424B5: Prospectus filed pursuant to Rule 424(b)(5)

Published on May 26, 2023

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-263169

PROSPECTUS SUPPLEMENT

(To prospectus dated March 1, 2022)

13,043,479 Shares

HANNON ARMSTRONG SUSTAINABLE

INFRASTRUCTURE CAPITAL, INC.

Common Stock

Hannon Armstrong Sustainable Infrastructure Capital, Inc. is a climate positive company that actively partners with clients to deploy real assets that facilitate the energy transition.

We are offering 13,043,479 shares of our common stock, par value $0.01 per share, or our common stock, as described in this prospectus supplement and the accompanying prospectus. All of the shares of our common stock offered by this prospectus supplement and the accompanying prospectus are being sold by us. Our common stock is listed on the New York Stock Exchange under the symbol HASI.

On May 22, 2023, the last reported sales price for our common stock on the New York Stock Exchange was $26.78 per share.

We elected and qualified to be taxed as a real estate investment trust for U.S. federal income tax purposes, or REIT, commencing with our taxable year ended December 31, 2013. To assist us in qualifying as a REIT, among other purposes, stockholders are generally restricted from owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of our common stock, the outstanding shares of any class or series of our preferred stock, or the outstanding shares of our capital stock. In addition, our charter contains various restrictions on the ownership and transfer of our shares. See Description of SecuritiesRestrictions on Ownership and Transfer in the accompanying prospectus.

Investing in our common stock involves risks. See Risk Factors beginning on page S-9 of this prospectus supplement and page 3 of the accompanying prospectus. You should also read carefully the risk factors described in our Securities and Exchange Commission filings, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, before investing in our common stock.

| Per Share |

Total | |||||||

| Public offering price |

$ | 23.0000 | $ | 300,000,017 | ||||

| Underwriting discount(1) |

$ | 0.7705 | $ | 10,050,001 | ||||

| Proceeds, before expenses, to us |

$ | 22.2295 | $ | 289,950,016 | ||||

| (1) | See Underwriting for complete details of underwriting compensation |

We have granted the underwriters the right to purchase up to 1,956,521 additional shares of our common stock from us at the public offering price, less the underwriting discount, within 30 days after the date of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these shares or determined if this prospectus supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

The shares of common stock sold in this offering will be ready for delivery on or about May 30, 2023.

Joint Book-Running Managers

| J.P. Morgan | BofA Securities |

Goldman Sachs & Co. LLC | ||

| Morgan Stanley | Barclays | Citigroup | ||

| RBC Capital Markets | Truist Securities | Wells Fargo Securities | ||

Co-Managers

| SMBC Nikko | B. Riley Securities | Baird | ||

| Credit Suisse | KeyBanc Capital Markets | Oppenheimer & Co. | ||

The date of this prospectus supplement is May 24, 2023.

Table of Contents

| Page | ||||

| ii | ||||

| S-1 | ||||

| S-7 | ||||

| S-9 | ||||

| S-10 | ||||

| S-11 | ||||

| S-12 | ||||

| S-18 | ||||

| S-19 | ||||

| WHERE YOU CAN FIND MORE INFORMATION AND INCORPORATION BY REFERENCE |

S-20 | |||

PROSPECTUS

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 9 | ||||

| 13 | ||||

| 15 | ||||

| 17 | ||||

| 19 | ||||

| 22 | ||||

| 24 | ||||

| CERTAIN PROVISIONS OF THE MARYLAND GENERAL CORPORATION LAW AND OUR CHARTER AND BYLAWS |

25 | |||

| HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE, L.P. PARTNERSHIP AGREEMENT |

31 | |||

| 34 | ||||

| 65 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

- i -

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, which describes the specific terms of this offering and also updates information contained in the accompanying prospectus and the documents incorporated by reference into the prospectus. The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus, the information in this prospectus supplement shall control. In addition, any statement in a filing we make with the Securities and Exchange Commission, or the SEC, that adds to, updates or changes information contained in an earlier filing we made with the SEC shall be deemed to modify and supersede such information in the earlier filing.

You should read this document together with additional information described under the heading Where You Can Find More Information and Incorporation by Reference in this prospectus supplement. You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompany prospectus. Neither we nor the underwriters have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus supplement and the accompanying prospectus, as well as the information we have previously filed with the SEC and incorporated by reference in this document, is accurate only as of its date or the dates which are specified in those documents, as applicable, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of shares of our common stock.

- ii -

Table of Contents

This summary highlights some of the information in this prospectus supplement and the accompanying prospectus. It does not contain all of the information that you should consider before investing in shares of our common stock. Before making an investment decision, you should read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, including the financial statements and related notes as well as the Risk Factors section in our Annual Report on Form 10-K (as supplemented by our Form 10-K/A) for the year ended December 31, 2022, or our 2022 10-K, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act. References in this prospectus supplement to we, our, us and our company refer to Hannon Armstrong Sustainable Infrastructure Capital, Inc., a Maryland corporation, Hannon Armstrong Sustainable Infrastructure, L.P., and any of our other subsidiaries. Hannon Armstrong Sustainable Infrastructure, L.P. is a Delaware limited partnership of which we are the sole general partner and to which we refer in this prospectus supplement as our operating partnership. Unless indicated otherwise, the information in this prospectus supplement assumes no exercise by the underwriters of their option to purchase up to an additional 1,956,521 shares of our common stock.

Company Overview

We are a climate positive company that actively partners with clients to deploy real assets that facilitate the energy transition. We believe that we are one of the first U.S. public companies solely dedicated to climate solutions. Our goal is to generate attractive returns from a diversified portfolio of project company investments with long-term, predictable cash flows from proven technologies that reduce carbon emissions or increase resilience to climate change.

We are internally managed, and our management team has extensive relevant industry knowledge and experience. We have long-standing relationships with the leading energy service companies, or ESCOs, manufacturers, project developers, utilities, owners and operators that provide recurring, programmatic investment and fee-generating opportunities. Additionally, we have relationships with leading commercial and investment banks and institutional investors from which we are referred additional investment and fee-generating opportunities.

We elected to be taxed as a REIT for U.S. federal income tax purposes, commencing with our taxable year ended December 31, 2013 and operate our business in a manner that will permit us to maintain our exemption from registration as an investment company under the Investment Company Act of 1940, as amended, or the 1940 Act.

Investments Overview

Our investments in climate solutions are focused on three markets:

| | Behind-the-Meter, or BTM: distributed building or facility projects, which reduce energy usage or cost through the use of solar generation and energy storage or energy efficiency improvements including heating, ventilation and air conditioning systems, or HVAC, lighting, energy controls, roofs, windows, building shells, and/or combined heat and power systems; |

| | Grid-Connected, or GC: renewable energy projects that deploy cleaner energy sources, such as solar, solar-plus-storage, and wind, to generate power production where the off-taker or counterparty may be part of the wholesale electric power markets; and |

| | Fuels, Transport and Nature, or FTN: renewable natural gas (RNG) plants, transportation fleet enhancements, and ecological restoration projects, among others, that increase resiliency or more efficiently use natural resources. |

S-1

Table of Contents

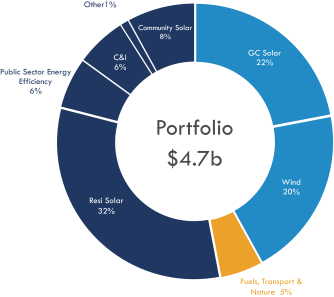

As of March 31, 2023, we held approximately $4.7 billion of transactions on our balance sheet, which we refer to as our Portfolio, an increase of approximately $0.4 billion from December 31, 2022.

The following chart illustrates our Portfolio by asset class as of March 31, 2023:

As of March 31, 2023, our Portfolio consisted of over 350 investments in approximately 8 asset classes, with an unlevered portfolio yield of 7.5%. From our Portfolio, as of March 31, 2023, our BTM investments had a yield of 7.9% and a production of 3 GW, our GC investments had a yield of 7.0% and a production of 11 GW and our FTN investments had a yield of 7.5%.

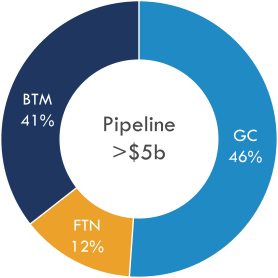

We have a large and active pipeline of potential new opportunities in over 8 asset classes that are in various stages of our underwriting process.

S-2

Table of Contents

The following chart illustrates our pipeline of transactions that could potentially close in the next 12 months as of March 31, 2023:

Our clients include over 40 leading clean energy and infrastructure companies and our strategy combines relationship-based investing with in-house portfolio management and engineering expertise to generate attractive risk adjusted fixed rate returns from a diversified portfolio of long-term, recurring and predictable cash flows. We focus on projects that use proven technology and that often have contractually committed agreements with an investment grade rated off-taker or counterparties and often hold a senior or preferred position in many of our investments. We believe our strategy is reflected in our loss history as we have experienced less than 20 bps of cumulative credit losses (net of recoveries) since 2012 (calculation represents credit losses as a percentage of cumulative originations, excluding equity method investments).

From 2014 through 2022 and from 2019 through 2022, we have experienced consistent growth in our distributable earnings per share and our dividends, respectively. In recent years, we have further diversified our sources of funding as compared to the period following our initial public offering. In addition, we have developed lending relationships with more than 15 banks and have raised debt from more than 200 institutional investors.

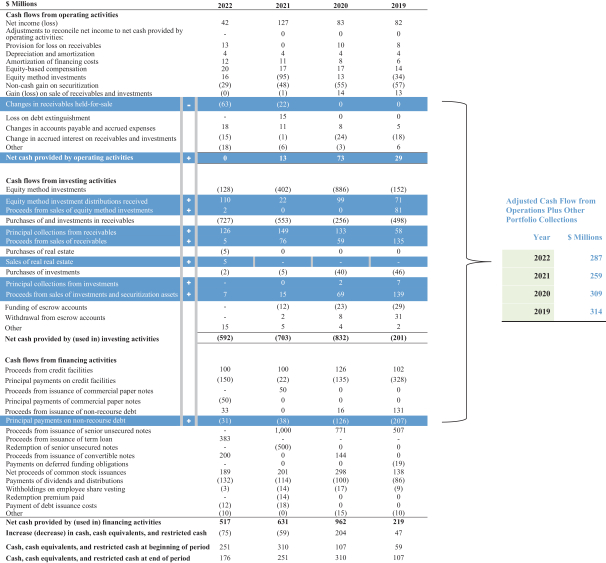

Non-GAAP Measures

Adjusted Cash Flow from Operations plus Other Portfolio Collections

We operate our business in a manner that considers total cash collected from our Portfolio and necessary operating and debt service payments to assess the amount of cash we have available to fund investments and distributions. The line items from our Statement of Cash Flows that are relevant to this measure are highlighted in the graphic below. We believe that the aggregate of these items, which combine as a non-GAAP financial measure titled Adjusted Cash Flow from Operations plus Other Portfolio Collections, is a useful measure of the liquidity we have available from our assets to fund both new investments and our regular quarterly dividends. This non-GAAP financial measure may not be comparable to similarly titled or other similar measures used by other companies. Although there is also not a directly comparable GAAP measure that demonstrates how we consider cash available for dividend payment, set forth below is how Adjusted Cash Flow from Operations plus Other Portfolio Collections compares to GAAP Net cash provided by operating activities.

S-3

Table of Contents

Adjusted Cash Flow from Operations plus Other Portfolio Collections differs from GAAP Net cash provided by operating activities on our Statement of Cash Flows, in that it (A) excludes Changes in receivables held-for-sale, (B) adds cash flow from Equity method investment distributions received, Proceeds from sales of equity method investments, Principal collections from receivables, Proceeds from sales of receivables, Principal collections from investments, and Proceeds from sales of investments and securitization assets, and (C) subtracts Principal payments on non-recourse debt.

In addition, in order to calculate this measure for the 12 months ended March 31, 2023, the following methodology should be used: (1) Apply the methodology set forth in the immediately preceding paragraph to our Statement of Cash Flows for the year ended December 31, 2022; (2) apply the methodology set forth in the immediately preceding paragraph to our Statement of Cash Flows for the quarter ended March 31, 2023; (3) apply the methodology set forth in the immediately preceding paragraph to our Statement of Cash Flows for the quarter ended March 31, 2022; (4) add the result obtained in clause (2) above to the result obtained in clause (1) above; and (5) subtract the result obtained in clause (3) from the result obtained in clause (4) above. This measure is not intended to demonstrate an alternative view of cash available from investment returns for dividend payment. Our Statement of Cash Flows for the year ended December 31, 2022 is included in the graphic below. Our Statements of Cash Flows for the three months ended March 31, 2023 and March 31, 2022 are included in our Quarterly report for the quarter ended March 31, 2023 that is incorporated herein by reference. Also, Adjusted Cash Flow from Operations plus Other Portfolio Collections differs from Net cash provided by (used in) investing activities in that it excludes many of the uses of cash used in our investing activities such as in Equity method investments, Purchases of and investments in receivables, Purchases of real estate, Purchases of investments, Funding of escrow accounts, and excludes Withdrawal from escrow accounts, and Other.

In addition, Adjusted Cash Flow from Operations plus Other Portfolio Collections is not comparable to Net cash provided by (used in) financing activities in that it excludes many of our financing activities such as proceeds from common stock issuances and borrowings and repayments of unsecured debt.

For the years ended December 31, 2022, 2021, 2020 and 2019, our Net cash provided by operating activities was $0, $13 million, $73 million and $29 million, respectively.

S-4

Table of Contents

The following table illustrates the calculation of Adjusted Cash Flow from Operations plus Other Portfolio Collections from our GAAP Statement of Cash Flows:

S-5

Table of Contents

The following table illustrates our cash flow sources and uses for the years ended December 31, 2022, 2021, 2020 and 2019:

| 2022 | 2021 | 2020 | 2019 | |||||||||||||

| $ Millions(1) | ||||||||||||||||

| Adjusted Cash Flow from Operations Plus Other Portfolio Collections |

$287 | $259 | $ 309 | $314 | ||||||||||||

| (-) Dividend |

($132 | ) | ($114 | ) | ($ 100 | ) | ($ 86 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (=) Cash Available for Reinvestment |

$155 | $146 | $ 209 | $227 | ||||||||||||

| (-) Investments Funded |

($871 | ) | ($960 | ) | ($1,183 | ) | ($715 | ) | ||||||||

| (+) Capital Raised |

$693 | $796 | $1,206 | $540 | ||||||||||||

| Other Sources/Uses of Cash |

($ 51 | ) | ($ 41 | ) | ($ 28 | ) | ($ 5 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Change in Cash |

($ 74 | ) | ($ 59 | ) | $ 204 | $ 47 | ||||||||||

| (1) | Amounts may not sum due to rounding |

Adjusted Cash Flow from Operations plus Other Portfolio Collections historically have exceeded dividends and we have reinvested the excess cash flows in our Portfolio.

S-6

Table of Contents

| Common stock offered by us | 13,043,479 shares (plus up to an additional 1,956,521 shares of our common stock that we may issue and sell upon the exercise of the underwriters option to purchase additional shares). | |

| Common stock and OP units to be outstanding upon completion of this offering | 104,955,323 shares and 1,361,347 limited partnership units in our operating partnership, or OP units.(1) | |

| Use of proceeds | We estimate that we will receive net proceeds from this offering of approximately $289.7 million, or approximately $333.1 million if the underwriters option to purchase additional shares is exercised in full, after deducting the underwriting discounts and commissions, and estimated expenses of this offering.

We intend to contribute the net proceeds of this offering to our operating partnership which in turn may use such proceeds for general corporate purposes, which may include repaying outstanding borrowings under our CarbonCount®-based revolving credit agreement, dated February 7, 2022, or the Credit Agreement, and our Loan Agreement (Approval-Based), dated as of December 13, 2018, or the Rhea Facility, purchasing outstanding commercial paper notes under our CarbonCount® Green Commercial Paper Note Program, or the Commercial Paper Program and acquiring our target assets in accordance with our investment strategy. Prior to the full investment of such net proceeds, we intend to invest such net proceeds in interest-bearing accounts, money market funds and short-term interest-bearing securities that are consistent with our intention to qualify for taxation as a REIT. For further information about our objectives and strategies, please see BusinessInvestment Strategy, included in our 2022 10-K, which is incorporated by reference into this prospectus supplement. |

|

| Dividend policy | We have and intend to continue to make regular quarterly distributions to holders of our common stock. U.S. federal income tax law generally requires that a REIT distribute annually at least 90% of its REIT taxable income, without regard to the deduction for dividends paid and excluding net capital gains, and that it pay tax at regular corporate rates to the extent that it annually distributes less than 100% of its REIT taxable income. Our current policy is to pay quarterly distributions, which on an annual basis will equal or exceed substantially all of our REIT taxable income. Any distributions we make will be at the discretion of our board of directors and will depend upon, among other things, our actual results of operations. These results and our ability to pay distributions will be affected by various factors, including the net interest and other income from our portfolio, our operating expenses and any other expenditures. | |

| (1) | Based on 91,911,844 shares of common stock and 1,361,347 operating partnership units outstanding as of May 23, 2023, and excludes (1) 1,956,521 shares of our common stock that we may issue and sell upon the full exercise of the underwriters option to purchase additional shares, (2) shares of our common stock (including restricted stock units, OP units, long-term incentive-plan units, or LTIP Units, or similar awards) that we may grant in the future under our 2022 equity incentive plan, (3) OP units held directly or indirectly by us and (4) 99,884 unvested performance-based restricted stock units, 488,296 unvested time-based OP LTIP Units and 493,858 unvested performance-based OP LTIP Units assuming payout at 100%. |

S-7

Table of Contents

| New York Stock Exchange, or NYSE, symbol | HASI | |

| Ownership and transfer restrictions | To assist us in complying with the limitations on the concentration of ownership of a REIT imposed by the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, among other purposes, our charter generally prohibits, among other prohibitions, any stockholder from beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of our common stock, the outstanding shares of any class or series of our preferred stock or the outstanding shares of our capital stock of all classes and series. See Description of SecuritiesRestrictions on Ownership and Transfer in the accompanying prospectus. | |

| Risk factors | Investing in our common stock involves a high degree of risk. You should carefully read the information contained under the caption Risk Factors in this prospectus supplement and page 3 of the accompanying prospectus, and the risks set forth under the caption Item 1A. Risk Factors included in our 2022 10-K and our other filings under the Exchange Act for risks that you should consider before deciding to invest in shares of our common stock. | |

| Regulatory | We have elected to qualify, and operate our business so as to qualify, to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code, commencing with our taxable year ended December 31, 2013.

We also intend to continue to operate our business in a manner that will permit us to maintain our exception from registration as an investment company under the 1940 Act. |

|

Our Corporate Information

Our principal executive offices are located at One Park Place, Suite 200, Annapolis, Maryland 21401. Our telephone number is (410) 571-9860. Our website is www.hasi.com. The information on our website is not intended to form a part of or be incorporated by reference into this prospectus supplement or the accompanying prospectus.

S-8

Table of Contents

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risk factors described in the section Risk Factors contained in our 2022 10-K, which is incorporated herein by reference, together with all of the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus. Any of these risks described could materially adversely affect our business, financial condition, results of operations, tax status or ability to make distributions to our stockholders. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If this were to happen, the price of our common stock could decline significantly and you could lose a part or all of your investment.

S-9

Table of Contents

We make forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act that are subject to risks and uncertainties. For these statements, we claim the protections of the safe harbor for forward-looking statements contained in such Sections. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words believe, expect, anticipate, estimate, plan, continue, intend, should, may or similar expressions, we intend to identify forward-looking statements. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements.

Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Forward-looking statements are not predictions of future events. Actual results may differ materially from those set forth in the forward-looking statements. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, important factors included in the risk factors described in the section captioned Risk Factors contained in our 2022 10-K and in subsequent periodic reports which we file with the SEC, as well as other information included or incorporated by reference in this prospectus supplement or the accompanying prospectus before purchasing any shares of our common stock (in addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements) that could have a significant impact on our operations and financial results, and could cause our actual results to differ materially from those contained or implied in forward-looking statements made by us or on our behalf in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein.

Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including, but not limited to, unanticipated events, after the date on which such statement is made, unless otherwise required by law. New factors emerge from time to time and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement.

S-10

Table of Contents

We estimate that we will receive net proceeds from this offering of approximately $289.7 million, or approximately $333.1 million if the underwriters option to purchase additional shares is exercised in full, after deducting the underwriting discounts and commissions, and estimated expenses of this offering.

We intend to contribute the net proceeds of this offering to our operating partnership which in turn may use such proceeds for general corporate purposes, which may include repaying outstanding borrowings under the Credit Agreement and the Rhea Facility purchasing outstanding commercial paper notes under the Commercial Paper Program and acquiring our target assets in accordance with our investment strategy. Prior to the full investment of such net proceeds, we intend to invest such net proceeds in interest-bearing accounts, money market funds and short-term interest-bearing securities that are consistent with our intention to qualify for taxation as a REIT.

As of May 23, 2023, we had approximately $300 million outstanding under the Credit Agreement. The scheduled maturity date of the Credit Agreement is February 7, 2025. Loans under the Credit Agreement bear interest at a rate of the SOFR or prime rate plus applicable margins based on our current credit rating, which may be adjusted downward up to 0.10% to the extent our portfolio achieves certain targeted levels of carbon emissions avoidance as measured by our CarbonCount® metric. As of May 23, 2023, the weighted average interest rate on the Credit Agreement was 6.90% per annum.

As of May 23, 2023, we had approximately $107 million outstanding under the Rhea Facility. The scheduled maturity date of the Rhea Facility is July 19, 2023. Loans under the Rhea Facility bear interest at a rate equal to one-month LIBOR plus 1.50% or 2.00% (depending on the type of collateral) or, under certain circumstances, the Federal Funds Rate plus 0.50% or 1.00% (depending on the type of collateral). As of May 23, 2023, the weighted average interest rate on the Rhea Facility was 7.10% per annum.

As of May 23, 2023, we had approximately $100 million outstanding under the Commercial Paper Program, with a weighted average interest rate of approximately 6.48% and an average original maturity of approximately 30 days. Commercial paper notes under our Commercial Paper Program are not redeemable, are not subject to voluntary prepayment and are not to exceed 397 days. The proceeds of our commercial paper notes are used to acquire or refinance, in whole or in part, eligible green projects, including assets that are neutral to negative on incremental carbon emissions. Green commercial paper notes are issued at a discount based on market pricing, subject to broker fees of 0.10%.

Certain of the underwriters and/or their affiliates are lenders under the Credit Agreement or the Rhea Facility or are dealers under the Commercial Paper Program.

S-11

Table of Contents

J.P. Morgan Securities LLC, BofA Securities, Inc. and Goldman Sachs & Co. LLC are acting as representatives of each of the underwriters named below. Subject to the terms and conditions set forth in an underwriting agreement among the underwriters and us, we have agreed to sell to the underwriters, and each of the underwriters has agreed, severally and not jointly, to purchase from us, the number of shares of common stock set forth opposite its name below.

| Underwriter |

Number of Shares | |||

| J.P. Morgan Securities LLC |

3,423,103 | |||

| BofA Securities, Inc. |

2,660,611 | |||

| Goldman Sachs & Co. LLC |

1,265,413 | |||

| Morgan Stanley & Co. LLC |

885,788 | |||

| Barclays Capital Inc. |

632,706 | |||

| Citigroup Global Markets Inc. |

632,706 | |||

| RBC Capital Markets, LLC |

632,706 | |||

| Truist Securities, Inc. |

632,706 | |||

| Wells Fargo Securities, LLC |

632,706 | |||

| SMBC Nikko Securities America, Inc. |

379,624 | |||

| B. Riley Securities, Inc. |

253,082 | |||

| Robert W. Baird & Co. Incorporated |

253,082 | |||

| Credit Suisse Securities (USA) LLC |

253,082 | |||

| KeyBanc Capital Markets Inc. |

253,082 | |||

| Oppenheimer & Co. Inc. |

253,082 | |||

|

|

|

|||

| Total |

13,043,479 | |||

|

|

|

|||

Subject to the terms and conditions set forth in the underwriting agreement, the underwriters have agreed, severally and not jointly, to purchase all of the shares sold under the underwriting agreement if any of these shares are purchased. If an underwriter defaults, the underwriting agreement provides that the purchase commitments of the nondefaulting underwriters may be increased or the underwriting agreement may be terminated.

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute to payments the underwriters may be required to make in respect of those liabilities.

The underwriters are offering the shares, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal matters by their counsel, including the validity of the shares, and other conditions contained in the underwriting agreement, such as the receipt by the underwriters of officers certificates and legal opinions. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

Commissions and Discounts

The representatives have advised us that the underwriters propose initially to offer the shares to the public at the public offering price set forth on the cover page of this prospectus supplement and to dealers at that price less a concession not in excess of $0.4623 per share. After the initial offering, the public offering price, concession or any other term of the offering may be changed.

The following table shows the public offering price, underwriting discount and proceeds before expenses to us. The information assumes either no exercise or full exercise by the underwriters of their option to purchase additional shares.

| Per Share | Without Option | With Option | ||||||||||

| Public offering price |

$ | 23.0000 | $ | 300,000,017 | $ | 345,000,000 | ||||||

| Underwriting discount |

$ | 0.7705 | $ | 10,050,001 | $ | 11,557,500 | ||||||

| Proceeds, before expenses, to us |

$ | 22.2295 | $ | 289,950,016 | $ | 333,442,500 | ||||||

S-12

Table of Contents

The expenses of the offering, not including the underwriting discount, are estimated at $300,000 (including the exercise by the underwriters of their option to purchase additional shares) and are payable by us.

Option to Purchase Additional Shares

We have granted an option to the underwriters, exercisable for 30 days after the date of this prospectus supplement, to purchase up to 1,956,521 additional shares at the public offering price, less the underwriting discount. If the underwriters exercise this option, each will be obligated, subject to conditions contained in the underwriting agreement, to purchase a number of additional shares proportionate to that underwriters initial amount reflected in the above table.

No Sales of Similar Securities

We, our executive officers and directors have agreed not to sell or transfer any common stock or securities convertible into, exchangeable for, exercisable for, or repayable with common stock, for 30 days after the date of the underwriting agreement among the underwriters and us without first obtaining the written consent of J.P. Morgan Securities LLC, BofA Securities, Inc. and Goldman Sachs & Co. LLC. Specifically, we and these other persons have agreed, with certain limited exceptions, not to directly or indirectly:

| | offer, pledge, sell or contract to sell any common stock, |

| | sell any option or contract to purchase any common stock, |

| | purchase any option or contract to sell any common stock, |

| | grant any option, right or warrant for the sale of any common stock, |

| | lend or otherwise dispose of or transfer any common stock, |

| | request or demand that we file a registration statement related to the common stock, or |

| | enter into any swap or other agreement that transfers, in whole or in part, the economic consequence of ownership of any common stock whether any such swap or transaction is to be settled by delivery of shares or other securities, in cash or otherwise. |

This lock-up provision applies to common stock and to securities convertible into or exchangeable or exercisable for or repayable with common stock. It also applies to common stock owned now or acquired later by the person executing the agreement or for which the person executing the agreement later acquires the power of disposition.

However, with respect to our directors and executive officers, the restrictions described above shall not apply to (i) bona fide gifts or transfers to family members or trusts for the direct or indirect benefit of the director or executive officer or his or her family members or bona fide gifts for charities, provided in each case that the transferee agrees in writing to be bound by the terms of the lock-up agreement, and (ii) for shares sold in certain instances based on withholding taxes for vesting of restricted stock. Further, with respect to certain of our executive officers, the restrictions described above shall not apply to certain sales and gifts made pursuant to their previously established 10b5-1 plans.

Listing

The shares are listed on the NYSE under the symbol HASI.

Price Stabilization, Short Positions and Penalty Bids

Until the distribution of the shares is completed, SEC rules may limit underwriters and selling group members from bidding for and purchasing our common stock. However, the representatives may engage in

S-13

Table of Contents

transactions that stabilize the price of the common stock, such as bids or purchases to peg, fix or maintain that price.

In connection with the offering, the underwriters may purchase and sell our common stock in the open market. These transactions may include short sales, purchases on the open market to cover positions created by short sales and stabilizing transactions. Short sales involve the sale by the underwriters of a greater number of shares than they are required to purchase in the offering. Covered short sales are sales made in an amount not greater than the underwriters option to purchase additional shares described above. The underwriters may close out any covered short position by either exercising their option to purchase additional shares or purchasing shares in the open market. In determining the source of shares to close out the covered short position, the underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the option granted to them. Naked short sales are sales in excess of such option. The underwriters must close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of our common stock in the open market after pricing that could adversely affect investors who purchase in the offering. Stabilizing transactions consist of various bids for or purchases of shares of common stock made by the underwriters in the open market prior to the completion of this offering.

The underwriters may also impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the representatives have repurchased shares sold by or for the account of such underwriter in stabilizing or short covering transactions.

Similar to other purchase transactions, the underwriters purchases to cover the syndicate short sales may have the effect of raising or maintaining the market price of our common stock or preventing or retarding a decline in the market price of our common stock. As a result, the price of our common stock may be higher than the price that might otherwise exist in the open market. The underwriters may conduct these transactions on the NYSE, in the over-the-counter market or otherwise.

Neither we nor any of the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of our common stock. In addition, neither we nor any of the underwriters make any representation that the representatives will engage in these transactions or that these transactions, once commenced, will not be discontinued without notice.

Electronic Distribution

In connection with the offering, certain of the underwriters or securities dealers may distribute prospectuses by electronic means, such as e-mail.

Conflict of Interest

In the past, certain of the underwriters and their affiliates have provided traditional commercial lending to us and our subsidiaries and affiliates in one off financings in the ordinary course of business. Some of the underwriters and their affiliates may in the future engage in investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. Accordingly, they have received, or may in the future receive, customary fees and commissions for these transactions. We have in the past, and may continue in the future, to purchase assets held by affiliates of one or more of the underwriters. In addition, certain of the underwriters and/or their affiliates are lenders under the Credit Agreement or the Rhea Facility or are dealers under the Commercial Paper Program.

In addition, in the ordinary course of their business activities, the underwriters and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers.

S-14

Table of Contents

Such investments and securities activities may involve securities and/or instruments of ours or our affiliates. The underwriters and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Notice to Prospective Investors in the Dubai International Financial Centre

This prospectus supplement and the accompanying prospectus relate to an Exempt Offer in accordance with the Offered Securities Rules of the Dubai Financial Services Authority, or DFSA. This prospectus supplement and the accompanying prospectus are intended for distribution only to persons of a type specified in the Offered Securities Rules of the DFSA. It must not be delivered to, or relied on by, any other person. The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers. The DFSA has not approved this prospectus supplement and the accompanying prospectus nor taken steps to verify the information set forth herein and has no responsibility for the prospectus supplement and the accompanying prospectus. The shares to which this prospectus supplement and the accompanying prospectus relate may be illiquid and/or subject to restrictions on their resale. Prospective purchasers of the shares offered should conduct their own due diligence on the shares. If you do not understand the contents of this prospectus supplement and the accompanying prospectus you should consult an authorized financial advisor.

Notice to Prospective Investors in Australia

No placement document, prospectus, product disclosure statement or other disclosure document has been lodged with the Australian Securities and Investments Commission, or ASIC, in relation to the offering.

This prospectus supplement and the accompanying prospectus do not constitute a prospectus, product disclosure statement or other disclosure document under the Corporations Act 2001, or the Corporations Act, and does not purport to include the information required for a prospectus, product disclosure statement or other disclosure document under the Corporations Act.

Any offer in Australia of the shares may only be made to persons, or the Exempt Investors, who are sophisticated investors (within the meaning of section 708(8) of the Corporations Act), professional investors (within the meaning of section 708(11) of the Corporations Act) or otherwise pursuant to one or more exemptions contained in section 708 of the Corporations Act so that it is lawful to offer the shares without disclosure to investors under Chapter 6D of the Corporations Act.

The shares applied for by Exempt Investors in Australia must not be offered for sale in Australia in the period of 12 months after the date of allotment under the offering, except in circumstances where disclosure to investors under Chapter 6D of the Corporations Act would not be required pursuant to an exemption under section 708 of the Corporations Act or otherwise or where the offer is pursuant to a disclosure document which complies with Chapter 6D of the Corporations Act. Any person acquiring shares must observe such Australian on-sale restrictions.

This prospectus supplement and the accompanying prospectus contain general information only and do not take account of the investment objectives, financial situation or particular needs of any particular person. It does not contain any securities recommendations or financial product advice. Before making an investment decision, investors need to consider whether the information in this prospectus supplement and the accompanying prospectus is appropriate to their needs, objectives and circumstances, and, if necessary, seek expert advice on those matters.

Notice to Prospective Investors in Hong Kong

The shares have not been offered or sold and will not be offered or sold in Hong Kong, by means of any document, other than (a) to professional investors as defined in the Securities and Futures Ordinance (Cap.

S-15

Table of Contents

571) of Hong Kong and any rules made under that Ordinance; or (b) in other circumstances which do not result in the document being a prospectus as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance. No advertisement, invitation or document relating to the shares has been or may be issued or has been or may be in the possession of any person for the purposes of issue, whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to shares which are or are intended to be disposed of only to persons outside Hong Kong or only to professional investors as defined in the Securities and Futures Ordinance and any rules made under that Ordinance.

Notice to Prospective Investors in Canada

The shares may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the shares must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus supplement (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchasers province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchasers province or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 (or, in the case of securities issued or guaranteed by the government of a non-Canadian jurisdiction, section 3A.4) of National Instrument 33-105 Underwriting Conflicts (NI 33-105), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

Notice to Prospective Investors in Switzerland

Shares of our common stock, this prospectus and any related services, information and opinions described or referenced in this prospectus are not, and may not be, offered or marketed to or directed at persons in Switzerland who are non-qualified in the meaning of Federal Act on Collective Investment Schemes, or CISA, and its implementing Ordinance or high-net-worth-individuals (including private investment structures for high-net-worth-individuals that do not have professional treasury operations), even if they have opted out of customer protection under the Financial Services Act, or FinSA and elected to be treated as professional clients and qualified investors. Therefore, this prospectus may only be provided to and shares of our common stock only be offered or marketed to persons in Switzerland who are qualified investors in the meaning of the CISA, or Qualified Investors, but to the exclusion of (high-net-worth-individuals or private investment structures for high-net-worth-individuals that do not have professional treasury operations who elected to be treated as qualified investors), or Elective Qualified Investors.

None of the information provided in this prospectus should be construed as an offer for the purchase or sale of, or advertising for, shares of our common stock nor as an offer of, or advertising for, any related services to non-qualified investors. Circulating this prospectus and offering advertising or selling shares of our common stock to other persons as Qualified Investors (not including Elective Qualified Investors) may trigger, in particular, licensing requirements, a requirement to appoint a representative and paying agent in Switzerland and other regulatory consequences in Switzerland.

S-16

Table of Contents

This prospectus does not constitute a prospectus pursuant to Articles 35 et seq. of FinSA and may not comply with the information standards required thereunder. No key information document pursuant to Swiss law has been established in connection with shares of our common stock and this prospectus. Shares of our common stock will not be listed on the SIX Swiss Exchange, and consequently, the information presented in this prospectus does not necessarily comply with the information standards as set out in the relevant listing rules.

This prospectus has not been and will not be approved by or filed with, and may not be able to be approved by or filed with FINMA (as defined below) under the CISA or any other Swiss regulatory authority. Therefore, investors do not benefit from protection under the CISA or supervision by the Swiss Financial Market Supervisory Authority, or FINMA. This prospectus does not constitute investment advice. It may only be used by those persons to whom it has been handed out in connection with shares of our common stock and may neither be copied nor directly or indirectly distributed or made available to other persons.

17

Table of Contents

Certain legal matters will be passed upon for us by Clifford Chance US LLP. In addition, the description of U.S. federal income tax consequences contained in the section of the accompanying prospectus entitled U.S. Federal Income Tax Considerations is based on the opinion of Clifford Chance US LLP. Certain legal matters relating to this offering will be passed upon for the underwriters by Ropes & Gray LLP.

S-18

Table of Contents

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022, and the effectiveness of our internal control over financial reporting as of December 31, 2022, as set forth in their reports, which are incorporated by reference in this prospectus supplement and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLPs reports, given on their authority as experts in accounting and auditing.

Ernst & Young LLP, an independent auditor, has audited the consolidated financial statements of Vivint Solar Asset 3 HoldCo Parent, LLC as of December 31, 2021 and 2020 and for the year ended December 31, 2021 and for the period from October 9, 2020 to December 31, 2020 included in our Annual Report on Form 10-K/A for the year ended December 31, 2022, as set forth in their report, which is incorporated by reference in this prospectus supplement and elsewhere in the registration statement. The consolidated financial statements of Vivint Solar Asset 3 HoldCo Parent, LLC are incorporated by reference in reliance on Ernst & Young LLPs report, given on their authority as experts in accounting and auditing.

Ernst & Young LLP, an independent auditor, has audited the consolidated financial statements of Rosie TargetCo LLC and subsidiaries included in our Annual Report on Form 10-K/A for the year ended December 31, 2022, as set forth in their report, which is incorporated by reference in this prospectus supplement and elsewhere in the registration statement. The consolidated financial statements of Rosie TargetCo LLC and subsidiaries are incorporated by reference in reliance on Ernst & Young LLPs report, given on their authority as experts in accounting and auditing.

The consolidated financial statements of SunStrong Capital Holdings, LLC as of December 31, 2022 and 2021, and for each of the years in the three-year period ended December 31, 2022, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent auditors, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

The consolidated financial statements of Rosie TargetCo LLC and subsidiaries as of December 31, 2020 and for the year ended December 31, 2020, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent auditors, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

Ernst & Young LLP, an independent auditor, has audited the consolidated financial statements of Lighthouse Renewable HoldCo 2 LLC and subsidiaries as of December 31, 2022 and 2021, and for the year ended December 31, 2022 and the period from December 17, 2021 through December 31, 2021 included in our Annual Report on Form 10-K/A for the year ended December 31, 2022, as set forth in their report, which is incorporated by reference in this prospectus supplement and elsewhere in the registration statement. The consolidated financial statements of Lighthouse Renewable HoldCo 2 LLC and subsidiaries are incorporated by reference in reliance on Ernst & Young LLPs report, given on their authority as experts in accounting and auditing.

S-19

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION AND INCORPORATION BY REFERENCE

We have filed a registration statement on Form S-3 with the SEC in connection with this offering. In addition, we file annual, quarterly, current reports, proxy statements and other information with the SEC. Our SEC filings are also available to the public at the SECs Internet site at http://www.sec.gov. Our reference to the SECs Internet site is intended to be an inactive textual reference only.

This prospectus supplement and the accompanying prospectus do not contain all of the information included in the registration statement. If a reference is made in this prospectus supplement or the accompanying prospectus to any of our contracts or other documents filed or incorporated by reference as an exhibit to the registration statement, the reference may not be complete and you should refer to the filed copy of the contract or document.

The SEC allows us to incorporate by reference into this prospectus supplement the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. Information incorporated by reference is part of this prospectus supplement. Later information filed with the SEC will update and supersede this information.

| Document |

Period |

|

| Annual Report on Form 10-K (File No. 001-35877) | Year ended December 31, 2022 | |

| Annual Report on Form 10-K/A (File No. 001-35877) | Year ended December 31, 2022 | |

| Quarterly Report on Form 10-Q (File No. 001-35877) | Quarter ended March 31, 2023 | |

| Document |

Filed |

|

| Definitive Proxy Statement on Schedule 14A (only with respect to information contained in such Definitive Proxy Statement that is incorporated by reference into Part III of our Annual Report on Form 10-K for the year ended December 31, 2022) (File No. 001-35877) | April 19, 2023 | |

| Document |

Filed |

|

| Current Report on Form 8-K (File No. 001-35877) | February 23, 2023 | |

| Current Report on Form 8-K (File No. 001-35877) | March 1, 2023 | |

| Current Report on Form 8-K (File No. 001-35877) | May 11, 2023 | |

| Document |

Filed |

|

| Registration Statement on Form 8-A, or Form 8-A, as updated by Exhibit 4.2 to the Annual Report on Form 10-K for the year ended December 31, 2019, or Exhibit 4.2 (each containing a description of our common stock, $0.01 par value per share) (File No. 001-35877) | April 15, 2013 (Form 8-A) February 25, 2020 (Exhibit 4.2) |

|

We also incorporate by reference into this prospectus supplement additional documents that we may file (but not those that we furnish) with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act from the date of this prospectus supplement until we have sold all of the securities to which this prospectus supplement and the accompanying prospectus relate or the offering is otherwise terminated.

All of the documents that are incorporated by reference are available at the website maintained by the SEC at http://www.sec.gov. In addition, if you request, either orally or in writing, we will provide you with a copy of any or all documents that are incorporated by reference. Such documents will be provided to you free of charge, but will not contain any exhibits, unless those exhibits are incorporated by reference into the document. Requests should be addressed to us at One Park Place, Suite 200, Annapolis, Maryland 21401, Attention: Hannon Armstrong Sustainable Infrastructure Capital, Inc., Investor Relations, or contact our offices at (410) 571-9860.

S-20

Table of Contents

PROSPECTUS

HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL, INC.

Common Stock,

Preferred Stock,

Depositary Shares,

Debt Securities

Warrants

and

Rights

We may offer from time to time, in one or more series or classes, separately or together, and in amounts, at prices and on terms to be set forth in one or more supplements to this prospectus, the following securities:

| | shares of our common stock, par value $0.01 per share; |

| | shares of our preferred stock, par value $0.01 per share; |

| | depositary shares representing entitlement to all rights and preferences of fractions of shares of our preferred stock of a specified class or series and represented by depositary receipts; |

| | debt securities; |

| | warrants to purchase our common stock, preferred stock, depositary shares or debt securities; or |

| | rights to purchase our common stock or preferred stock. |

We refer to the common stock, preferred stock, depositary shares, debt securities, warrants and rights, collectively, as the securities in this prospectus.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in a supplement to this prospectus.

The applicable prospectus supplement will also contain information, where applicable, about certain U.S. federal income tax consequences relating to, and any listing on a securities exchange of, the securities covered by such prospectus supplement. It is important that you read both this prospectus and the applicable prospectus supplement before you invest.

We may offer the securities directly, through agents, or to or through underwriters. The prospectus supplement will describe the terms of the plan of distribution and set forth the names of any underwriters involved in the sale of the securities. See Plan of Distribution beginning on page 7 for more information on this topic. No securities may be sold without delivery of this prospectus and a prospectus supplement describing the method and terms of the offering of those securities.

Our common stock is listed on the New York Stock Exchange, or the NYSE, under the symbol HASI. On February 28, 2022, the closing sale price of our common stock on the NYSE was $47.34 per share.

Investing in these securities involves risks. You should carefully read the risk factors described in our Securities and Exchange Commission, or SEC, filings, including those described under Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2021 and in our subsequently filed periodic reports incorporated by reference herein, before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 1, 2022.

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 9 | ||||

| 13 | ||||

| 15 | ||||

| 17 | ||||

| 19 | ||||

| 22 | ||||

| 24 | ||||

| CERTAIN PROVISIONS OF THE MARYLAND GENERAL CORPORATION LAW AND OUR CHARTER AND BYLAWS |

25 | |||

| HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE, L.P. PARTNERSHIP AGREEMENT |

31 | |||

| 34 | ||||

| 65 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

- i -

Table of Contents

This prospectus is part of a shelf registration statement. Under this shelf registration statement, we may sell any combination of common stock, preferred stock, depositary shares, debt securities, warrants and rights. You should rely only on the information provided or incorporated by reference in this prospectus, any applicable prospectus supplement or any free writing prospectus. We have not authorized anyone to provide you with different or additional information. We are not making an offer to sell these securities in any jurisdiction where the offer or sale of these securities is not permitted. You should not assume that the information appearing in this prospectus, any applicable prospectus supplement or any free writing prospectus or the documents incorporated by reference herein or therein is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read carefully the entirety of this prospectus, any applicable prospectus supplement and any free writing prospectus, as well as the documents incorporated by reference herein or therein, before making an investment decision.

In this prospectus, unless otherwise specified or the context requires otherwise, we use the terms company, we, us and our to refer to Hannon Armstrong Sustainable Infrastructure Capital, Inc., together with its subsidiaries.

- 1 -

Table of Contents

We invest in climate solutions developed or sponsored by leading companies in the energy efficiency, renewable energy and other sustainable infrastructure markets. We believe that we are one of the first U.S. public companies solely dedicated to climate solution investments. Our goal is to generate attractive returns from a diversified portfolio of project company investments with long-term, predictable cash flows from proven technologies that reduce carbon emissions or increase resilience to climate change. Our vision is that every investment improves our climate future. In executing this vision, we focus on a wide variety of climate solutions including:

| Building Energy Efficiency |

LED Building Lighting |

|

| Energy Efficient Heating, Cooling and Ventilation |

Building Controls and Sensors |

|

| Combined Heat and Power Systems |

Electric Distribution Systems |

|

| LED Street Lighting |

Distributed Commercial and Industrial Solar |

|

| Community Solar |

Residential Solar |

|

| Utility Scale Solar |

Utility Scale Wind |

|

| Water and Stream Distribution Systems |

Storm Water Management |

|

| Nature Based Solutions and Environmental Credits |

Other Climate Related Technologies |

|

We are internally managed, and our management team has extensive relevant industry knowledge and experience. We have long-standing relationships with the leading energy service companies, or ESCOs, manufacturers, project developers, utilities, owners and operators, which provide recurring, programmatic investment and fee-generating opportunities. Additionally, we have relationships with leading commercial and investment banks and institutional investors from which we are referred additional investment and fee-generating opportunities.

We use borrowings as part of our strategy to increase potential returns to our stockholders and have available to us a broad range of financing sources including non-recourse or recourse debt, equity, and off-balance sheet securitization structures.

We elected to be taxed as a real estate investment trust for U.S. federal income tax purposes, or a REIT, commencing with our taxable year ended December 31, 2013 and operate our business in a manner that will permit us to maintain our exemption from registration as an investment company under the Investment Company Act of 1940, as amended, or the 1940 Act.

Our principal executive offices are located at 1906 Towne Centre Blvd, Suite 370, Annapolis, Maryland 21401. Our telephone number is (410) 571-9860. Our website is www.hannonarmstrong.com. The information on our website is not intended to form a part of or be incorporated by reference into this prospectus.

- 2 -

Table of Contents

Investing in any securities offered pursuant to this prospectus involves a high degree of risk. Before making an investment decision, you should carefully consider the risk factors described in the section captioned Risk Factors contained in our Annual Report on Form 10-K for the year ended December 31, 2021, or our 2021 10-K, and in subsequent periodic reports which we file with the SEC, as well as other information in this prospectus and any applicable prospectus supplement before purchasing any shares of our common stock. Any of these risks described could materially adversely affect our business, financial condition, results of operations, tax status or ability to make distributions to our stockholders. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If this were to happen, the price of our securities could decline significantly and you could lose a part or all of your investment. Each of the risks described could materially adversely affect our business, financial condition, results of operations, or ability to make distributions to our stockholders. In such case, you could lose all or a portion of your original investment. See Where You Can Find More Information beginning on page 69 of this prospectus.

- 3 -

Table of Contents

We make forward-looking statements in this prospectus and the documents incorporated by reference in this prospectus within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are subject to risks and uncertainties. For these statements, we claim the protections of the safe harbor for forward-looking statements contained in such Sections. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives, and include the ongoing impact of the current outbreak of the novel coronavirus, or COVID-19. When we use the words believe, expect, anticipate, estimate, plan, continue, intend, should, may or similar expressions, we intend to identify forward-looking statements. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements.

Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Forward-looking statements are not predictions of future events. Actual results may differ materially from those set forth in the forward-looking statements. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, important factors included in the risk factors described in the section captioned Risk Factors contained in our 2021 10-K and in subsequent periodic reports which we file with the SEC, as well as other information included or incorporated by reference in this prospectus or any applicable prospectus supplement before purchasing any shares of our common stock (in addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements) that could have a significant impact on our operations and financial results, and could cause our actual results to differ materially from those contained or implied in forward-looking statements made by us or on our behalf in this prospectus, any applicable prospectus supplement and the documents incorporated by reference in this prospectus.

Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including, but not limited to, unanticipated events, after the date on which such statement is made, unless otherwise required by law. New factors emerge from time to time and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement. Such new factors may be included in the documents that we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus which will be considered to be incorporated by reference into this prospectus.

- 4 -

Table of Contents

Unless otherwise specified in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities to acquire our target assets, repay indebtedness or for general corporate purposes. Further details relating to the use of the net proceeds will be set forth in the applicable prospectus supplement.

- 5 -

Table of Contents

If the registration statement of which this prospectus forms a part is used by selling securityholders for the resale of any securities registered thereunder pursuant to a registration rights agreement to be entered into by us with such selling securityholders or otherwise, information about such selling securityholders, their beneficial ownership of the securities and their relationship with us will be set forth in a prospectus supplement, in a post-effective amendment, or in filings we make with the SEC under the Exchange Act that are incorporated by reference into such registration statement.

- 6 -

Table of Contents

We may sell the securities to one or more underwriters for public offering and sale by them or may sell the securities to investors directly or through agents. Any underwriter or agent involved in the offer and sale of the securities will be named in the applicable prospectus supplement. Underwriters and agents in any distribution contemplated hereby may from time to time be designated on terms to be set forth in the applicable prospectus supplement.

Underwriters or agents could make sales in privately negotiated transactions and any other method permitted by law. Securities may be sold in one or more of the following transactions: (a) block transactions (which may involve crosses) in which a broker-dealer may sell all or a portion of the securities as agent but may position and resell all or a portion of the block as principal to facilitate the transaction; (b) purchases by a broker-dealer as principal and resale by the broker-dealer for its own account pursuant to a prospectus supplement; (c) a special offering, an exchange distribution or a secondary distribution in accordance with applicable NYSE or other stock exchange rules; (d) ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers; (e) at the market offerings or sales at the market, within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market on an exchange or otherwise; (f) sales in other ways not involving market makers or established trading markets, including direct sales to purchasers; or (g) through a combination of any of these methods. Broker-dealers may also receive compensation from purchasers of these securities which is not expected to exceed those customary in the types of transactions involved.

Underwriters or agents may offer and sell the securities at a fixed price or prices, which may be changed in relation to the prevailing market prices at the time of sale or at negotiated prices. We also may, from time to time, authorize underwriters acting as our agents to offer and sell the securities upon the terms and conditions as are set forth in the applicable prospectus supplement. If indicated in the applicable prospectus supplement, we may authorize underwriters or other agents to solicit offers by institutions to purchase securities from it pursuant to contracts providing for payment and delivery on a future date. Institutions with which it may make these delayed delivery contracts include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and others. In connection with the sale of securities, underwriters or agents may be deemed to have received compensation from us in the form of underwriting discounts or commissions and may also receive commissions from purchasers of securities for whom they may act as agent. Underwriters or agents may sell securities to or through dealers, and the dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters or the agents and/or commissions from the purchasers for whom they may act as agent.

Any underwriting compensation paid by us to underwriters or agents in connection with the offering of securities, and any discounts, concessions or commissions allowed by underwriters or agents to participating dealers, will be set forth in the applicable prospectus supplement. Underwriters, dealers and agents participating in the distribution of the securities may be deemed to be underwriters, and any discounts and commissions received by them and any profit realized by them on resale of the securities may be deemed to be underwriting discounts and commissions, under the Securities Act. Underwriters, dealers and agents may be entitled, under agreements entered into with us to indemnification against and contribution toward civil liabilities, including liabilities under the Securities Act.

We may have agreements with the underwriters, dealers, agents and remarketing firms to indemnify them against certain civil liabilities, including liabilities under the Securities Act, or to contribute with respect to payments that the underwriters, dealers, agents or remarketing firms may be required to make. Underwriters, dealers, agents and remarketing firms may be customers of, engage in transactions with or perform services for us in the ordinary course of their businesses.

- 7 -

Table of Contents

Any securities issued hereunder (other than common stock) will be new issues of securities with no established trading market. Any underwriters or agents to or through whom such securities are sold by us for public offering and sale may make a market in such securities, but such underwriters or agents will not be obligated to do so and may discontinue any market making at any time without notice. We cannot assure you as to the liquidity of the trading market for any such securities.

- 8 -

Table of Contents

This prospectus contains summary descriptions of the material terms of the common stock, preferred stock, depositary shares, debt securities, warrants and rights that we may offer and sell from time to time. These summary descriptions are not meant to be complete descriptions of each security. The particular terms of any security will be described in the applicable prospectus supplement and are subject to and qualified in their entirety by reference to Maryland law and our charter and bylaws. See Where You Can Find More Information.