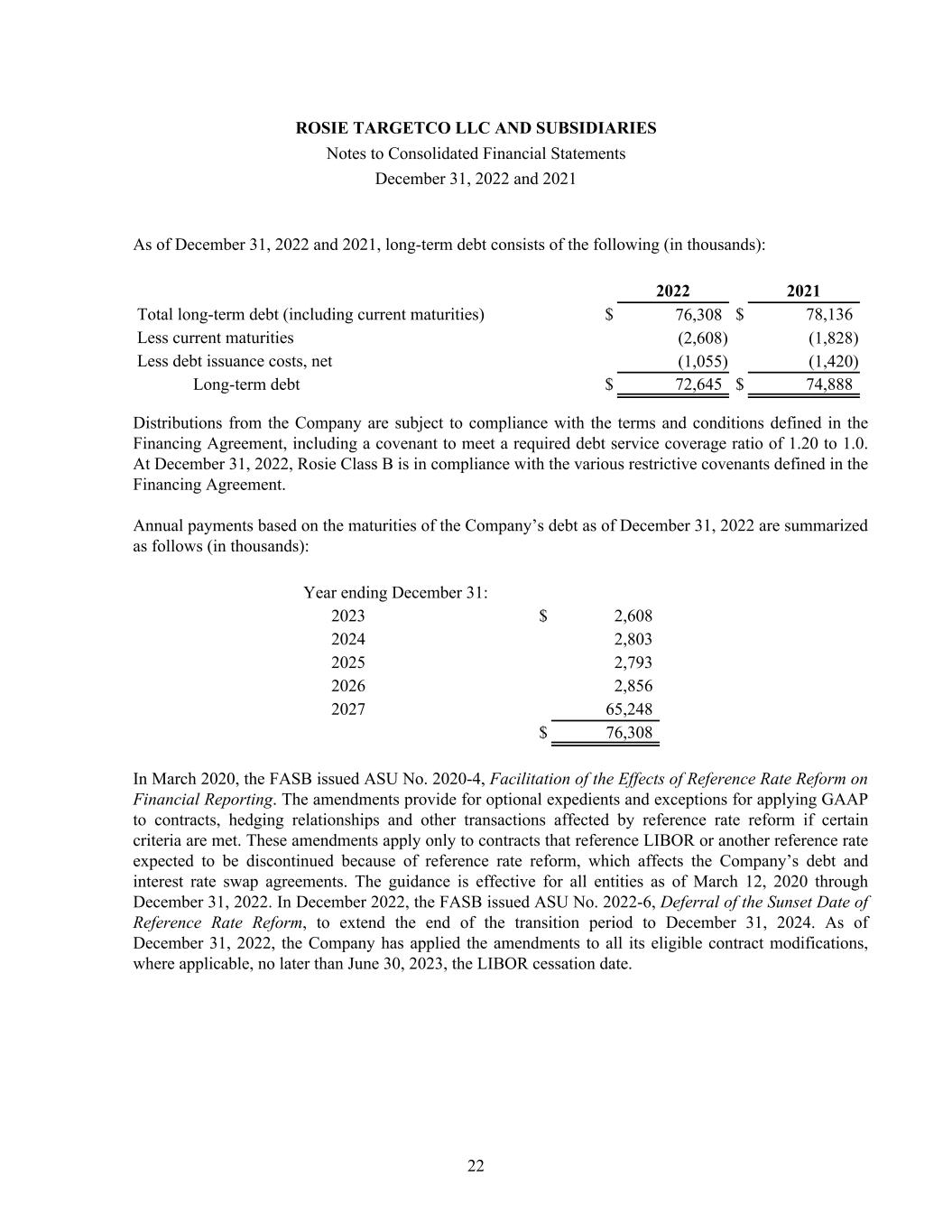

As of December 31, 2022 and 2021, long-term debt consists of the following (in thousands): 2022 2021 Total long-term debt (including current maturities) $ 76,308 $ 78,136 Less current maturities (2,608) (1,828) Less debt issuance costs, net (1,055) (1,420) Long-term debt $ 72,645 $ 74,888 Distributions from the Company are subject to compliance with the terms and conditions defined in the Financing Agreement, including a covenant to meet a required debt service coverage ratio of 1.20 to 1.0. At December 31, 2022, Rosie Class B is in compliance with the various restrictive covenants defined in the Financing Agreement. Annual payments based on the maturities of the Company’s debt as of December 31, 2022 are summarized as follows (in thousands): Year ending December 31: 2023 $ 2,608 2024 2,803 2025 2,793 2026 2,856 2027 65,248 $ 76,308 In March 2020, the FASB issued ASU No. 2020-4, Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The amendments provide for optional expedients and exceptions for applying GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. These amendments apply only to contracts that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform, which affects the Company’s debt and interest rate swap agreements. The guidance is effective for all entities as of March 12, 2020 through December 31, 2022. In December 2022, the FASB issued ASU No. 2022-6, Deferral of the Sunset Date of Reference Rate Reform, to extend the end of the transition period to December 31, 2024. As of December 31, 2022, the Company has applied the amendments to all its eligible contract modifications, where applicable, no later than June 30, 2023, the LIBOR cessation date. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 22

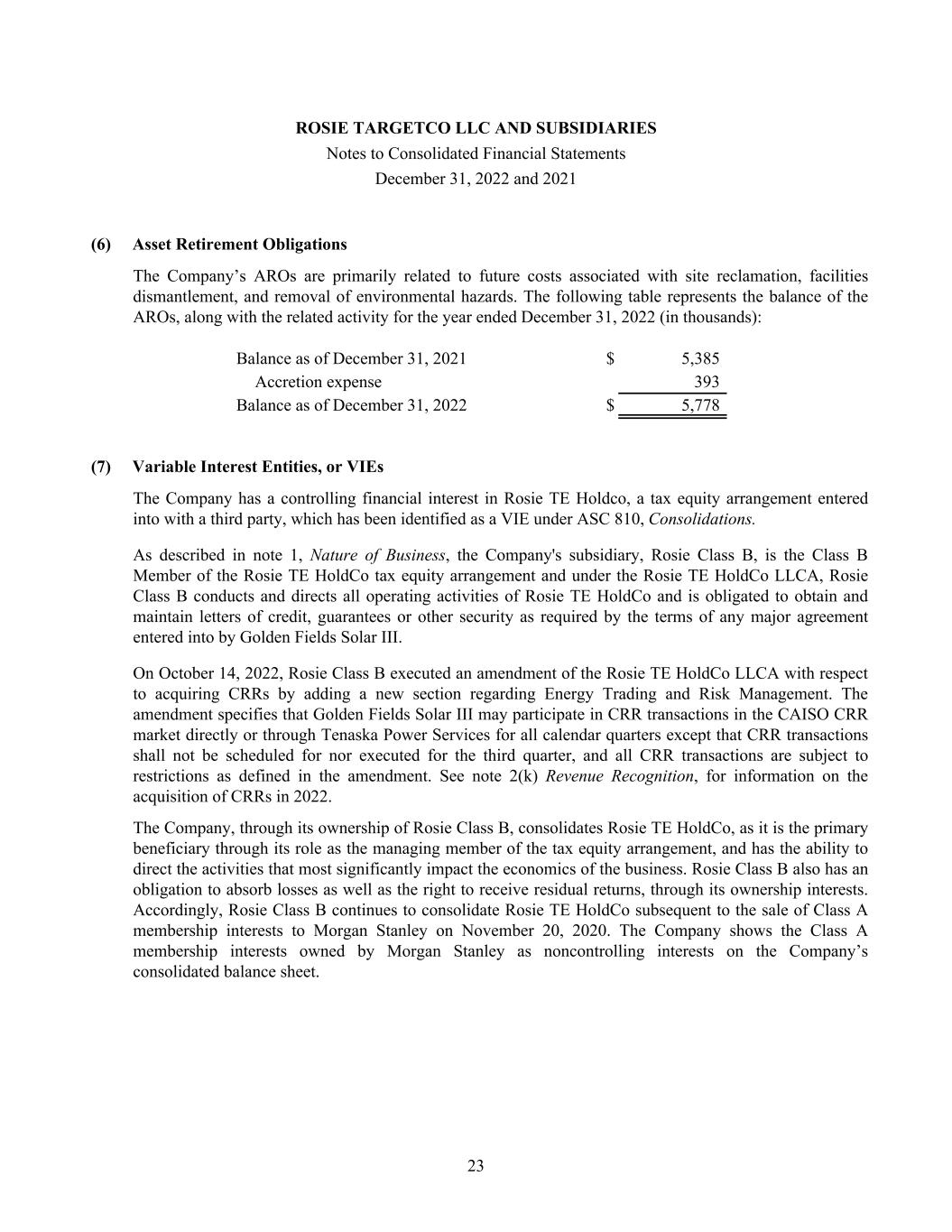

(6) Asset Retirement Obligations The Company’s AROs are primarily related to future costs associated with site reclamation, facilities dismantlement, and removal of environmental hazards. The following table represents the balance of the AROs, along with the related activity for the year ended December 31, 2022 (in thousands): Balance as of December 31, 2021 $ 5,385 Accretion expense 393 Balance as of December 31, 2022 $ 5,778 (7) Variable Interest Entities, or VIEs The Company has a controlling financial interest in Rosie TE Holdco, a tax equity arrangement entered into with a third party, which has been identified as a VIE under ASC 810, Consolidations. As described in note 1, Nature of Business, the Company's subsidiary, Rosie Class B, is the Class B Member of the Rosie TE HoldCo tax equity arrangement and under the Rosie TE HoldCo LLCA, Rosie Class B conducts and directs all operating activities of Rosie TE HoldCo and is obligated to obtain and maintain letters of credit, guarantees or other security as required by the terms of any major agreement entered into by Golden Fields Solar III. On October 14, 2022, Rosie Class B executed an amendment of the Rosie TE HoldCo LLCA with respect to acquiring CRRs by adding a new section regarding Energy Trading and Risk Management. The amendment specifies that Golden Fields Solar III may participate in CRR transactions in the CAISO CRR market directly or through Tenaska Power Services for all calendar quarters except that CRR transactions shall not be scheduled for nor executed for the third quarter, and all CRR transactions are subject to restrictions as defined in the amendment. See note 2(k) Revenue Recognition, for information on the acquisition of CRRs in 2022. The Company, through its ownership of Rosie Class B, consolidates Rosie TE HoldCo, as it is the primary beneficiary through its role as the managing member of the tax equity arrangement, and has the ability to direct the activities that most significantly impact the economics of the business. Rosie Class B also has an obligation to absorb losses as well as the right to receive residual returns, through its ownership interests. Accordingly, Rosie Class B continues to consolidate Rosie TE HoldCo subsequent to the sale of Class A membership interests to Morgan Stanley on November 20, 2020. The Company shows the Class A membership interests owned by Morgan Stanley as noncontrolling interests on the Company’s consolidated balance sheet. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 23

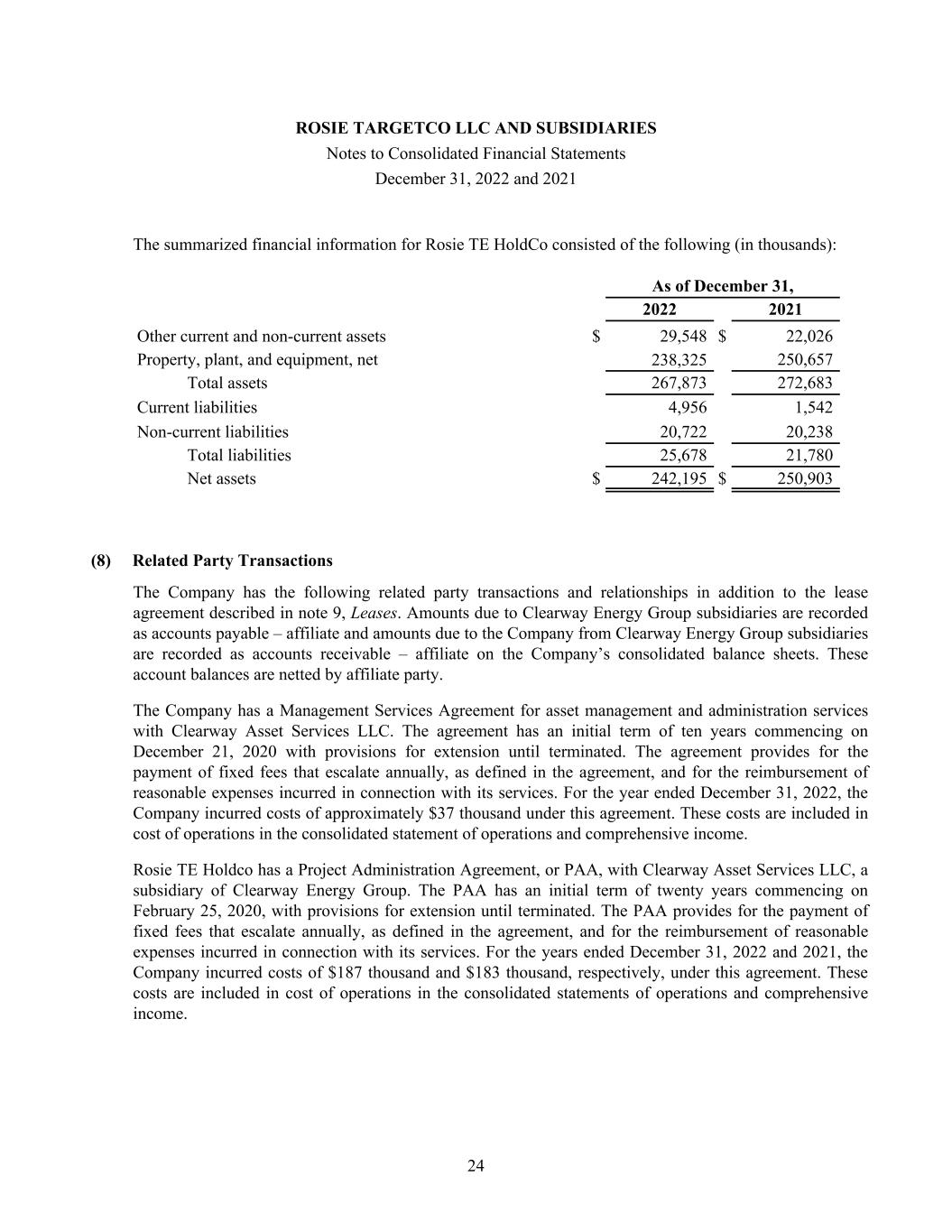

The summarized financial information for Rosie TE HoldCo consisted of the following (in thousands): As of December 31, 2022 2021 Other current and non-current assets $ 29,548 $ 22,026 Property, plant, and equipment, net 238,325 250,657 Total assets 267,873 272,683 Current liabilities 4,956 1,542 Non-current liabilities 20,722 20,238 Total liabilities 25,678 21,780 Net assets $ 242,195 $ 250,903 (8) Related Party Transactions The Company has the following related party transactions and relationships in addition to the lease agreement described in note 9, Leases. Amounts due to Clearway Energy Group subsidiaries are recorded as accounts payable – affiliate and amounts due to the Company from Clearway Energy Group subsidiaries are recorded as accounts receivable – affiliate on the Company’s consolidated balance sheets. These account balances are netted by affiliate party. The Company has a Management Services Agreement for asset management and administration services with Clearway Asset Services LLC. The agreement has an initial term of ten years commencing on December 21, 2020 with provisions for extension until terminated. The agreement provides for the payment of fixed fees that escalate annually, as defined in the agreement, and for the reimbursement of reasonable expenses incurred in connection with its services. For the year ended December 31, 2022, the Company incurred costs of approximately $37 thousand under this agreement. These costs are included in cost of operations in the consolidated statement of operations and comprehensive income. Rosie TE Holdco has a Project Administration Agreement, or PAA, with Clearway Asset Services LLC, a subsidiary of Clearway Energy Group. The PAA has an initial term of twenty years commencing on February 25, 2020, with provisions for extension until terminated. The PAA provides for the payment of fixed fees that escalate annually, as defined in the agreement, and for the reimbursement of reasonable expenses incurred in connection with its services. For the years ended December 31, 2022 and 2021, the Company incurred costs of $187 thousand and $183 thousand, respectively, under this agreement. These costs are included in cost of operations in the consolidated statements of operations and comprehensive income. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 24

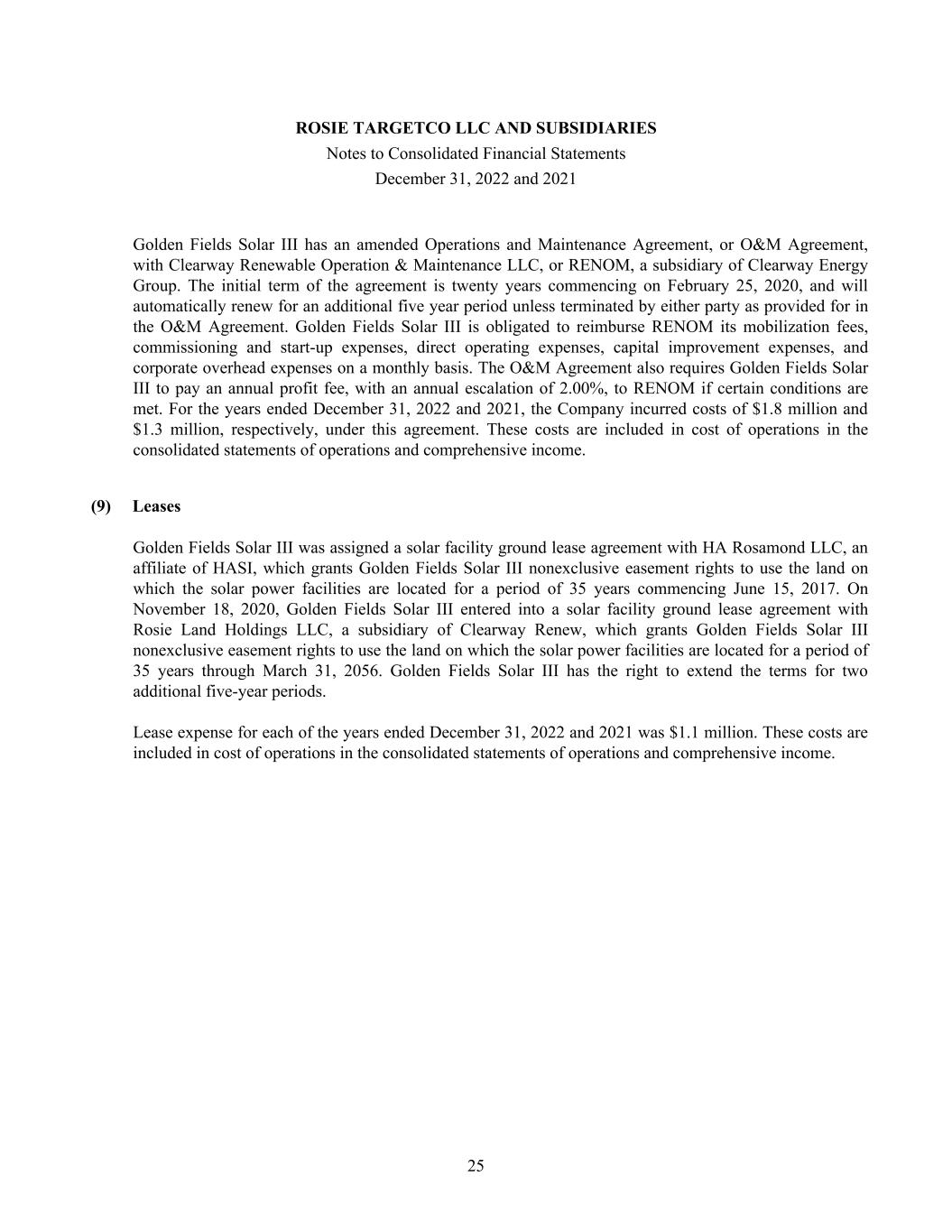

Golden Fields Solar III has an amended Operations and Maintenance Agreement, or O&M Agreement, with Clearway Renewable Operation & Maintenance LLC, or RENOM, a subsidiary of Clearway Energy Group. The initial term of the agreement is twenty years commencing on February 25, 2020, and will automatically renew for an additional five year period unless terminated by either party as provided for in the O&M Agreement. Golden Fields Solar III is obligated to reimburse RENOM its mobilization fees, commissioning and start-up expenses, direct operating expenses, capital improvement expenses, and corporate overhead expenses on a monthly basis. The O&M Agreement also requires Golden Fields Solar III to pay an annual profit fee, with an annual escalation of 2.00%, to RENOM if certain conditions are met. For the years ended December 31, 2022 and 2021, the Company incurred costs of $1.8 million and $1.3 million, respectively, under this agreement. These costs are included in cost of operations in the consolidated statements of operations and comprehensive income. (9) Leases Golden Fields Solar III was assigned a solar facility ground lease agreement with HA Rosamond LLC, an affiliate of HASI, which grants Golden Fields Solar III nonexclusive easement rights to use the land on which the solar power facilities are located for a period of 35 years commencing June 15, 2017. On November 18, 2020, Golden Fields Solar III entered into a solar facility ground lease agreement with Rosie Land Holdings LLC, a subsidiary of Clearway Renew, which grants Golden Fields Solar III nonexclusive easement rights to use the land on which the solar power facilities are located for a period of 35 years through March 31, 2056. Golden Fields Solar III has the right to extend the terms for two additional five-year periods. Lease expense for each of the years ended December 31, 2022 and 2021 was $1.1 million. These costs are included in cost of operations in the consolidated statements of operations and comprehensive income. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 25

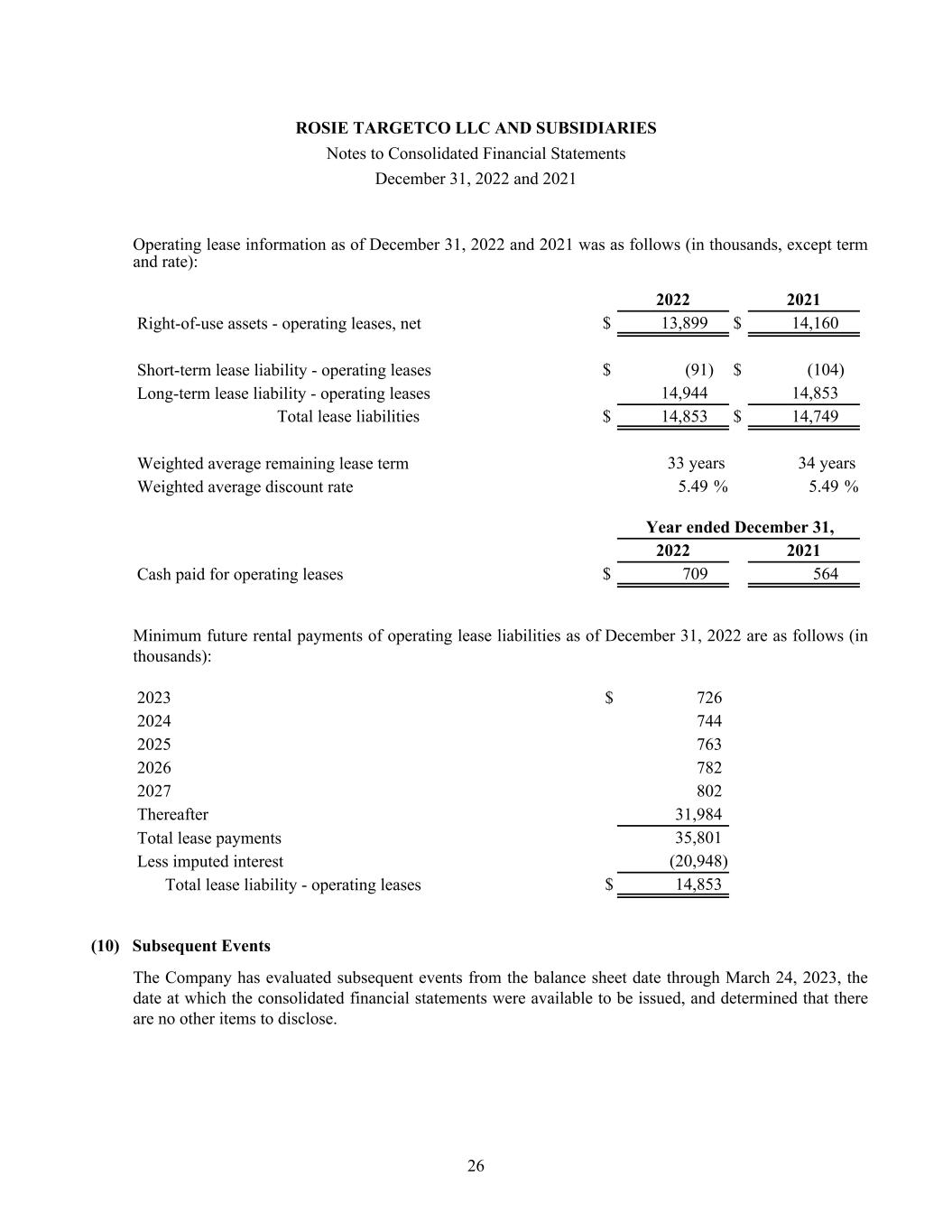

Operating lease information as of December 31, 2022 and 2021 was as follows (in thousands, except term and rate): 2022 2021 Right-of-use assets - operating leases, net $ 13,899 $ 14,160 Short-term lease liability - operating leases $ (91) $ (104) Long-term lease liability - operating leases 14,944 14,853 Total lease liabilities $ 14,853 $ 14,749 Weighted average remaining lease term 33 years 34 years Weighted average discount rate 5.49 % 5.49 % Year ended December 31, 2022 2021 Cash paid for operating leases $ 709 564 Minimum future rental payments of operating lease liabilities as of December 31, 2022 are as follows (in thousands): 2023 $ 726 2024 744 2025 763 2026 782 2027 802 Thereafter 31,984 Total lease payments 35,801 Less imputed interest (20,948) Total lease liability - operating leases $ 14,853 (10) Subsequent Events The Company has evaluated subsequent events from the balance sheet date through March 24, 2023, the date at which the consolidated financial statements were available to be issued, and determined that there are no other items to disclose. ROSIE TARGETCO LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2022 and 2021 26