8-K: Current report filing

Published on December 9, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

(Exact Name of Registrant as Specified in its Charter)

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code:

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading |

Name of each exchange on which registered |

||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 8.01 | Other Events |

On December 9, 2024, HA Sustainable Infrastructure Capital, Inc. a Delaware corporation (the “Company”) commenced, subject to market conditions, a private add-on offering (the “Offering”) of 6.375% green senior unsecured notes due 2034 (the “Notes”). At issuance, the Notes will be guaranteed by Hannon Armstrong Sustainable Infrastructure, L.P., Hannon Armstrong Capital, LLC, HAT Holdings I LLC, HAT Holdings II LLC, HAC Holdings I LLC and HAC Holdings II LLC. In connection with the Offering, the Company distributed a preliminary offering memorandum which included the following Company update:

Investments Ovreview

As of September 30, 2024, we had over $5.5 billion of transactions in our pipeline comprised of more than 150 opportunities with over 30 programmatic clients that could potentially close in the next 12 months, of which 46% are related to BTM assets, 30% are related to GC assets and 24% are related to FTN assets. We prefer investments in which the assets use proven technology and have a long-term, creditworthy off-taker or counterparties. For BTM assets, the off-taker or counterparty may be the building owner or occupant, and our investment may be secured by the installed improvements or other real estate rights. For GC assets, the off-takers or counterparties may be utility or electric users who have entered into contractual commitments, such as power purchase agreements, to purchase power produced by a renewable energy project at a specified price with potential price escalators for a portion of the project’s estimated life. There can, however, be no assurance with regard to any specific terms of such pipeline transactions or that any or all of the transactions in our pipeline will be completed.

The two highest volume asset classes within our completed transactions have changed every year since the year ending December 31, 2020. As of the years ending December 31, 2023, 2022, 2021and 2020, the two highest volume asset classes within our completed transactions have been FTN and Community Solar, Public Sector and Residential Solar, Public Sector and GC Solar, and Onshore Wind and GC Solar, respectively. The two highest volume asset classes within our completed transactions through November 7, 2024 have been GC Solar and Public Sector. We completed approximately $1.7 billion in transactions through November 7, 2024 and expect to add approximately 10 new clients in 2024.

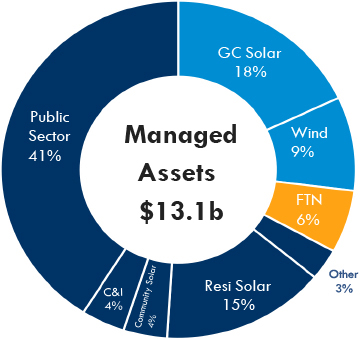

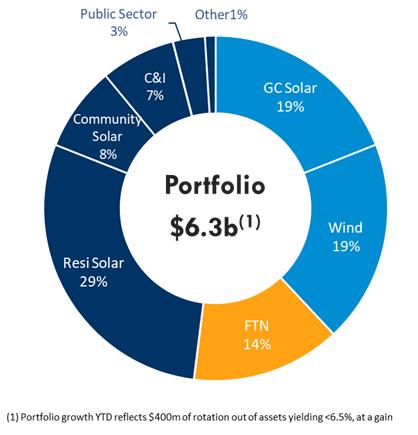

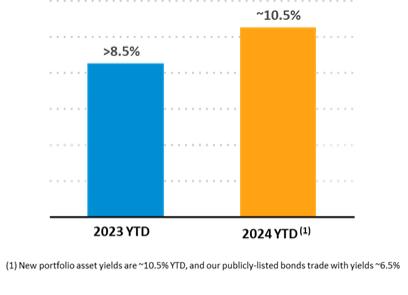

As of September 30, 2024, pursuant to our strategy of holding transactions on our balance sheet, we held approximately $6.3 billion of transactions on our balance sheet, which we refer to as our “Portfolio,” an increase in growth year-over-year of 15%. As of September 30, 2024, our Portfolio consisted of approximately eight asset classes, with a portfolio yield of 8.1%. Our new asset yields, excluding follow-on investments of previous transactions, for the nine months ended September 30, 2024 yielded approximately 10.5% on average. We seek to manage the diversity of our Portfolio by, among other factors, project type, project operator, type of investment, type of technology, transaction size, geography, obligor and maturity. For those transactions that we choose not to hold on our balance sheet, we transfer all or a portion of the economics of the transaction, typically using securitization trusts, to institutional investors in exchange for cash and/or residual interests in the assets and in some cases, ongoing fees. As of September 30, 2024, we managed approximately $6.8 billion in assets in these securitization trusts or vehicles that are not consolidated on our balance sheet. When combined with our Portfolio, as of September 30, 2024, we manage approximately $13.1 billion of assets which we refer to as our “Managed Assets,” an increase in growth year-over-year of 14%.

The following chart illustrates our Managed Assets by asset class as of September 30, 2024.

Our Portfolio totaled approximately $6.3 billion as of September 30, 2024, growing 15% year-over-year as of September 30, 2024, and included approximately $3.0 billion of BTM assets, approximately $2.4 billion of GC assets and approximately $0.9 billion of FTN assets. Approximately 51% of our Portfolio consisted of unconsolidated equity investments in renewable energy related projects. Approximately 42% of our Portfolio was financing receivables. Our

Portfolio consisted of over 520 transactions with an average size of $12 million and the weighted average remaining life of our Portfolio (excluding match-funded transactions) is approximately 17 years as of September 30, 2024.

We invest in multiple sectors and technologies within the energy transition. As of December 31, 2023, our managed portfolio included over 360 energy efficient investments, 11.4 GW of GC Wind and Solar Land, 4.3 GW of GC Wind, 2.7 GW of GC Solar, 4.3 GW of BTM Solar, over 770 fleet vehicles and 5.8 MMBtu of annual renewable gas capacity.

The following chart illustrates our Portfolio by asset class as of September 30, 2024.

The following chart illustrates new portfolio asset yields as of September 30, 2023 and September 30, 2024, respectively.

Our clients include leading clean energy and infrastructure companies and our strategy combines relationship-based investing with in-house portfolio management and engineering expertise to generate attractive risk adjusted fixed-rate returns from a diversified portfolio of long-term, recurring cash flows. We focus on projects that use proven technology and that often have contractually committed agreements with an investment grade-rated off-taker or counterparties and often hold a senior or preferred position in many of our investments.

As of September 30, 2024 and the years ended December 31, 2023, 2022, 2021, 2020 and 2019, we had a portfolio yield of 8.1%, 7.9%, 7.5%, 7.5%, 7.6% and 7.6%, respectively. Portfolio yield is not a financial measure calculated in accordance with GAAP. It is calculated as the weighted average underwritten yield of the investments in our Portfolio as of the end of the period. Underwritten yield for both our Portfolio and individual assets is the rate at which we discount the cash flows from the assets in our Portfolio to determine our purchase price. In calculating underwritten yield, we make certain assumptions, including the timing and amounts of cash flows generated by our investments, which may differ from actual results, and we may update this yield to reflect our most current estimates of project performance.

As of the nine months ended September 30, 2024, we had an adjusted return on equity of 12.4%. Adjusted return on equity is not a financial measure calculated in accordance with GAAP. It is calculated as adjusted earnings for the applicable period as described under the heading “Adjusted Earnings” in the Q3 2024 Form 10-Q and the 2023 Form 10-K divided by the average of our GAAP stockholders’ equity as of the last day of each of the quarters during the respective period. Our stockholders’ equity at September 30, 2024, June 30, 2024 and March 31, 2024 was (in thousands) $2,323,099, $2,323,167, and $ 2,273,415, respectively.

Our equity investments in climate solutions projects are operated by various renewable energy companies or by joint ventures in which we participate. These transactions allow us to participate in the cash flows associated with these projects, typically on a priority basis. Our debt investments in various renewable energy or other sustainable infrastructure projects or portfolios of projects are generally secured by the installed improvements, or other real estate rights. Our energy efficiency debt investments are usually assigned the payment stream from the project savings and other contractual rights, often using our pre-existing master purchase agreements with the ESCOs.

We often make investments where we hold a preferred or mezzanine position in a project company where we are subordinated to project debt and/or preferred forms of equity. Investing greater than 10% of our assets in any single investment requires the approval of a majority of our independent directors. We may adjust the mix and duration of our assets over time in order to allow us to manage various aspects of our Portfolio, including expected risk-adjusted returns, macroeconomic conditions, liquidity, availability of adequate financing for our assets, and our exemption from registration as an investment company under the Investment Company Act.

We believe we have available a broad range of financing sources as part of our strategy to fund our investments. We finance our business through cash on hand, recourse and non-recourse debt, convertible or exchangeable securities or equity issuances and may also decide to finance such transactions through the use of off-balance sheet securitization or syndication, or co-investment structures. Certain of our debt issuances meet the environmental eligibility criteria for green bonds as defined by the International Capital Markets Association’s Green Bond Principles, which we believe makes our debt more attractive for certain investors compared to such offerings that do not qualify under these principles. We may also consider the use of special purpose entities or funds in which outside investors participate to facilitate the expansion of the investments that we make or to manage our Portfolio diversification. In May 2024, we entered into a strategic partnership with KKR, where we have each committed to invest $1 billion into climate solutions projects.

As part of our investment process, we calculate the ratio of the estimated first year of metric tons of carbon emissions avoided by our investments divided by the capital invested to quantify the carbon impact of our investments. In this calculation, which we refer to as CarbonCount®, we use emissions factor data, expressed on a CO2 equivalent basis representing the locational marginal emissions associated with a project to determine an estimate of a project’s energy production or savings to compute an estimate of metric tons of carbon emissions avoided. Refer to Environmental Metrics described in the Q3 2024 Form 10-Q, which is incorporated by reference herein, for a discussion of the carbon emissions avoided as a result of our investments. In addition to carbon emission avoidance, we also consider other environmental attributes, such as water use reduction, stormwater remediation benefits and stream restoration benefits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| HA SUSTAINABLE INFRASTRUCTURE CAPITAL, INC. | ||

| By: | /s/ Steven L. Chuslo |

|

|

|

Steven L. Chuslo | |

|

|

Executive Vice President and Chief Legal Officer | |

Date: December 9, 2024