EX-99.2

Published on March 28, 2025

LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Consolidated Financial Statements December 31, 2024, 2023, and 2022 (With Report of Independent Auditors)

LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Table of Contents Page Report of Independent Auditors 1 Consolidated Balance Sheets — December 31, 2024 and 2023 3 Consolidated Statements of Operations — Years ended December 31, 2024, 2023, and 2022 4 Consolidated Statements of Equity — Years ended December 31, 2024, 2023, and 2022 5 Consolidated Statements of Cash Flows — Years ended December 31, 2024, 2023, and 2022 6 Consolidated Statements of Cash Flows — Supplemental Disclosures — Years ended December 31, 2024, 2023, and 2022 7 Notes to Consolidated Financial Statements 8

PricewaterhouseCoopers LLP, 100 East Pratt Street, Baltimore, Maryland 21202 T: (410) 783 7600, www.pwc.com/us Report of Independent Auditors To the Members of Lighthouse Renewable Holdco 2 LLC Opinion We have audited the accompanying consolidated financial statements of Lighthouse Renewable Holdco 2 LLC and its subsidiaries (the "Company"), which comprise the consolidated balance sheet as of December 31, 2024, and the related consolidated statements of operations, of equity and of cash flows for the year then ended, including the related notes (collectively referred to as the "consolidated financial statements"). In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2024, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors' Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Other Matter The consolidated financial statements of the Company as of December 31, 2023, and for the year then ended, were audited by other auditors whose report, dated March 28, 2024, expressed an unmodified opinion on those statements. Emphasis of Matter As discussed in Note 1 to the consolidated financial statements, the Company estimates based on its forecasts of expected cash flows during the twelve months from the report issuance date that there may be insufficient cash to pay for all of its obligations as they become due. Management’s evaluation of the events and conditions and management’s plans to mitigate these matters are also described in Note 1. As discussed in Note 1 to the consolidated financial statements, in order to fund its obligations, the Company has as obtained letters from Clearway Energy Operating LLC on behalf of its subsidiary Lighthouse Renewable Class A LLC and HA Lighthouse LLC confirming they will not demand payment on the outstanding intercompany demand promissory notes and intend to provide support up to $1.75 million each to meet the Company’s obligations as they become due through at least one year and a day from March 27, 2025. Our opinion is not modified with respect to this matter. Responsibilities of Management for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

PricewaterhouseCoopers LLP, 100 East Pratt Street, Suite 2600, Baltimore, MD 21202 T: (410) 783 7600, www.pwc.com/us 2 In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for one year after the date the consolidated financial statements are available to be issued. Auditors' Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors' report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with US GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. The consolidating balance sheet and consolidating statement of income as of December 31, 2023, and for the year then ended were audited by other auditors whose report, dated March 28, 2024 expressed an opinion that the 2023 consolidating balance sheet and consolidating statement of operations were fairly stated, in all material respects, in relation to the 2023 consolidated financial statements taken as a whole. PricewaterhouseCoopers LLP Baltimore, Maryland March 27, 2025

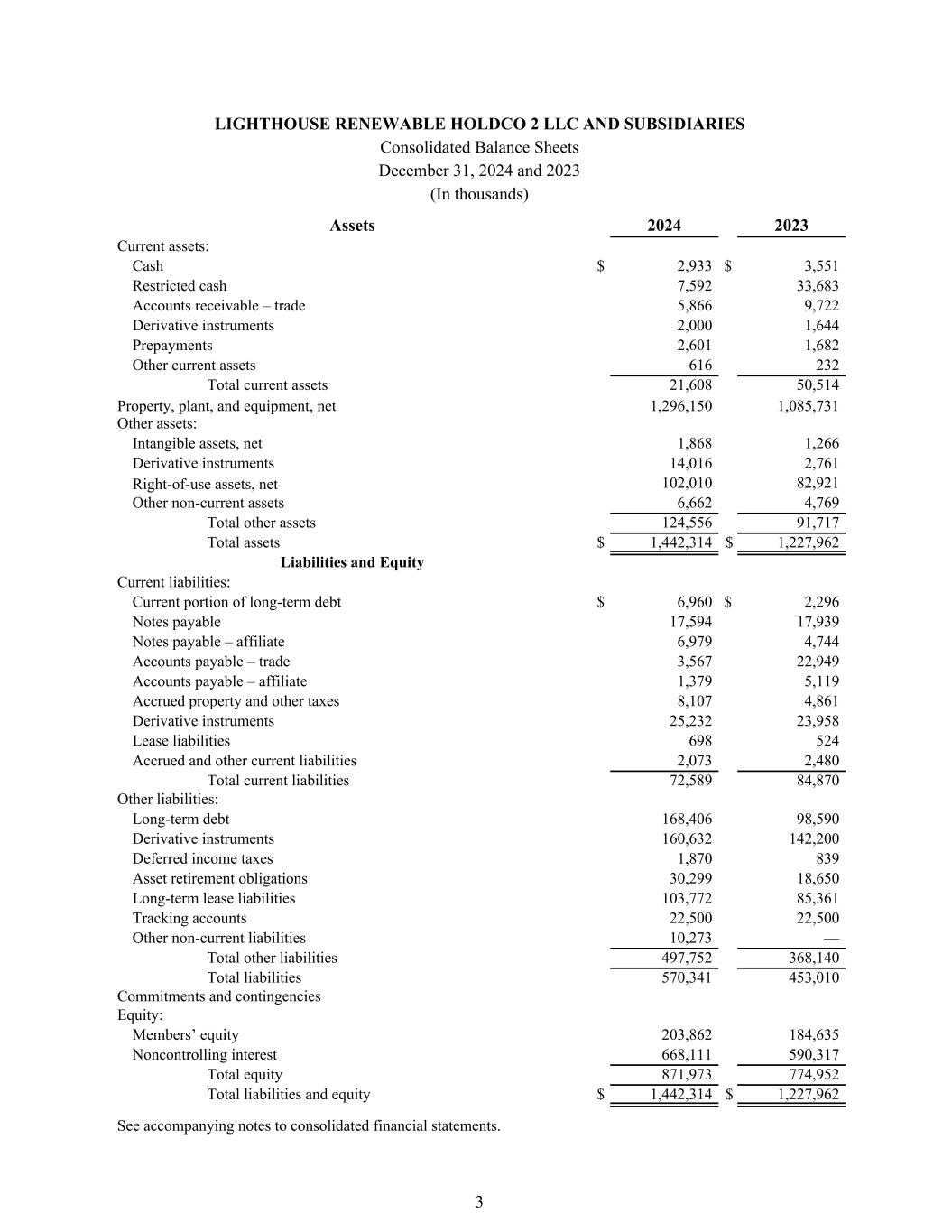

LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Consolidated Balance Sheets December 31, 2024 and 2023 (In thousands) Assets 2024 2023 Current assets: Cash $ 2,933 $ 3,551 Restricted cash 7,592 33,683 Accounts receivable – trade 5,866 9,722 Derivative instruments 2,000 1,644 Prepayments 2,601 1,682 Other current assets 616 232 Total current assets 21,608 50,514 Property, plant, and equipment, net 1,296,150 1,085,731 Other assets: Intangible assets, net 1,868 1,266 Derivative instruments 14,016 2,761 Right-of-use assets, net 102,010 82,921 Other non-current assets 6,662 4,769 Total other assets 124,556 91,717 Total assets $ 1,442,314 $ 1,227,962 Liabilities and Equity Current liabilities: Current portion of long-term debt $ 6,960 $ 2,296 Notes payable 17,594 17,939 Notes payable – affiliate 6,979 4,744 Accounts payable – trade 3,567 22,949 Accounts payable – affiliate 1,379 5,119 Accrued property and other taxes 8,107 4,861 Derivative instruments 25,232 23,958 Lease liabilities 698 524 Accrued and other current liabilities 2,073 2,480 Total current liabilities 72,589 84,870 Other liabilities: Long-term debt 168,406 98,590 Derivative instruments 160,632 142,200 Deferred income taxes 1,870 839 Asset retirement obligations 30,299 18,650 Long-term lease liabilities 103,772 85,361 Tracking accounts 22,500 22,500 Other non-current liabilities 10,273 — Total other liabilities 497,752 368,140 Total liabilities 570,341 453,010 Commitments and contingencies Equity: Members’ equity 203,862 184,635 Noncontrolling interest 668,111 590,317 Total equity 871,973 774,952 Total liabilities and equity $ 1,442,314 $ 1,227,962 See accompanying notes to consolidated financial statements. 3

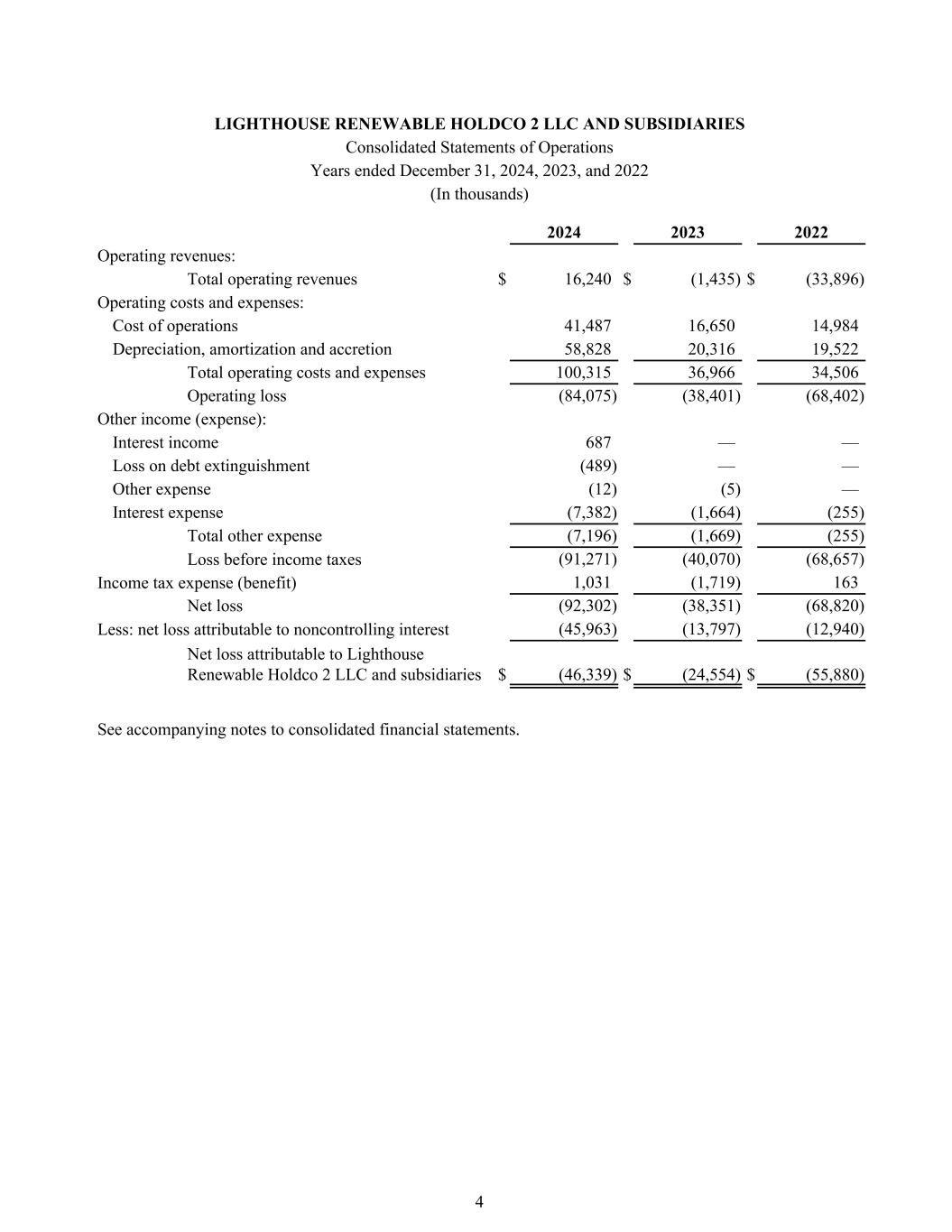

LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Consolidated Statements of Operations Years ended December 31, 2024, 2023, and 2022 (In thousands) 2024 2023 2022 Operating revenues: Total operating revenues $ 16,240 $ (1,435) $ (33,896) Operating costs and expenses: Cost of operations 41,487 16,650 14,984 Depreciation, amortization and accretion 58,828 20,316 19,522 Total operating costs and expenses 100,315 36,966 34,506 Operating loss (84,075) (38,401) (68,402) Other income (expense): Interest income 687 — — Loss on debt extinguishment (489) — — Other expense (12) (5) — Interest expense (7,382) (1,664) (255) Total other expense (7,196) (1,669) (255) Loss before income taxes (91,271) (40,070) (68,657) Income tax expense (benefit) 1,031 (1,719) 163 Net loss (92,302) (38,351) (68,820) Less: net loss attributable to noncontrolling interest (45,963) (13,797) (12,940) Net loss attributable to Lighthouse Renewable Holdco 2 LLC and subsidiaries $ (46,339) $ (24,554) $ (55,880) See accompanying notes to consolidated financial statements. 4

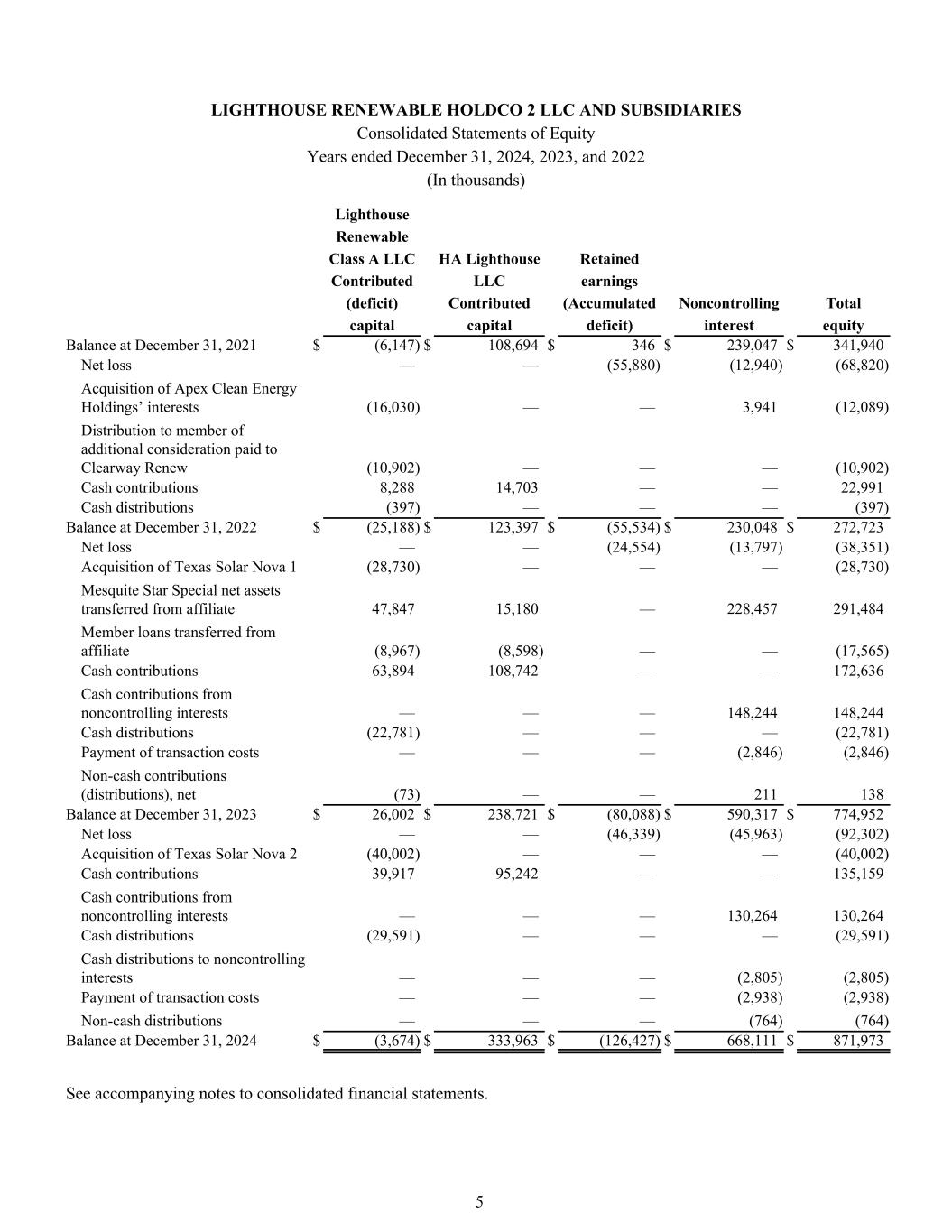

LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Consolidated Statements of Equity Years ended December 31, 2024, 2023, and 2022 (In thousands) Lighthouse Renewable Class A LLC HA Lighthouse Retained Contributed LLC earnings (deficit) Contributed (Accumulated Noncontrolling Total capital capital deficit) interest equity Balance at December 31, 2021 $ (6,147) $ 108,694 $ 346 $ 239,047 $ 341,940 Net loss — — (55,880) (12,940) (68,820) Acquisition of Apex Clean Energy Holdings’ interests (16,030) — — 3,941 (12,089) Distribution to member of additional consideration paid to Clearway Renew (10,902) — — — (10,902) Cash contributions 8,288 14,703 — — 22,991 Cash distributions (397) — — — (397) Balance at December 31, 2022 $ (25,188) $ 123,397 $ (55,534) $ 230,048 $ 272,723 Net loss — — (24,554) (13,797) (38,351) Acquisition of Texas Solar Nova 1 (28,730) — — — (28,730) Mesquite Star Special net assets transferred from affiliate 47,847 15,180 — 228,457 291,484 Member loans transferred from affiliate (8,967) (8,598) — — (17,565) Cash contributions 63,894 108,742 — — 172,636 Cash contributions from noncontrolling interests — — — 148,244 148,244 Cash distributions (22,781) — — — (22,781) Payment of transaction costs — — — (2,846) (2,846) Non-cash contributions (distributions), net (73) — — 211 138 Balance at December 31, 2023 $ 26,002 $ 238,721 $ (80,088) $ 590,317 $ 774,952 Net loss — — (46,339) (45,963) (92,302) Acquisition of Texas Solar Nova 2 (40,002) — — — (40,002) Cash contributions 39,917 95,242 — — 135,159 Cash contributions from noncontrolling interests — — — 130,264 130,264 Cash distributions (29,591) — — — (29,591) Cash distributions to noncontrolling interests — — — (2,805) (2,805) Payment of transaction costs — — — (2,938) (2,938) Non-cash distributions — — — (764) (764) Balance at December 31, 2024 $ (3,674) $ 333,963 $ (126,427) $ 668,111 $ 871,973 See accompanying notes to consolidated financial statements. 5

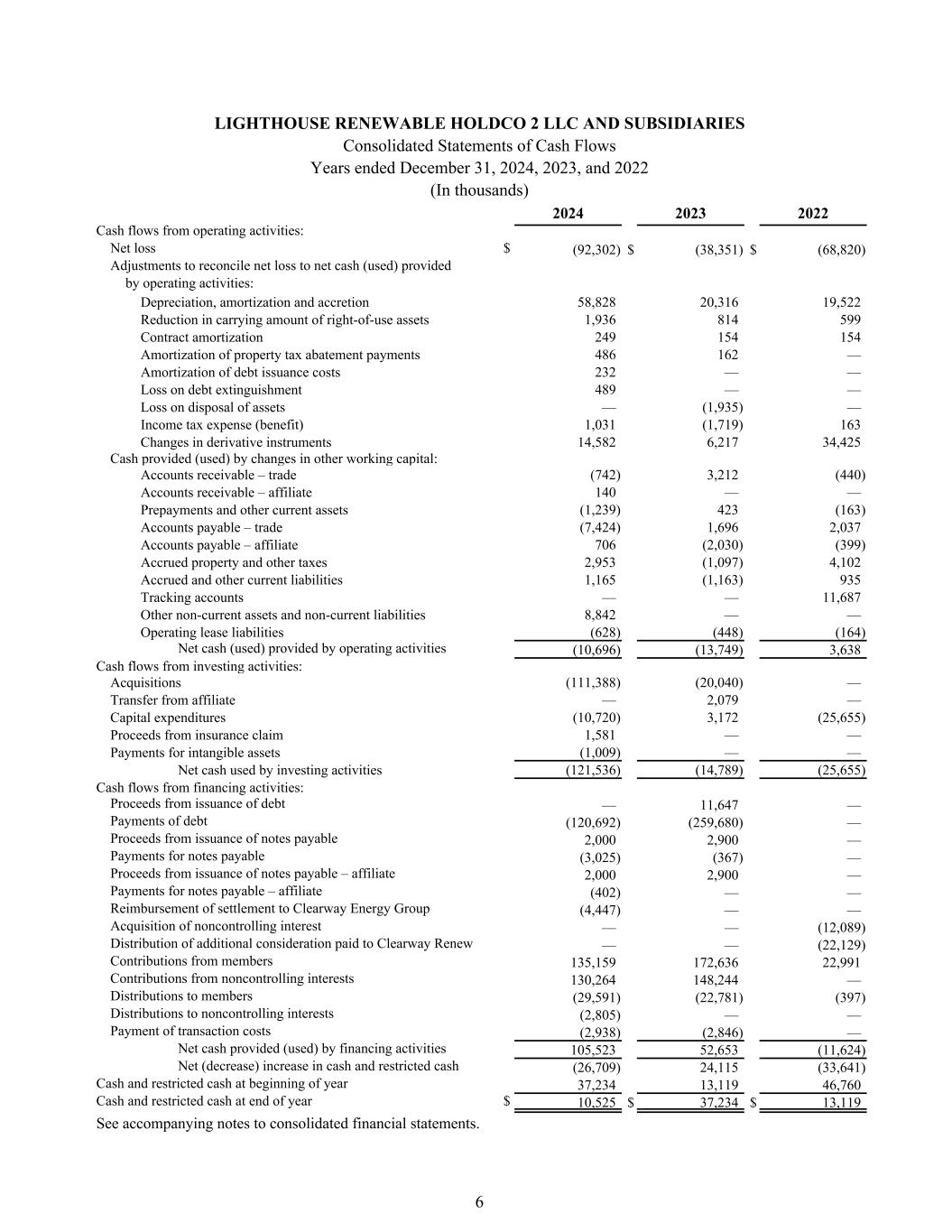

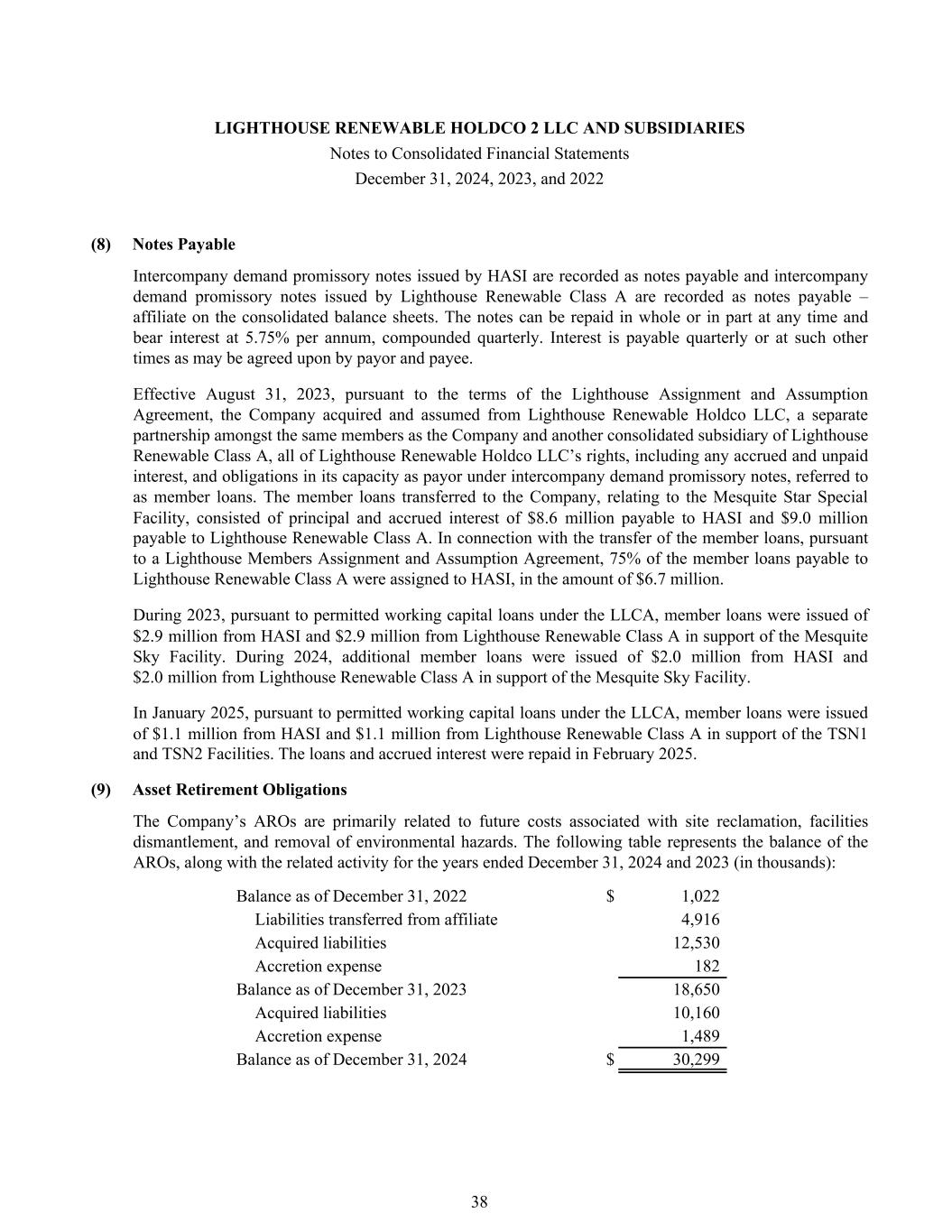

LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Consolidated Statements of Cash Flows Years ended December 31, 2024, 2023, and 2022 (In thousands) 2024 2023 2022 Cash flows from operating activities: Net loss $ (92,302) $ (38,351) $ (68,820) Adjustments to reconcile net loss to net cash (used) provided by operating activities: Depreciation, amortization and accretion 58,828 20,316 19,522 Reduction in carrying amount of right-of-use assets 1,936 814 599 Contract amortization 249 154 154 Amortization of property tax abatement payments 486 162 — Amortization of debt issuance costs 232 — — Loss on debt extinguishment 489 — — Loss on disposal of assets — (1,935) — Income tax expense (benefit) 1,031 (1,719) 163 Changes in derivative instruments 14,582 6,217 34,425 Cash provided (used) by changes in other working capital: Accounts receivable – trade (742) 3,212 (440) Accounts receivable – affiliate 140 — — Prepayments and other current assets (1,239) 423 (163) Accounts payable – trade (7,424) 1,696 2,037 Accounts payable – affiliate 706 (2,030) (399) Accrued property and other taxes 2,953 (1,097) 4,102 Accrued and other current liabilities 1,165 (1,163) 935 Tracking accounts — — 11,687 Other non-current assets and non-current liabilities 8,842 — — Operating lease liabilities (628) (448) (164) Net cash (used) provided by operating activities (10,696) (13,749) 3,638 Cash flows from investing activities: Acquisitions (111,388) (20,040) — Transfer from affiliate — 2,079 — Capital expenditures (10,720) 3,172 (25,655) Proceeds from insurance claim 1,581 — — Payments for intangible assets (1,009) — — Net cash used by investing activities (121,536) (14,789) (25,655) Cash flows from financing activities: Proceeds from issuance of debt — 11,647 — Payments of debt (120,692) (259,680) — Proceeds from issuance of notes payable 2,000 2,900 — Payments for notes payable (3,025) (367) — Proceeds from issuance of notes payable – affiliate 2,000 2,900 — Payments for notes payable – affiliate (402) — — Reimbursement of settlement to Clearway Energy Group (4,447) — — Acquisition of noncontrolling interest — — (12,089) Distribution of additional consideration paid to Clearway Renew — — (22,129) Contributions from members 135,159 172,636 22,991 Contributions from noncontrolling interests 130,264 148,244 — Distributions to members (29,591) (22,781) (397) Distributions to noncontrolling interests (2,805) — — Payment of transaction costs (2,938) (2,846) — Net cash provided (used) by financing activities 105,523 52,653 (11,624) Net (decrease) increase in cash and restricted cash (26,709) 24,115 (33,641) Cash and restricted cash at beginning of year 37,234 13,119 46,760 Cash and restricted cash at end of year $ 10,525 $ 37,234 $ 13,119 See accompanying notes to consolidated financial statements. 6

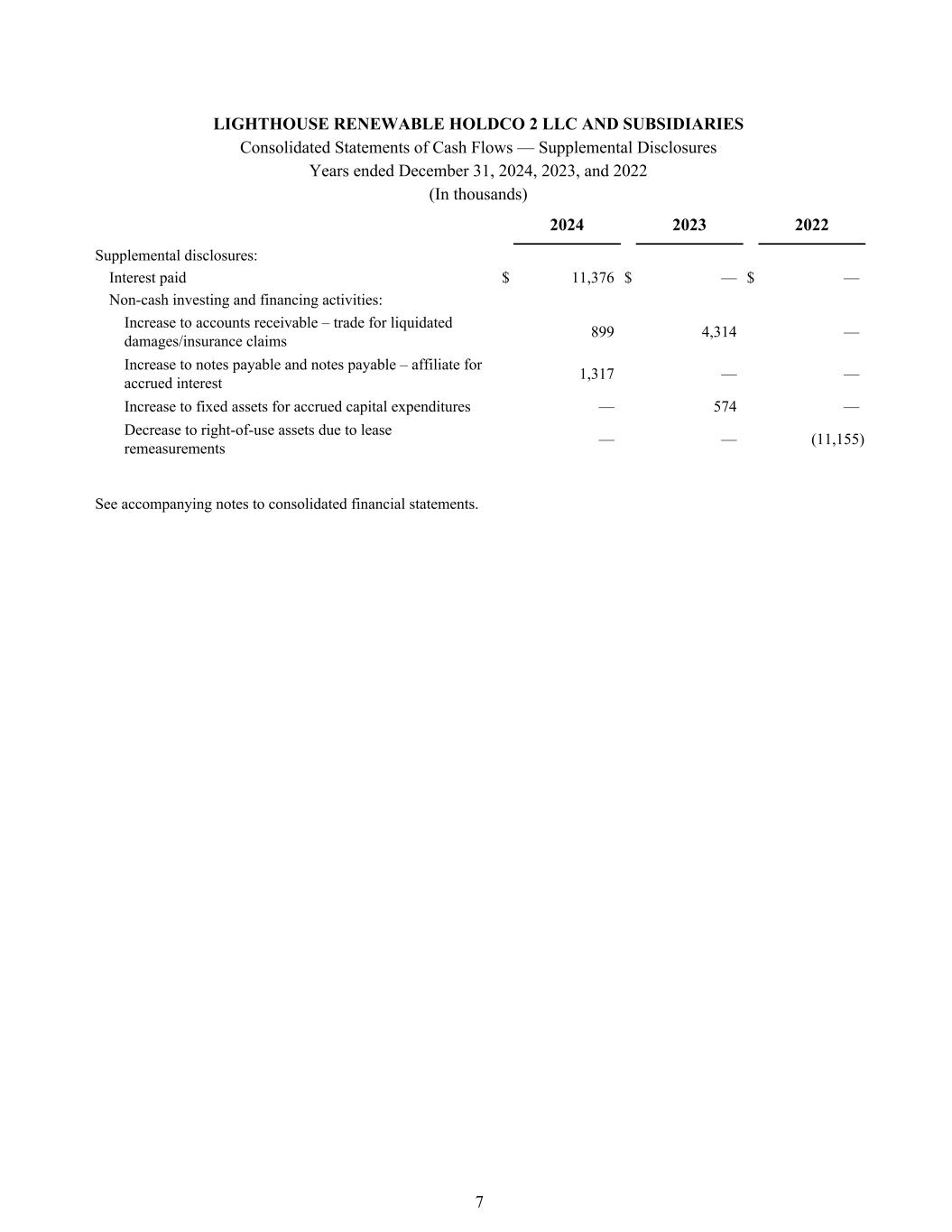

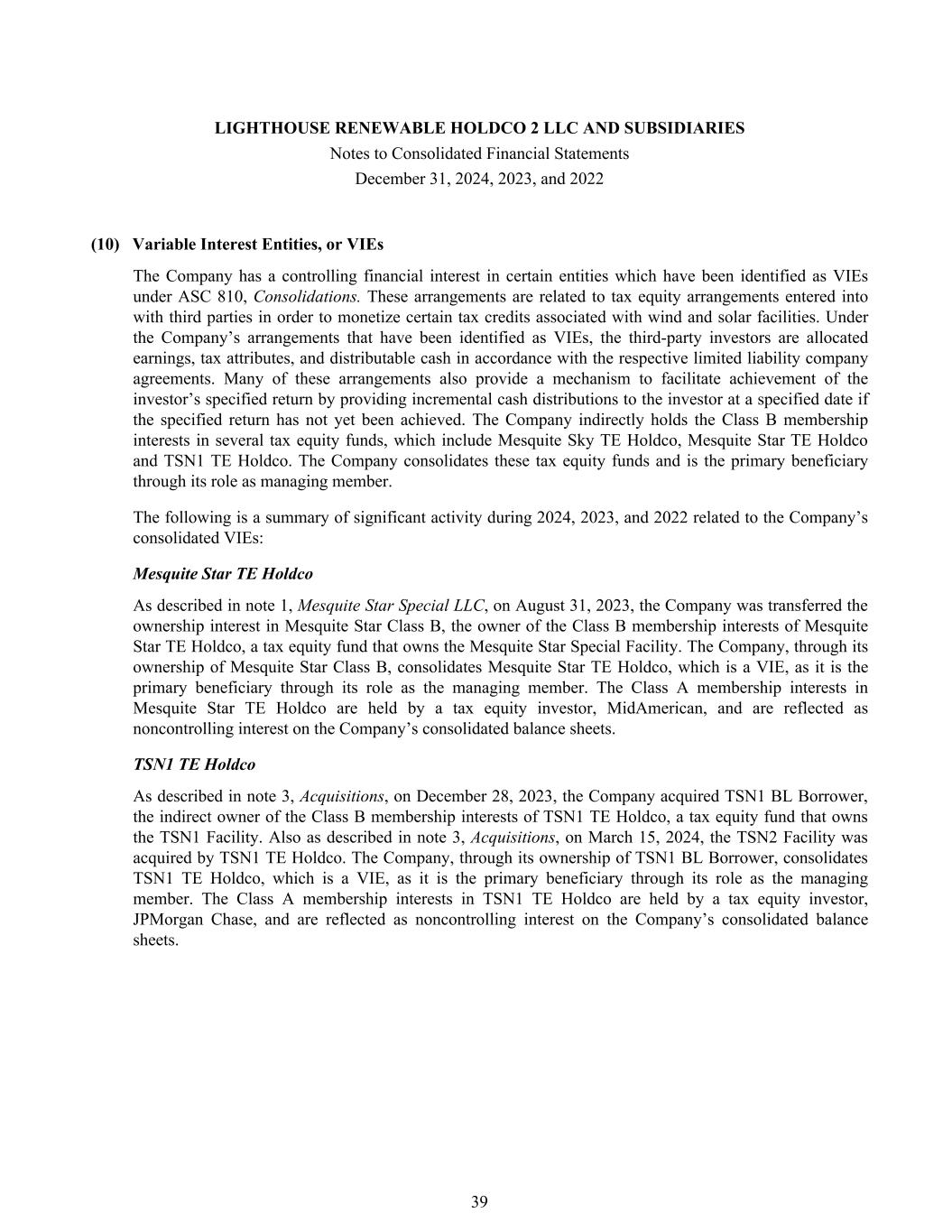

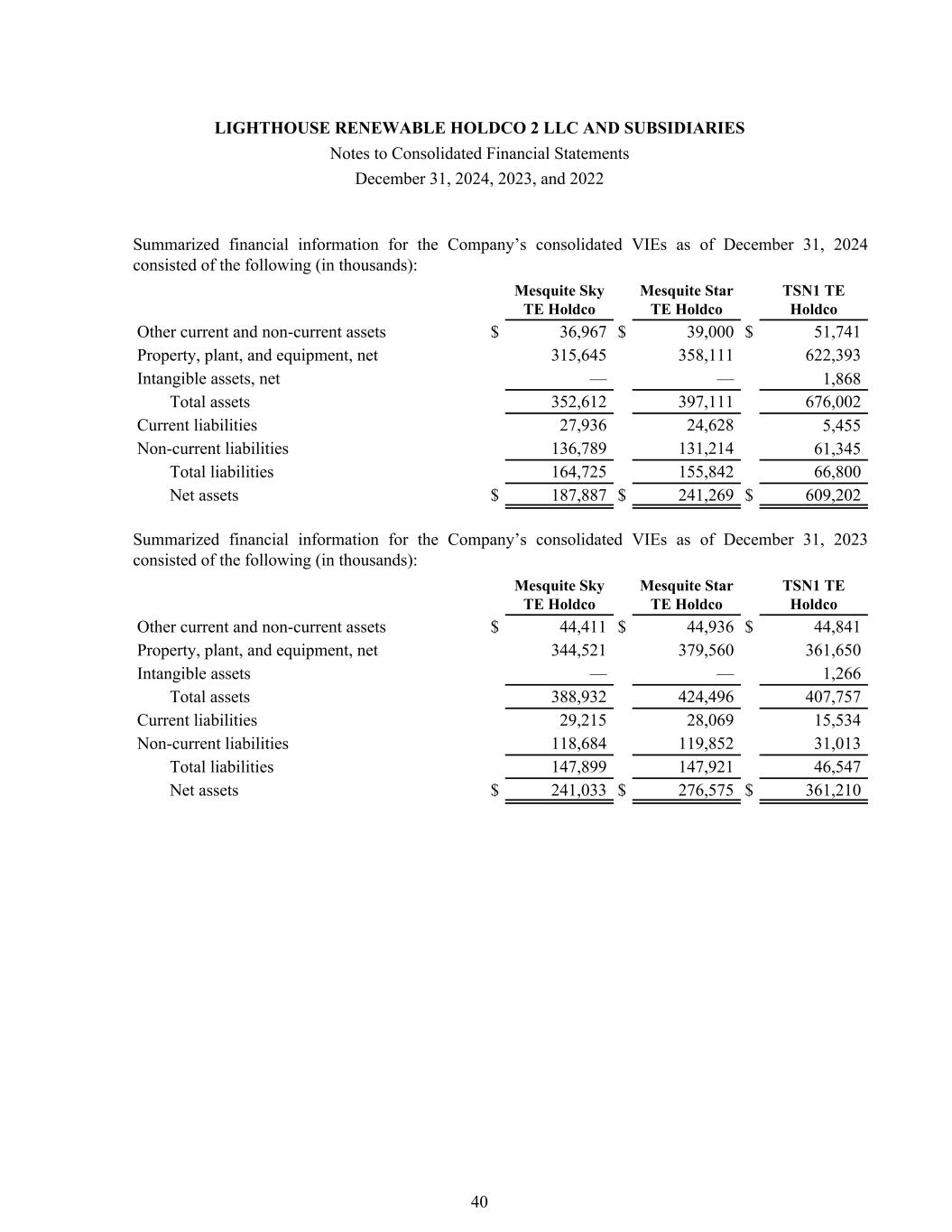

LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Consolidated Statements of Cash Flows — Supplemental Disclosures Years ended December 31, 2024, 2023, and 2022 (In thousands) 2024 2023 2022 Supplemental disclosures: Interest paid $ 11,376 $ — $ — Non-cash investing and financing activities: Increase to accounts receivable – trade for liquidated damages/insurance claims 899 4,314 — Increase to notes payable and notes payable – affiliate for accrued interest 1,317 — — Increase to fixed assets for accrued capital expenditures — 574 — Decrease to right-of-use assets due to lease remeasurements — — (11,155) See accompanying notes to consolidated financial statements. 7

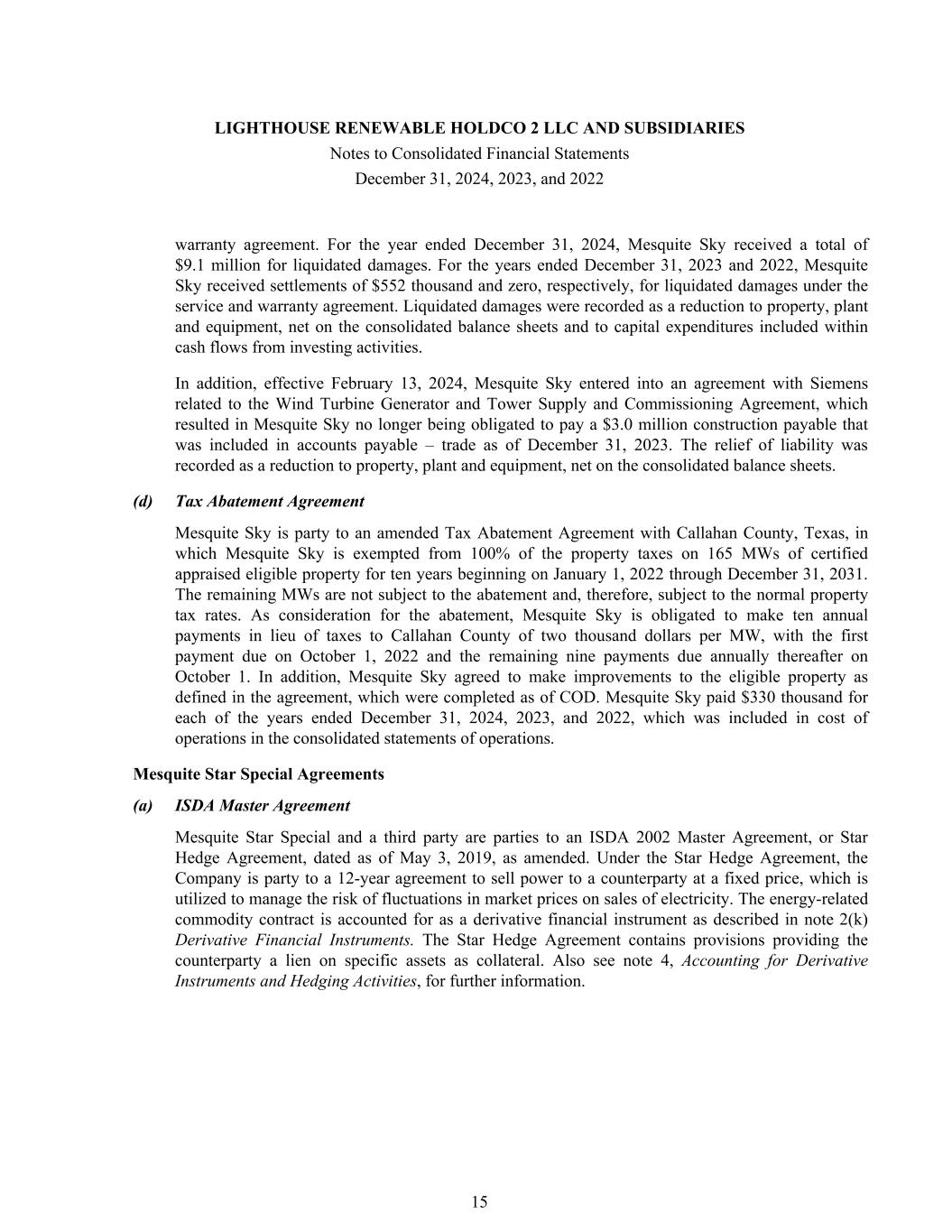

(1) Nature of Business Lighthouse Renewable Holdco 2 LLC, or Lighthouse 2, or the Company, a Delaware limited liability company, was formed on November 5, 2021 and is a partnership between Lighthouse Renewable Class A LLC, or the Class A Member, a subsidiary of Clearway Energy Operating LLC, HA Lighthouse LLC, or HASI, a cash equity investor, and Clearway Renew LLC, or Clearway Renew, a direct wholly-owned subsidiary of Clearway Energy Group LLC, or Clearway Energy Group. Clearway Renew’s membership interests in Lighthouse 2 are not participating interests and provide for the potential future allocation of cash in the event of excess returns on investment to HASI. Clearway Energy Operating LLC is a wholly-owned subsidiary of Clearway Energy LLC, which is owned by Clearway Energy, Inc. and Clearway Energy Group. Clearway Energy Group is equally owned by Global Infrastructure Partners III and TotalEnergies SE. As of December 31, 2024, Clearway Energy, Inc., through its ownership of Class A and Class C common stock, had a 58.10% economic interest in Clearway Energy LLC, while Clearway Energy Group, through its ownership of Class B and Class D common stock, had a 54.91% voting interest in Clearway Energy, Inc. and a 41.90% economic interest in Clearway Energy LLC. Liquidity Matters The Company estimates based on its forecasts of expected cash flows during the next twelve months from the report issuance date that there may be insufficient cash to pay for all its obligations as they become due. The Company has intercompany demand promissory notes, including accrued interest, of $24.9 million outstanding as of December 31, 2024 that could be demanded from its members, as further described in note 8, Notes Payable. The Company has obtained letters from Clearway Energy Operating LLC, on behalf of its subsidiary Lighthouse Renewable Class A LLC, and HA Lighthouse LLC confirming that they will not demand payment on the outstanding intercompany demand promissory notes and intend to provide support up to $1.75 million each to meet the Company’s obligations as they become due through at least one year and a day from March 27, 2025. A description of the Company’s solar and wind facilities portfolio is set forth below: Texas Solar Nova 2 LLC On March 15, 2024, through its consolidated subsidiaries (shown in the diagram below), Lighthouse 2 acquired Texas Solar Nova 2 LLC, or Texas Solar Nova 2, also referred to as TSN2, as further described in note 3, Acquisitions. TSN2 is directly owned by the Company’s indirect subsidiary, TSN1 TE Holdco LLC, or TSN1 TE Holdco, a tax equity arrangement between TSN1 Class B Member LLC, or TSN1 Class B, and a third-party investor, JPMorgan Chase Bank, N.A, or JPMorgan Chase. TSN2 owns and operates a 200-megawatt (MW) solar photovoltaic power generating facility, or the TSN2 Facility, located in Kent County, Texas. The TSN2 Facility achieved 100% commercial operations, or COD, on February 15, 2024. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 8

Also on March 15, 2024, in accordance with the Equity Capital Contribution Agreement, or ECCA, as amended, between the members of TSN1 TE Holdco, JPMorgan Chase made a contribution of $130.3 million in connection with the acquisition of TSN2, the proceeds of which were used for the repayment of debt assumed in the acquisition and for a $14.9 million distribution to Clearway Renew. Texas Solar Nova 1 LLC On December 28, 2023, through its consolidated subsidiaries (shown in the diagram below), Lighthouse 2 acquired Texas Solar Nova 1, LLC, or Texas Solar Nova 1, also referred to as TSN1, as further described in note 3, Acquisitions. TSN1 is directly owned by TSN1 TE Holdco. TSN1 owns and operates a 252-MW solar photovoltaic power generating facility, or the TSN1 Facility, located in Kent County, Texas. The TSN1 Facility achieved 100% COD on December 1, 2023. Concurrent with the acquisition on December 28, 2023, in accordance with the ECCA between the members of TSN1 TE Holdco, JPMorgan Chase made a contribution of $148.2 million and acquired the Class A membership interests in TSN 1 TE Holdco, whereas TSN1 Class B retained the Class B membership interests. Tax equity proceeds were used for the repayment of debt assumed in the acquisition and transaction expenses. Mesquite Star Special LLC Effective on August 31, 2023 and pursuant to a Master Transfer Agreement, a separate partnership owned by the Company’s Class A Member, Lighthouse Renewable Holding Sub LLC, transferred its ownership interest in Mesquite Star Class B Holdco LLC, or Mesquite Star Class B, to the Company. Mesquite Star Class B owns the Class B membership interests of Mesquite Star Tax Equity Holdco LLC, or Mesquite Star TE Holdco, a tax equity arrangement with third-party investor MidAmerican Wind Tax Equity Holdings LLC, or MidAmerican. Mesquite Star TE Holdco directly owns Mesquite Star Special, LLC, or Mesquite Star Special, who owns and operates a 418.9-MW wind powered electricity-generating system comprised of Siemens Gamesa SG3.55-132 MW turbines, a power collection system and power substation, or the Mesquite Star Special Facility, located in Fisher County, Texas. The Mesquite Star Special Facility achieved 100% COD on May 26, 2020. The assets and liabilities transferred to the Company relate to interests under common control by Clearway Energy Group and were recorded at historical cost in accordance with ASC 805-50, Business Combinations - Related Issues. This was concluded to be an asset acquisition and the Company consolidates Mesquite Star Special on a prospective basis in its financial statements. Simultaneously on August 31, 2023, a separate partnership owned by the Company’s Class A Member, Lighthouse Renewable Holdco LLC, transferred and assigned to the Company all of its rights and obligations under member loans, as further discussed in note 8, Notes Payable. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 9

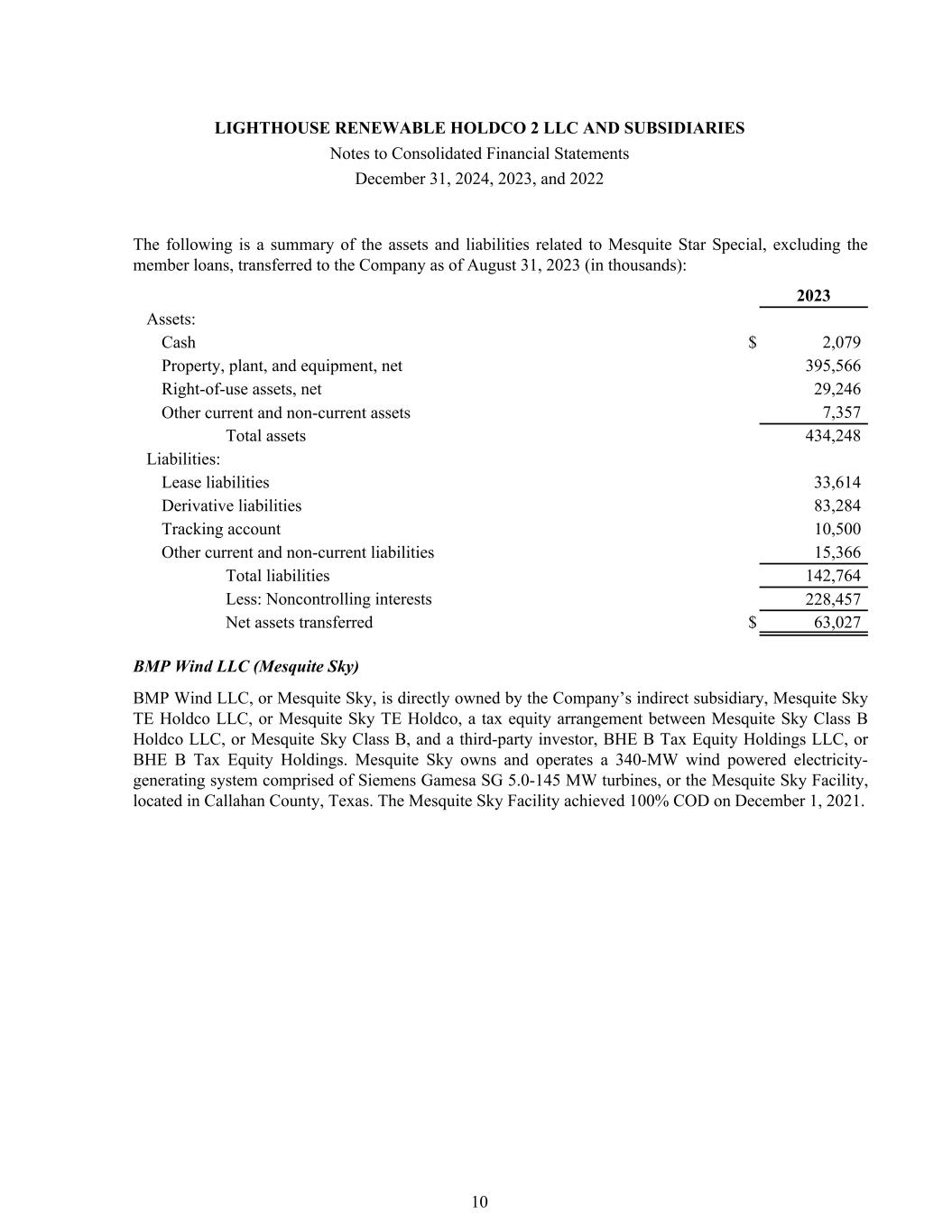

The following is a summary of the assets and liabilities related to Mesquite Star Special, excluding the member loans, transferred to the Company as of August 31, 2023 (in thousands): 2023 Assets: Cash $ 2,079 Property, plant, and equipment, net 395,566 Right-of-use assets, net 29,246 Other current and non-current assets 7,357 Total assets 434,248 Liabilities: Lease liabilities 33,614 Derivative liabilities 83,284 Tracking account 10,500 Other current and non-current liabilities 15,366 Total liabilities 142,764 Less: Noncontrolling interests 228,457 Net assets transferred $ 63,027 BMP Wind LLC (Mesquite Sky) BMP Wind LLC, or Mesquite Sky, is directly owned by the Company’s indirect subsidiary, Mesquite Sky TE Holdco LLC, or Mesquite Sky TE Holdco, a tax equity arrangement between Mesquite Sky Class B Holdco LLC, or Mesquite Sky Class B, and a third-party investor, BHE B Tax Equity Holdings LLC, or BHE B Tax Equity Holdings. Mesquite Sky owns and operates a 340-MW wind powered electricity- generating system comprised of Siemens Gamesa SG 5.0-145 MW turbines, or the Mesquite Sky Facility, located in Callahan County, Texas. The Mesquite Sky Facility achieved 100% COD on December 1, 2021. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 10

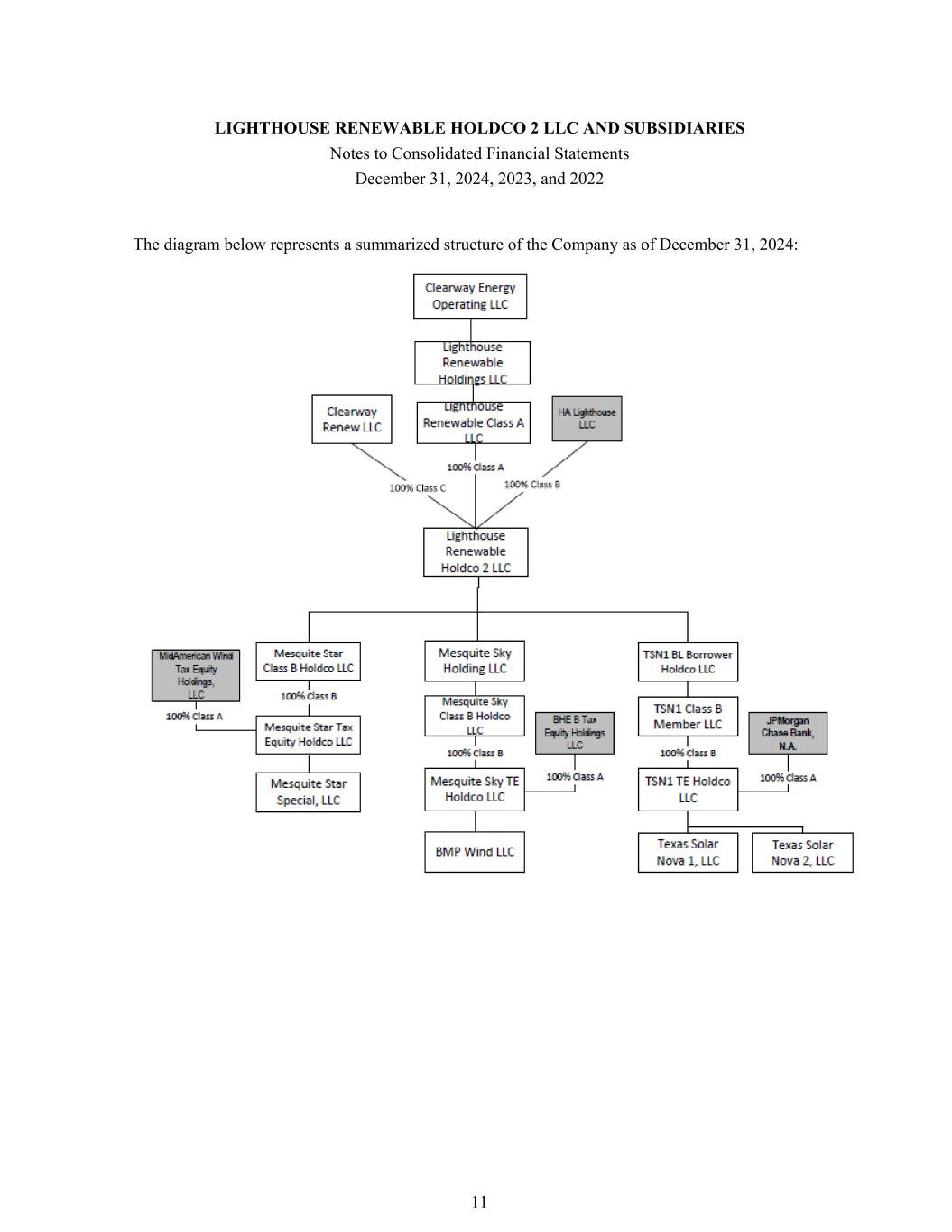

The diagram below represents a summarized structure of the Company as of December 31, 2024: LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 11

A summary of the major agreements related to the Company is set forth below: Limited Liability Company Agreement The Company is governed by a limited liability agreement, or LLCA, executed on December 17, 2021, which was amended on each of March 18, 2022, August 30, 2023, December 28, 2023 and March 15, 2024. The LLCA provides for allocations of income, taxable items and available cash related to the Mesquite Sky and Mesquite Star Special facilities, which are 50.01% to Lighthouse Renewable Class A and 49.99% to HASI, except that allocations of available cash are first utilized to pay back member loans, if any. For the TSN1 and TSN2 Facilities, allocations of income, taxable items and available cash are 50% to Lighthouse Renewable Class A and 50% to HASI until December 2033, then are 25% to Lighthouse Renewable Class A and 75% to HASI thereafter, also subject to the pay back of member loans, if any. In addition, subsequent to December 31, 2036, up to 100% of Lighthouse Renewable Class A’s cash may be allocated to HASI which provides a reallocation of cash in order to ensure that HASI achieves its target return on investment. If HASI achieves a return above a specified threshold, certain amounts may be allocated to Clearway Renew, through its ownership of the Class C membership interests. In the event that additional working capital is required by the Mesquite Sky Facility, the Mesquite Star Special Facility, or the TSN1 and TSN2 Facilities, to cause the assets to be properly operated and maintained and pay for the costs, expenses, obligations and liabilities of each facility, and such amounts are not available from its reserves, then Lighthouse Renewable Class A and HASI have the right, but not the obligation, to participate in member loans to advance needed funds. See note 8, Notes Payable for information regarding member loans issued in 2023 and 2024. In accordance with the provisions of the LLCA, the Class A Member is the Manager, as defined, and conducts the activities of the Company on behalf of the members. The Manager has engaged Clearway Asset Services LLC to perform certain of its duties as Manager. All management services provided are at the direction of the Manager and the Manager retains its obligations with respect to its duties and responsibilities. See note 11, Related Party Transactions, for further detail. In addition, the LLCA establishes both a review committee, which is responsible for material decisions that protect the interests of both the Class A Member and Class B Member, and is comprised of two members appointed by each of the Class A Member and Class B Member, and an operations committee, which is responsible for advising the Company and the review committee with respect to the Company’s operations. Mesquite Sky Agreements (a) ISDA Master Agreement Mesquite Sky and a third party are parties to an amended ISDA 2002 Master Agreement, dated as of December 30, 2020, and a Side Agreement, dated October 1, 2021, as amended, collectively the Sky Hedge Agreement. Under the Sky Hedge Agreement, Mesquite Sky is party to a 12-year agreement to sell power to a counterparty at a fixed price, which is utilized to manage the risk of fluctuations in market prices on sales of electricity. The energy-related commodity contract is accounted for as a derivative financial instrument as described in note 2(k), Derivative Financial Instruments. The Sky Hedge Agreement contains provisions providing the counterparty a lien on specific assets as collateral. Also see note 4, Accounting for Derivative Instruments and Hedging Activities, for further information. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 12

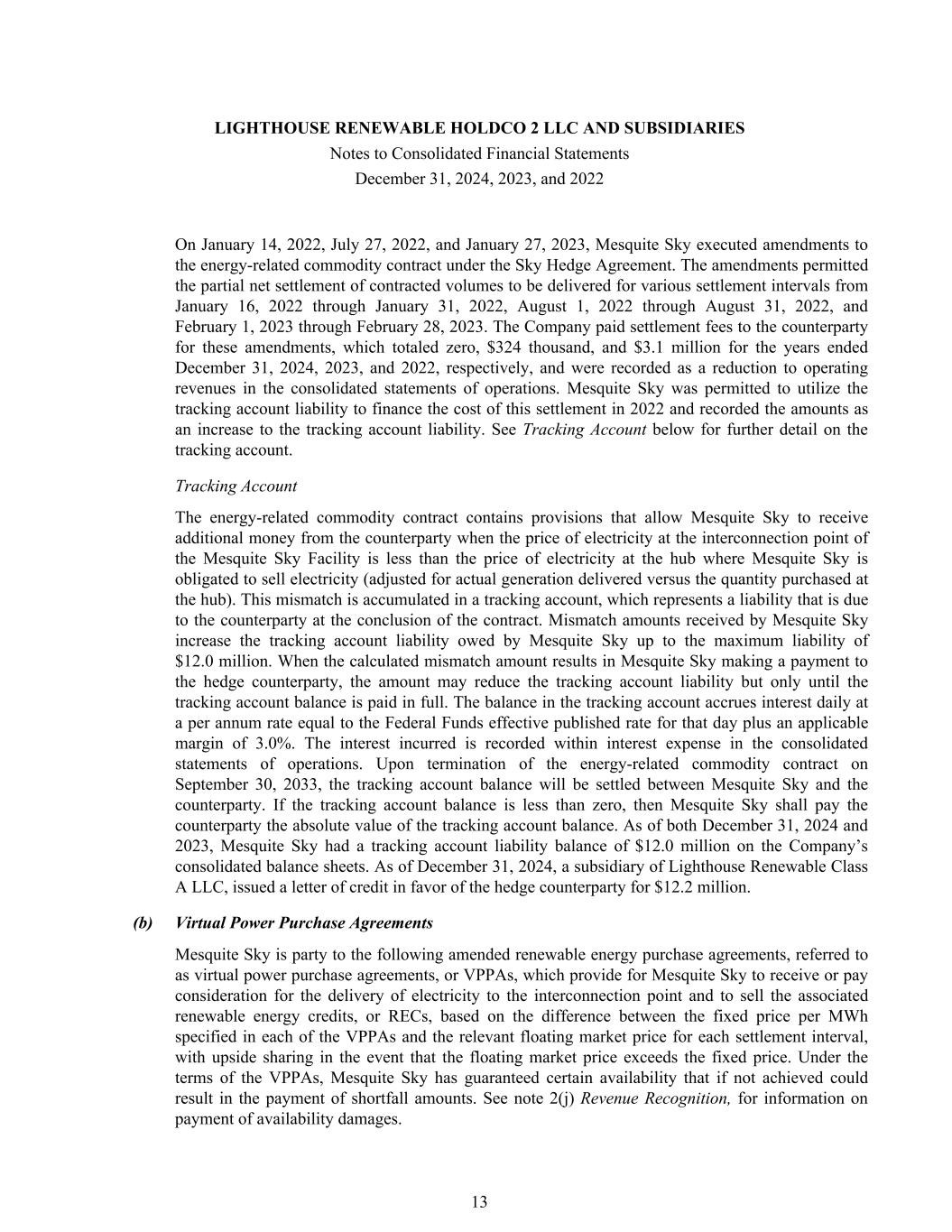

On January 14, 2022, July 27, 2022, and January 27, 2023, Mesquite Sky executed amendments to the energy-related commodity contract under the Sky Hedge Agreement. The amendments permitted the partial net settlement of contracted volumes to be delivered for various settlement intervals from January 16, 2022 through January 31, 2022, August 1, 2022 through August 31, 2022, and February 1, 2023 through February 28, 2023. The Company paid settlement fees to the counterparty for these amendments, which totaled zero, $324 thousand, and $3.1 million for the years ended December 31, 2024, 2023, and 2022, respectively, and were recorded as a reduction to operating revenues in the consolidated statements of operations. Mesquite Sky was permitted to utilize the tracking account liability to finance the cost of this settlement in 2022 and recorded the amounts as an increase to the tracking account liability. See Tracking Account below for further detail on the tracking account. Tracking Account The energy-related commodity contract contains provisions that allow Mesquite Sky to receive additional money from the counterparty when the price of electricity at the interconnection point of the Mesquite Sky Facility is less than the price of electricity at the hub where Mesquite Sky is obligated to sell electricity (adjusted for actual generation delivered versus the quantity purchased at the hub). This mismatch is accumulated in a tracking account, which represents a liability that is due to the counterparty at the conclusion of the contract. Mismatch amounts received by Mesquite Sky increase the tracking account liability owed by Mesquite Sky up to the maximum liability of $12.0 million. When the calculated mismatch amount results in Mesquite Sky making a payment to the hedge counterparty, the amount may reduce the tracking account liability but only until the tracking account balance is paid in full. The balance in the tracking account accrues interest daily at a per annum rate equal to the Federal Funds effective published rate for that day plus an applicable margin of 3.0%. The interest incurred is recorded within interest expense in the consolidated statements of operations. Upon termination of the energy-related commodity contract on September 30, 2033, the tracking account balance will be settled between Mesquite Sky and the counterparty. If the tracking account balance is less than zero, then Mesquite Sky shall pay the counterparty the absolute value of the tracking account balance. As of both December 31, 2024 and 2023, Mesquite Sky had a tracking account liability balance of $12.0 million on the Company’s consolidated balance sheets. As of December 31, 2024, a subsidiary of Lighthouse Renewable Class A LLC, issued a letter of credit in favor of the hedge counterparty for $12.2 million. (b) Virtual Power Purchase Agreements Mesquite Sky is party to the following amended renewable energy purchase agreements, referred to as virtual power purchase agreements, or VPPAs, which provide for Mesquite Sky to receive or pay consideration for the delivery of electricity to the interconnection point and to sell the associated renewable energy credits, or RECs, based on the difference between the fixed price per MWh specified in each of the VPPAs and the relevant floating market price for each settlement interval, with upside sharing in the event that the floating market price exceeds the fixed price. Under the terms of the VPPAs, Mesquite Sky has guaranteed certain availability that if not achieved could result in the payment of shortfall amounts. See note 2(j) Revenue Recognition, for information on payment of availability damages. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 13

Contract Effective capacity VPPA VPPA offtaker date (MW) COD term (a) Deere & Company (b) 12/20/2019 48 12/01/2021 12 years Whirlpool Corporation (c) 7/09/2020 57 12/01/2021 15 years Deere & Company (b) 10/26/2020 63 12/01/2021 15 years 168 (a) VPPA term effective through 12th or 15th anniversary of COD. (b) Mesquite Sky issued surety bonds in favor of Deere & Company for $11.1 million as of December 31, 2024. (c) A subsidiary of Lighthouse Renewable Class A, on behalf of Mesquite Sky, issued a letter of credit in favor of Whirlpool Corporation for $5.7 million as of December 31, 2024, which expires on December 17, 2025. (c) Siemens Gamesa Renewable Energy, Inc. Service and Warranty Agreement Mesquite Sky contracted with Siemens Gamesa Renewable Energy, Inc., or Siemens, to provide certain warranty, maintenance, and repair services for the wind turbines. Payment provisions provide for an annual service fee per turbine plus escalation paid in quarterly installments. On July 11, 2022, Mesquite Sky’s service and warranty agreement with Siemens was amended and restated in its entirety, and further amended on February 23, 2024 to include additional scheduled and unscheduled services and to provide the tools, parts, equipment, and labor necessary to carry out the scheduled and unscheduled services. In addition, the amended and restated agreement provided for an increase in the annual service fee per turbine plus escalation for a selected period, an increase in the availability threshold, set annual limitations on availability liquidated damages, and set the term of the agreement to expire on July 11, 2032, unless extended until December 31, 2032, or terminated early as provided for in the agreement. Total costs incurred under this agreement were $4.3 million, $3.0 million, and $2.1 million, for the years ended December 31, 2024, 2023, and 2022, respectively. These costs are included in cost of operations in the consolidated statements of operations. Payment of the service fees and accrued interest of $4.3 million related to 2024 has been deferred until the Mesquite Sky Facility reaches 95% availability for six consecutive months pursuant to the agreement described above, and is included in other non-current liabilities on the consolidated balance sheets as of December 31, 2024. The deferred service fee balance accrues interest at 1% per annum. The interest incurred is recorded within cost of operations in the consolidated statements of operations. Pursuant to the terms of the agreement with Siemens, the wind turbines are required to meet certain minimum availability thresholds. Failure to achieve minimum availability, as defined in the agreement, could result in payments due from Siemens to the Company. Effective January 1, 2024, Mesquite Sky entered into a settlement agreement with Siemens for liquidated damages under the service and warranty agreement totaling $5.9 million, received March 6, 2024, for the period from July 11, 2022 through July 10, 2023 and for anticipated damages for the period from January 1, 2024 through July 10, 2024. On September 18, 2024, Mesquite Sky received an additional $3.2 million for liquidated damages for the period from January 1, 2024 through July 10, 2024 under the service and LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 14

warranty agreement. For the year ended December 31, 2024, Mesquite Sky received a total of $9.1 million for liquidated damages. For the years ended December 31, 2023 and 2022, Mesquite Sky received settlements of $552 thousand and zero, respectively, for liquidated damages under the service and warranty agreement. Liquidated damages were recorded as a reduction to property, plant and equipment, net on the consolidated balance sheets and to capital expenditures included within cash flows from investing activities. In addition, effective February 13, 2024, Mesquite Sky entered into an agreement with Siemens related to the Wind Turbine Generator and Tower Supply and Commissioning Agreement, which resulted in Mesquite Sky no longer being obligated to pay a $3.0 million construction payable that was included in accounts payable – trade as of December 31, 2023. The relief of liability was recorded as a reduction to property, plant and equipment, net on the consolidated balance sheets. (d) Tax Abatement Agreement Mesquite Sky is party to an amended Tax Abatement Agreement with Callahan County, Texas, in which Mesquite Sky is exempted from 100% of the property taxes on 165 MWs of certified appraised eligible property for ten years beginning on January 1, 2022 through December 31, 2031. The remaining MWs are not subject to the abatement and, therefore, subject to the normal property tax rates. As consideration for the abatement, Mesquite Sky is obligated to make ten annual payments in lieu of taxes to Callahan County of two thousand dollars per MW, with the first payment due on October 1, 2022 and the remaining nine payments due annually thereafter on October 1. In addition, Mesquite Sky agreed to make improvements to the eligible property as defined in the agreement, which were completed as of COD. Mesquite Sky paid $330 thousand for each of the years ended December 31, 2024, 2023, and 2022, which was included in cost of operations in the consolidated statements of operations. Mesquite Star Special Agreements (a) ISDA Master Agreement Mesquite Star Special and a third party are parties to an ISDA 2002 Master Agreement, or Star Hedge Agreement, dated as of May 3, 2019, as amended. Under the Star Hedge Agreement, the Company is party to a 12-year agreement to sell power to a counterparty at a fixed price, which is utilized to manage the risk of fluctuations in market prices on sales of electricity. The energy-related commodity contract is accounted for as a derivative financial instrument as described in note 2(k) Derivative Financial Instruments. The Star Hedge Agreement contains provisions providing the counterparty a lien on specific assets as collateral. Also see note 4, Accounting for Derivative Instruments and Hedging Activities, for further information. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 15

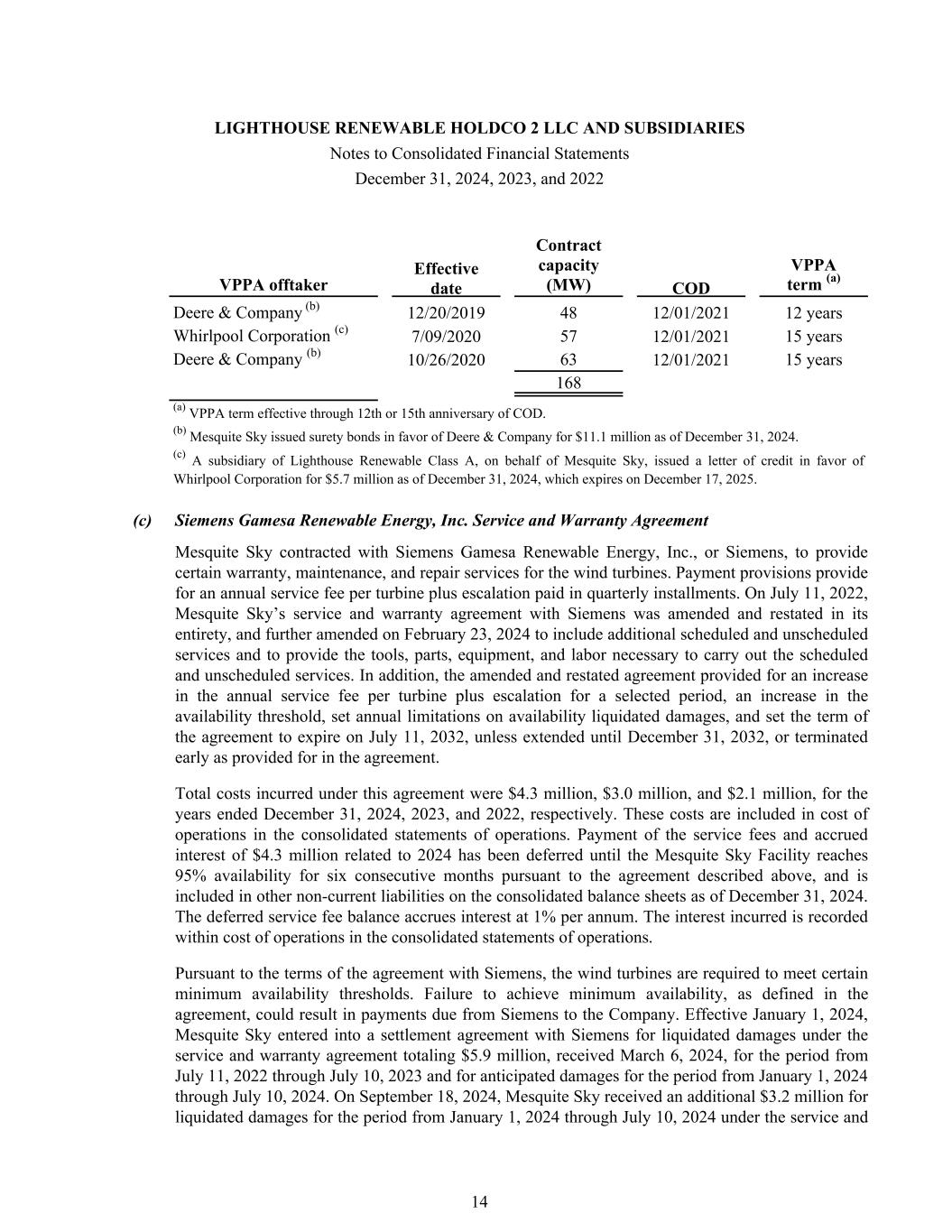

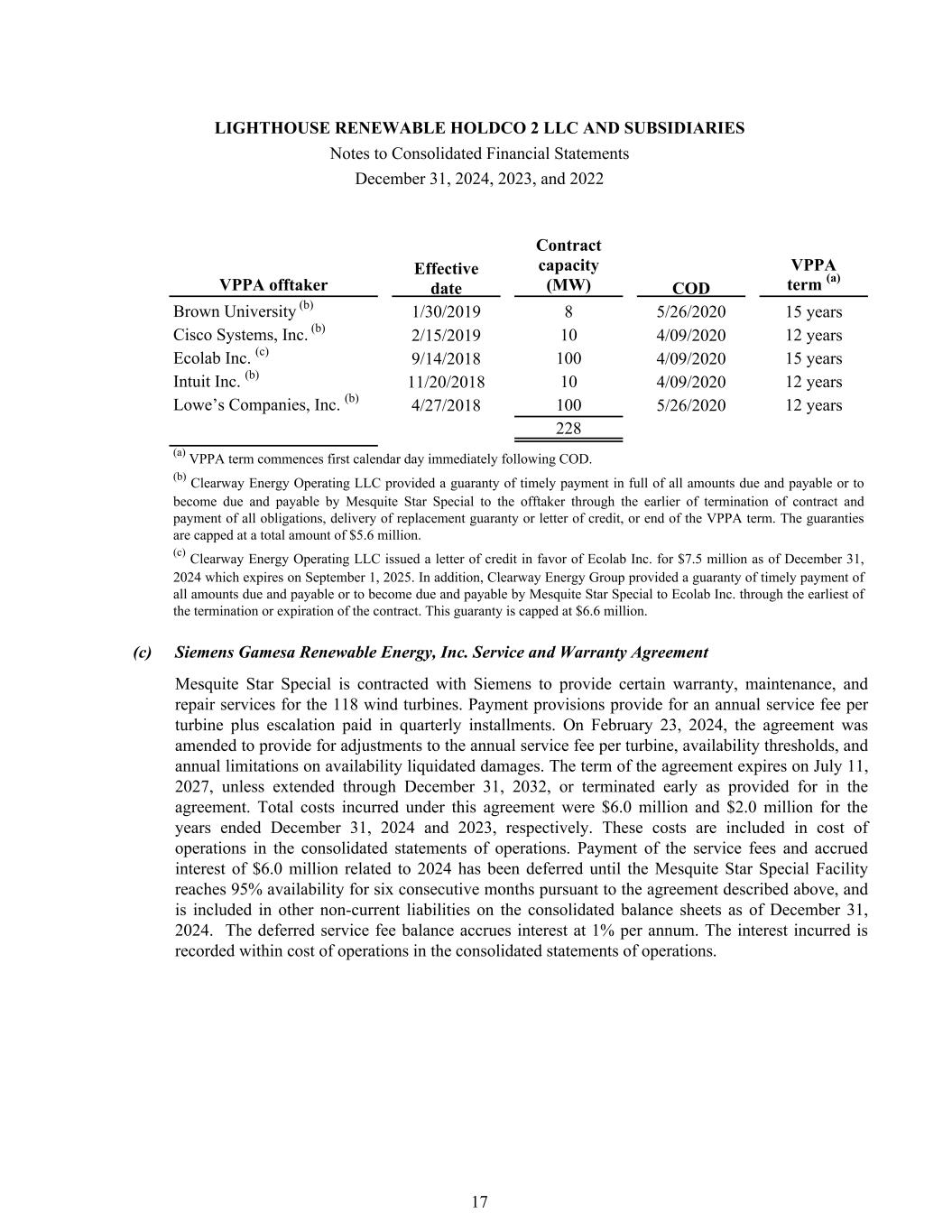

Tracking Account The energy-related commodity contract contains provisions that allow Mesquite Star Special to receive additional money from the counterparty when the price of electricity at the interconnection point of the Mesquite Star Special Facility is less than the price of electricity at the hub where Mesquite Star Special is obligated to sell electricity (adjusted for actual generation delivered versus the quantity purchased at the hub). This mismatch is accumulated in a tracking account, which represents a liability that is due to the counterparty at the conclusion of the contract. Mismatch amounts received by Mesquite Star Special increase the tracking account liability owed by Mesquite Star Special up to the maximum liability of $10.5 million. When the calculated mismatch amount results in Mesquite Star Special making a payment to the hedge counterparty, the amount may reduce the tracking account balance but only until the tracking account balance is paid in full. The balance in the tracking account accrues interest at Adjusted Secured Overnight Financing Rate, or Adjusted SOFR, plus an adjustment of 0.26161% and an applicable margin of 2.5%. The interest incurred is recorded within interest expense in the consolidated statements of operations. Upon termination of the energy-related commodity contract on May 31, 2032, the tracking account balance will be settled between the Mesquite Star Special and the counterparty. If the tracking account balance is less than zero, then Mesquite Star Special shall pay the counterparty the absolute value of the tracking account balance. As of both December 31, 2024 and 2023, Mesquite Star Special had a tracking account liability balance of $10.5 million on the Company’s consolidated balance sheets. (b) Virtual Power Purchase Agreements Mesquite Star Special is party to the following VPPAs, which provide for Mesquite Star Special to receive or pay consideration for the delivery of electricity to the interconnection point and to sell the associated RECs based on the difference between the fixed price per MWh specified in each of the VPPAs and the relevant floating market price for each settlement interval, with upside sharing in the event that the floating market price exceeds the fixed price. Under the terms of the VPPAs, Mesquite Star Special has guaranteed certain availability that if not achieved could result in the payment of shortfall amounts. See note 2(j) Revenue Recognition, for information on payment of availability damages. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 16

Contract Effective capacity VPPA VPPA offtaker date (MW) COD term (a) Brown University (b) 1/30/2019 8 5/26/2020 15 years Cisco Systems, Inc. (b) 2/15/2019 10 4/09/2020 12 years Ecolab Inc. (c) 9/14/2018 100 4/09/2020 15 years Intuit Inc. (b) 11/20/2018 10 4/09/2020 12 years Lowe’s Companies, Inc. (b) 4/27/2018 100 5/26/2020 12 years 228 (a) VPPA term commences first calendar day immediately following COD. (b) Clearway Energy Operating LLC provided a guaranty of timely payment in full of all amounts due and payable or to become due and payable by Mesquite Star Special to the offtaker through the earlier of termination of contract and payment of all obligations, delivery of replacement guaranty or letter of credit, or end of the VPPA term. The guaranties are capped at a total amount of $5.6 million. (c) Clearway Energy Operating LLC issued a letter of credit in favor of Ecolab Inc. for $7.5 million as of December 31, 2024 which expires on September 1, 2025. In addition, Clearway Energy Group provided a guaranty of timely payment of all amounts due and payable or to become due and payable by Mesquite Star Special to Ecolab Inc. through the earliest of the termination or expiration of the contract. This guaranty is capped at $6.6 million. (c) Siemens Gamesa Renewable Energy, Inc. Service and Warranty Agreement Mesquite Star Special is contracted with Siemens to provide certain warranty, maintenance, and repair services for the 118 wind turbines. Payment provisions provide for an annual service fee per turbine plus escalation paid in quarterly installments. On February 23, 2024, the agreement was amended to provide for adjustments to the annual service fee per turbine, availability thresholds, and annual limitations on availability liquidated damages. The term of the agreement expires on July 11, 2027, unless extended through December 31, 2032, or terminated early as provided for in the agreement. Total costs incurred under this agreement were $6.0 million and $2.0 million for the years ended December 31, 2024 and 2023, respectively. These costs are included in cost of operations in the consolidated statements of operations. Payment of the service fees and accrued interest of $6.0 million related to 2024 has been deferred until the Mesquite Star Special Facility reaches 95% availability for six consecutive months pursuant to the agreement described above, and is included in other non-current liabilities on the consolidated balance sheets as of December 31, 2024. The deferred service fee balance accrues interest at 1% per annum. The interest incurred is recorded within cost of operations in the consolidated statements of operations. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 17

Pursuant to the terms of the agreement with Siemens, the wind turbines are required to meet certain minimum availability thresholds. Failure to achieve minimum availability, as defined in the agreement, could result in payments due from Siemens to the Company. Effective January 1, 2024, Mesquite Star Special entered into a settlement agreement with Siemens for liquidated damages under the service and warranty agreement totaling $1.7 million, received on March 21, 2024, for the period from July 11, 2022 through July 10, 2023 and for anticipated damages for the period from January 1, 2024 through July 10, 2024. In September 2024, Mesquite Star Special accrued an additional $899 thousand for liquidated damages for the period from July 11, 2023 through December 31, 2023 under the service and warranty agreement, included in accounts receivable – trade as of December 31, 2024. Mesquite Star Special recorded total liquidated damages of $2.6 million as a reduction to property, plant, and equipment, net on the consolidated balance sheets as of December 31, 2024 and $1.7 million to capital expenditures included within cash flows from investing activities. In addition, effective September 27, 2023, Mesquite Star Special entered into a settlement agreement with Siemens for settlement of a dispute regarding the power curve guarantee provided for under a related turbine supply and commissioning agreement. Pursuant to the terms of the turbine supply and commissioning agreement, Siemens paid Mesquite Star Special $7.3 million in liquidated damages, which was recorded as a reduction to property, plant, and equipment, net on the consolidated balance sheets as of December 31, 2023, and to capital expenditures included within cash flows from investing activities. (d) Tax Abatement Agreements Mesquite Star Special is party to ten-year property tax abatement agreements with Fisher County, Texas for a property tax limitation based on the certified appraised value of certain eligible property within Fisher County from January 1, 2020 through December 31, 2029. As consideration for the abatement under certain of the agreements, Mesquite Star Special made payments totaling $4.9 million that are being amortized straight line over January 1, 2020 through December 31, 2029. Amortization is recorded as part of cost of operations in the consolidated statements of operations. As of both December 31, 2024 and 2023, $486 thousand was recorded to prepayments and other current assets on the Company’s consolidated balance sheets. As of December 31, 2024 and 2023, $1.9 million and $2.4 million, respectively, were recorded to other non-current assets on the Company’s consolidated balance sheets. Mesquite Star Special is also obligated to make annual payments to Fisher County as defined in the remaining agreements beginning on January 1, 2020 through December 31, 2029, which are recorded as part of cost of operations in the consolidated statements of operations. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 18

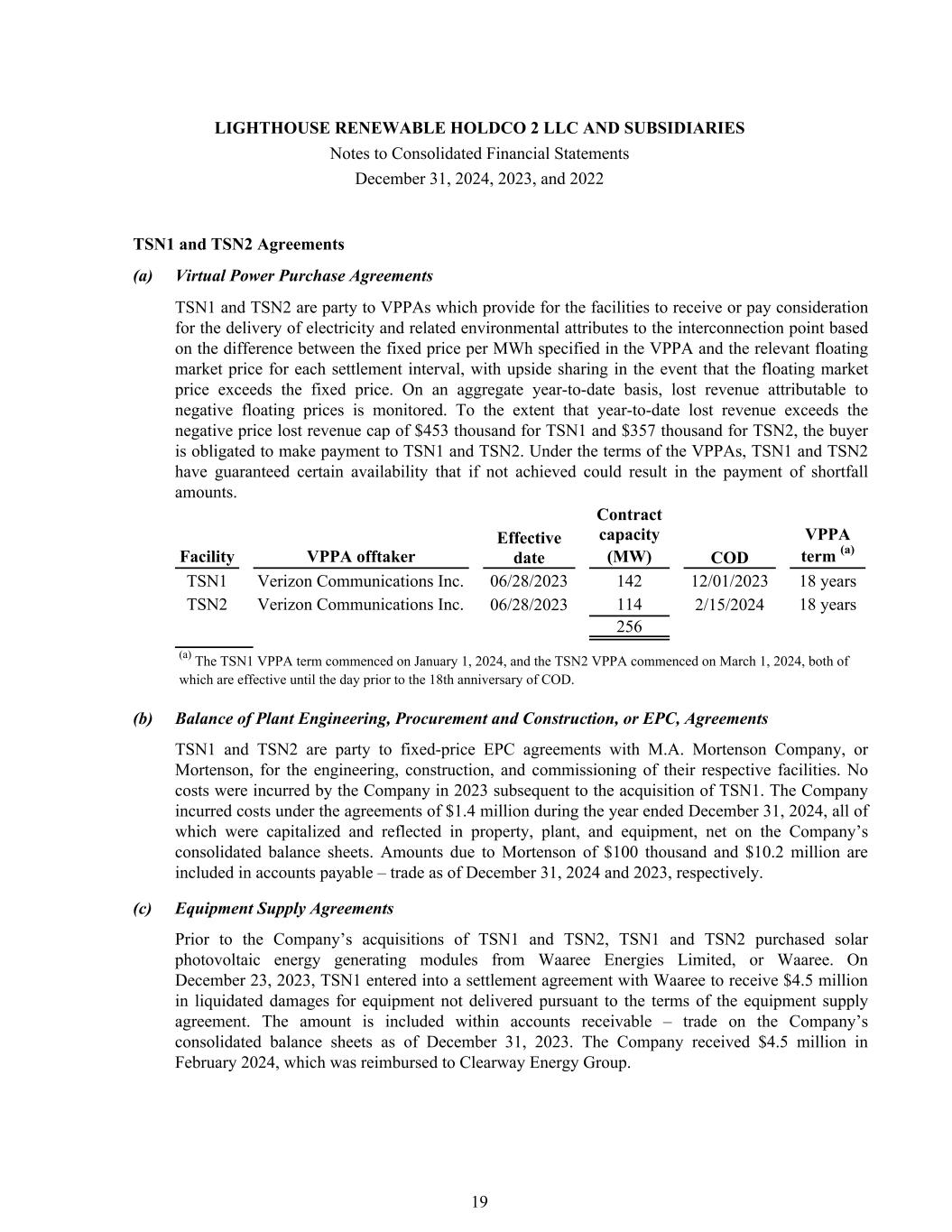

TSN1 and TSN2 Agreements (a) Virtual Power Purchase Agreements TSN1 and TSN2 are party to VPPAs which provide for the facilities to receive or pay consideration for the delivery of electricity and related environmental attributes to the interconnection point based on the difference between the fixed price per MWh specified in the VPPA and the relevant floating market price for each settlement interval, with upside sharing in the event that the floating market price exceeds the fixed price. On an aggregate year-to-date basis, lost revenue attributable to negative floating prices is monitored. To the extent that year-to-date lost revenue exceeds the negative price lost revenue cap of $453 thousand for TSN1 and $357 thousand for TSN2, the buyer is obligated to make payment to TSN1 and TSN2. Under the terms of the VPPAs, TSN1 and TSN2 have guaranteed certain availability that if not achieved could result in the payment of shortfall amounts. Contract Effective capacity VPPA Facility VPPA offtaker date (MW) COD term (a) TSN1 Verizon Communications Inc. 06/28/2023 142 12/01/2023 18 years TSN2 Verizon Communications Inc. 06/28/2023 114 2/15/2024 18 years 256 (a) The TSN1 VPPA term commenced on January 1, 2024, and the TSN2 VPPA commenced on March 1, 2024, both of which are effective until the day prior to the 18th anniversary of COD. (b) Balance of Plant Engineering, Procurement and Construction, or EPC, Agreements TSN1 and TSN2 are party to fixed-price EPC agreements with M.A. Mortenson Company, or Mortenson, for the engineering, construction, and commissioning of their respective facilities. No costs were incurred by the Company in 2023 subsequent to the acquisition of TSN1. The Company incurred costs under the agreements of $1.4 million during the year ended December 31, 2024, all of which were capitalized and reflected in property, plant, and equipment, net on the Company’s consolidated balance sheets. Amounts due to Mortenson of $100 thousand and $10.2 million are included in accounts payable – trade as of December 31, 2024 and 2023, respectively. (c) Equipment Supply Agreements Prior to the Company’s acquisitions of TSN1 and TSN2, TSN1 and TSN2 purchased solar photovoltaic energy generating modules from Waaree Energies Limited, or Waaree. On December 23, 2023, TSN1 entered into a settlement agreement with Waaree to receive $4.5 million in liquidated damages for equipment not delivered pursuant to the terms of the equipment supply agreement. The amount is included within accounts receivable – trade on the Company’s consolidated balance sheets as of December 31, 2023. The Company received $4.5 million in February 2024, which was reimbursed to Clearway Energy Group. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 19

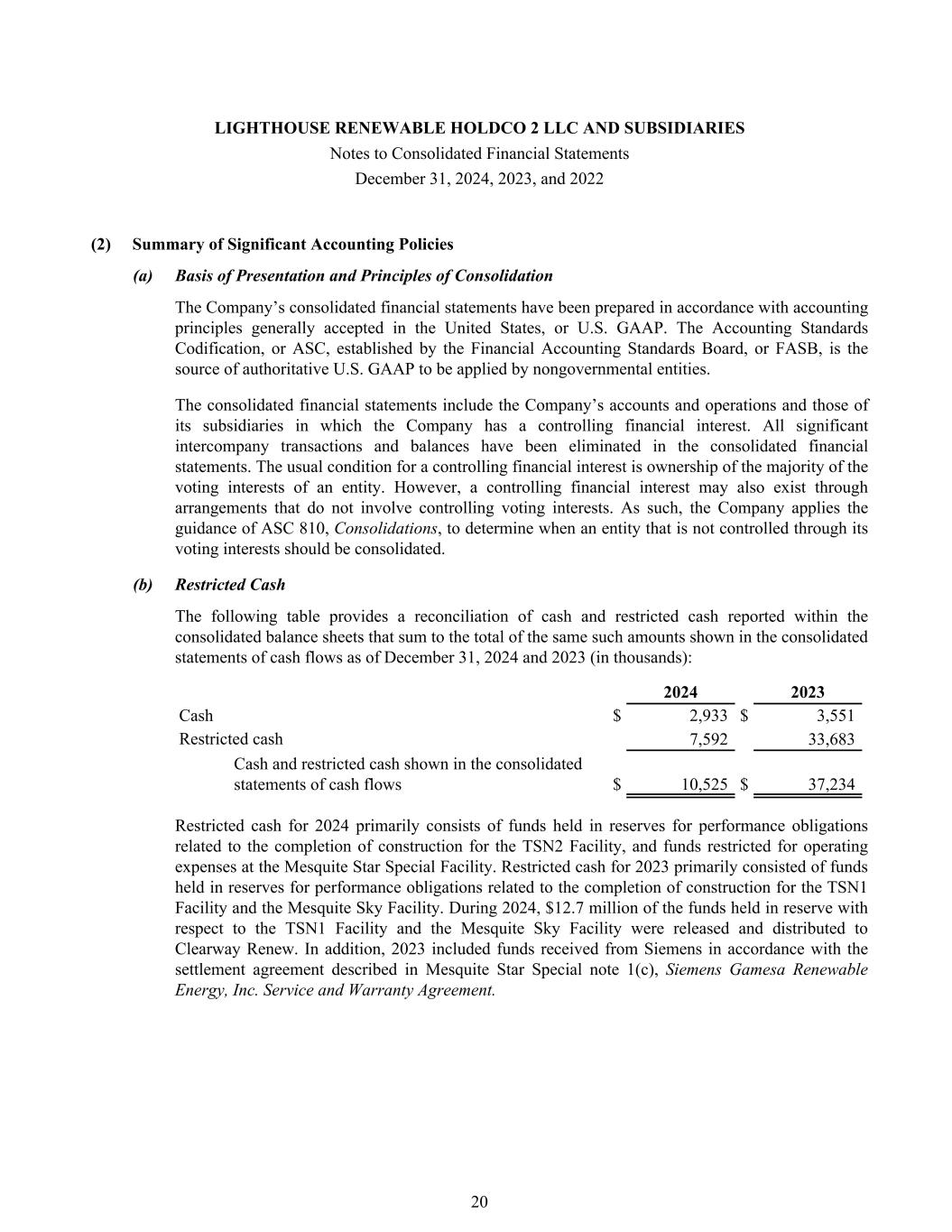

(2) Summary of Significant Accounting Policies (a) Basis of Presentation and Principles of Consolidation The Company’s consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. The Accounting Standards Codification, or ASC, established by the Financial Accounting Standards Board, or FASB, is the source of authoritative U.S. GAAP to be applied by nongovernmental entities. The consolidated financial statements include the Company’s accounts and operations and those of its subsidiaries in which the Company has a controlling financial interest. All significant intercompany transactions and balances have been eliminated in the consolidated financial statements. The usual condition for a controlling financial interest is ownership of the majority of the voting interests of an entity. However, a controlling financial interest may also exist through arrangements that do not involve controlling voting interests. As such, the Company applies the guidance of ASC 810, Consolidations, to determine when an entity that is not controlled through its voting interests should be consolidated. (b) Restricted Cash The following table provides a reconciliation of cash and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the consolidated statements of cash flows as of December 31, 2024 and 2023 (in thousands): 2024 2023 Cash $ 2,933 $ 3,551 Restricted cash 7,592 33,683 Cash and restricted cash shown in the consolidated statements of cash flows $ 10,525 $ 37,234 Restricted cash for 2024 primarily consists of funds held in reserves for performance obligations related to the completion of construction for the TSN2 Facility, and funds restricted for operating expenses at the Mesquite Star Special Facility. Restricted cash for 2023 primarily consisted of funds held in reserves for performance obligations related to the completion of construction for the TSN1 Facility and the Mesquite Sky Facility. During 2024, $12.7 million of the funds held in reserve with respect to the TSN1 Facility and the Mesquite Sky Facility were released and distributed to Clearway Renew. In addition, 2023 included funds received from Siemens in accordance with the settlement agreement described in Mesquite Star Special note 1(c), Siemens Gamesa Renewable Energy, Inc. Service and Warranty Agreement. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 20

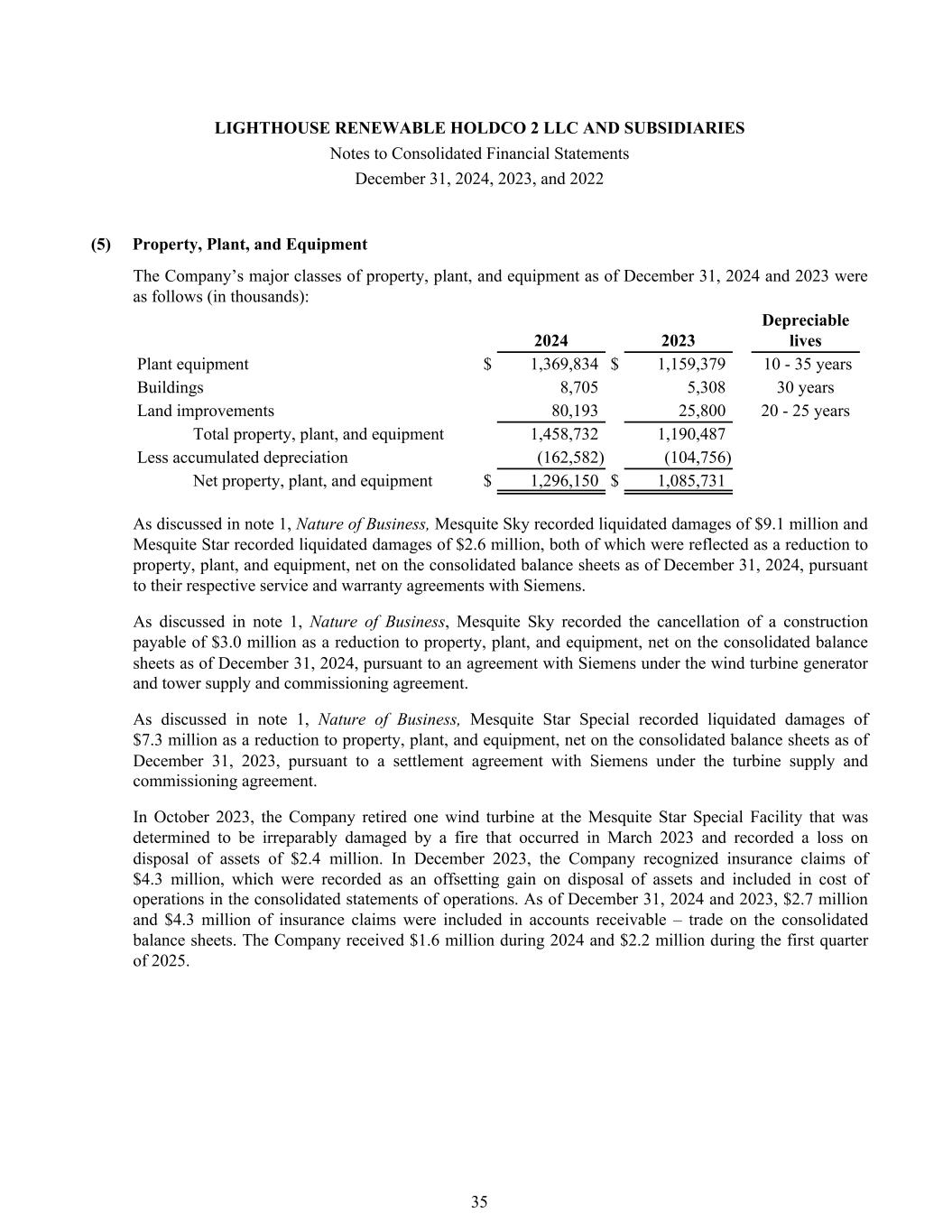

(c) Accounts Receivable – Trade Trade accounts receivable are recorded at the invoiced amount and do not bear interest. The Company’s energy revenue related customers typically receive invoices monthly with payment due within 30 days, and the Company receives payment for the sale of RECs quarterly, semi-annually or annually, as defined per contract. There was no allowance for credit losses as of December 31, 2024 and 2023. (d) Property, Plant, and Equipment Property, plant, and equipment are stated at cost; however, impairment adjustments are recorded whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Significant additions or improvements extending asset lives are capitalized as incurred, while repairs and maintenance that do not improve or extend the life of the respective asset are charged to expense as incurred. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Certain assets and their related accumulated depreciation amounts are adjusted for asset retirements and disposals with the resulting gain or loss included in cost of operations in the consolidated statements of operations. See note 5, Property, Plant, and Equipment, for additional information. (e) Asset Impairments Long-lived assets that are held and used are reviewed for impairment whenever events or changes in circumstances indicate their carrying amounts may not be recoverable. Such reviews are performed in accordance with ASC 360, Property, Plant, and Equipment. An impairment loss is indicated if the total future estimated undiscounted cash flows expected from an asset are less than its carrying amount. An impairment charge is measured as the excess of an asset’s carrying amount over its fair value with the difference recorded in operating costs and expenses in the consolidated statements of operations. Fair values are determined by a variety of valuation methods, including third-party appraisals, sales prices of similar assets, and present value techniques. There were no indicators of impairment loss as of December 31, 2024, 2023 and 2022. (f) Debt Issuance Costs Debt issuance costs consist of legal fees and closing costs incurred by TSN1 and TSN2 in obtaining their financings. These costs are capitalized and amortized as interest expense using the effective interest method over the term of the related debt, and are presented on the consolidated balance sheets as a direct deduction from the carrying amount of the related debt. Amortization expense, included in interest expense in the consolidated statements of operations, was $232 thousand for the year ended December 31, 2024. There was no amortization expense recorded for the years ended December 31, 2023 and 2022. In addition, the Company recorded a $489 thousand loss on extinguishment of debt associated with writing off a portion of the debt issuance costs for the year ended December 31, 2024. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 21

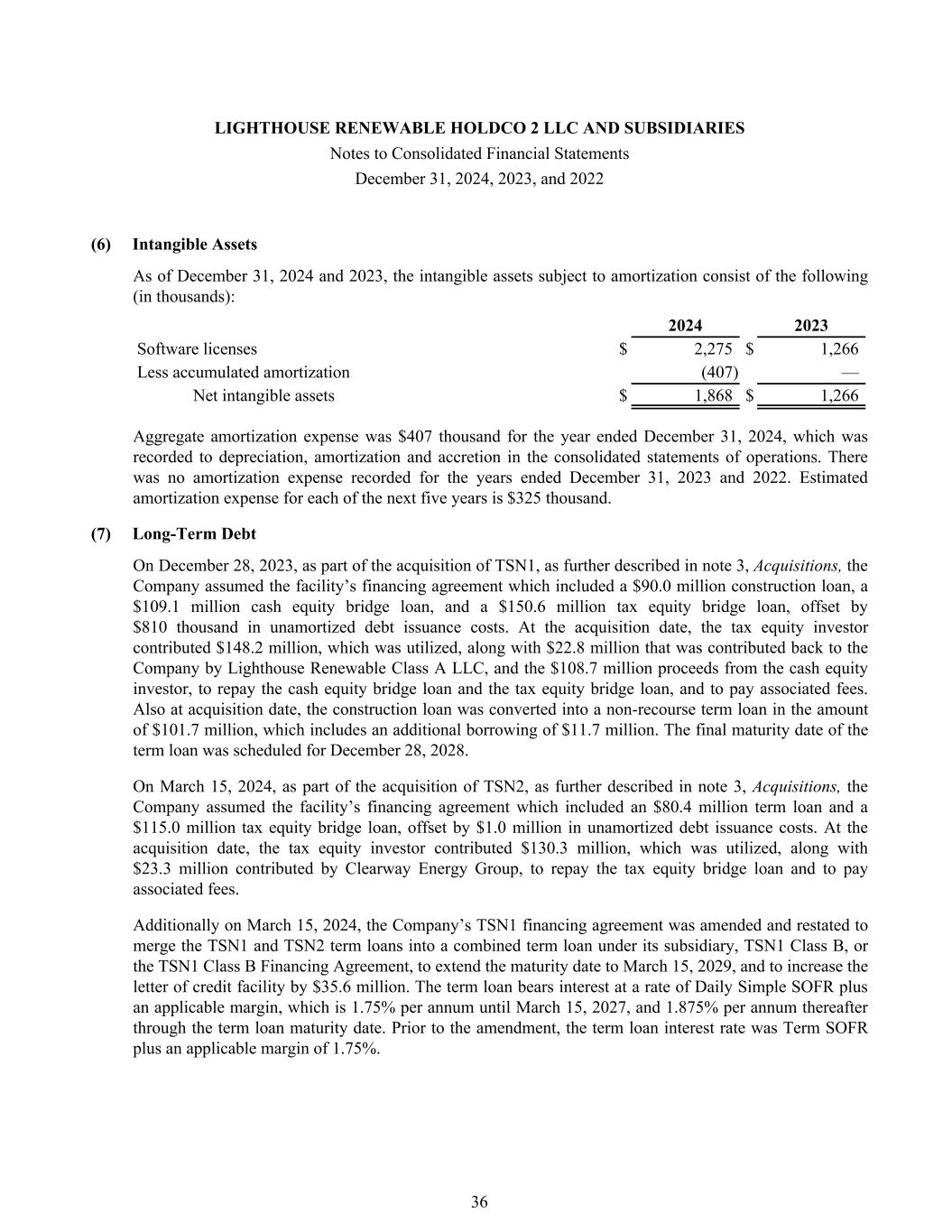

(g) Intangible Assets Intangible assets represents the fair value of software licenses acquired. The Company recognizes specifically identifiable intangible assets when specific rights and contracts are acquired. The assets are amortized on a straight-line basis over the estimated useful life of the software or seven years. See note 6, Intangible Assets, for additional information. (h) Leases The Company accounts for its leases under ASC 842, Leases, or ASC 842. ASC 842 requires the establishment of a lease liability and related right-of-use asset for all leases with a term longer than 12 months. The Company evaluates each arrangement at inception to determine if it contains a lease. The Company has elected to apply the practical expedient to not separate lease and non-lease components of the leases. The Company records its operating lease liabilities at the present value of the lease payments over the lease term at lease commencement date. Lease payments include fixed payment amounts, as well as variable rate payments based on an index initially measured at lease commencement date. Variable payments, including payments based on future performance and based on index changes, are recorded when the expense is probable. The Company determines the relevant lease term by evaluating whether renewal and termination options are reasonably certain to be exercised. The Company uses its incremental borrowing rate to calculate the present value of the lease payments, based on information available at the lease commencement date. All of the Company’s leases are operating leases. See note 12, Leases for information on the Company’s leases. (i) Income Taxes The Company is classified as a partnership for federal and state income tax purposes. Therefore, federal and most state income taxes are assessed at the partner level. The state of Texas, however, imposes a franchise tax (characterized as an income tax for U.S. GAAP purposes) to which the Company’s subsidiaries are subject. For the years ended December 31, 2024, 2023 and 2022, the Company had no current income tax expense and has calculated deferred income tax expense (benefit) of $1.0 million, $(1.7) million and $163 thousand, respectively. The Company has determined that, based on a more-likely-than not evaluation of the tax positions taken, there are no material uncertain tax positions to be recognized as of December 31, 2024, 2023, and 2022 by the Company. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 22

(j) Revenue Recognition Virtual Power Purchase Agreements The Company accounts for energy revenue recognized under the VPPAs in accordance with ASC 606, Revenue from Contracts with Customers, or ASC 606. Revenue from the sale of bundled RECs under the VPPAs is recognized when the related energy is generated and simultaneously delivered to the market, even in cases where there is a certification lag, as it has been deemed to be perfunctory as this is the point in time in which the performance obligation is satisfied and control of the REC is transferred to the customer. In such cases, it is unnecessary to allocate transaction price to multiple performance obligations. For the years ended December 31, 2024, 2023, and 2022, Mesquite Sky incurred $3.0 million, $295 thousand, and $1.5 million, respectively, in availability damages to the offtakers under the VPPAs. For the years ended December 31, 2024 and 2023, Mesquite Star Special incurred zero and $96 thousand, respectively, in availability damages to the offtakers under the VPPAs. Availability damages were recorded as a reduction to operating revenues in the consolidated statements of operations. Merchant Revenue The Company sells uncontracted electricity into the Electric Reliability Council of Texas, or ERCOT, real-time market. This merchant electric revenue is recognized when the electricity is produced by the facilities and simultaneously delivered to ERCOT. Unbundled Renewable Energy Certificates/Credits, or RECs, Revenue The Company has agreements with third parties for the sale of RECs from the Mesquite Sky Facility, the TSN1 Facility, and the TSN2 Facility, for RECs generated from 2022 through 2037. RECs are sold at a fixed price up to a stated contract quantity as defined in the agreement. Termination of the agreements may be allowed under specific circumstances, such as under an event of default. The REC agreements are derivative financial instruments that qualify for the normal purchase normal sale exception and as such, the REC agreements are accounted for under the revenue recognition guidance in ASC 606. Revenue from the sale of the RECs is recognized when the related energy is generated and simultaneously delivered to the market, even in cases where there is a certification lag, as it has been deemed to be perfunctory as this is the point in time in which the performance obligation is satisfied and control of the REC is transferred to the customer. Contract Amortization Included in other non-current assets on the consolidated balance sheets are capitalized costs to acquire the VPPAs at the Mesquite Sky Facility. The costs are amortized as a reduction to operating revenues on a straight-line basis over the terms of the VPPAs, through 2036. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 23

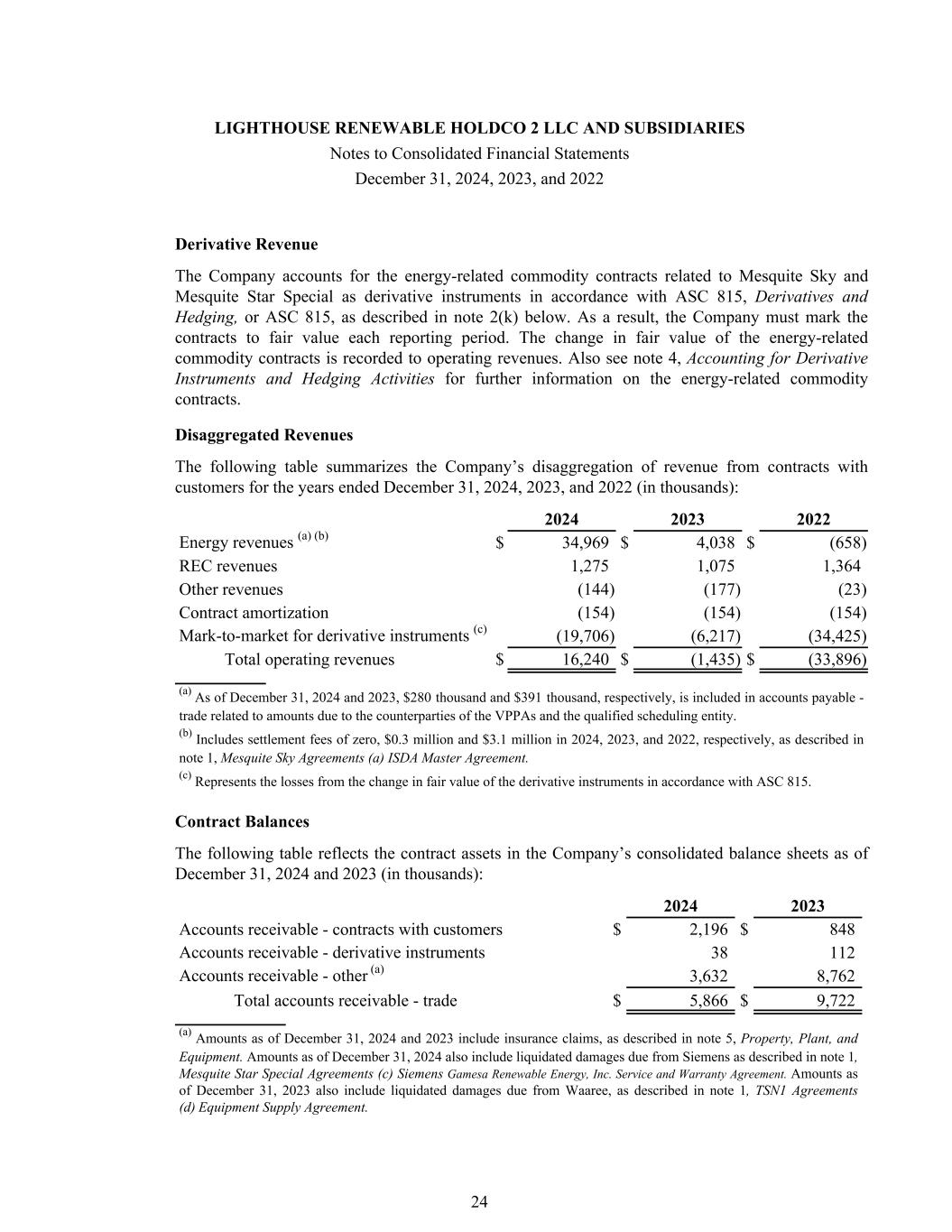

Derivative Revenue The Company accounts for the energy-related commodity contracts related to Mesquite Sky and Mesquite Star Special as derivative instruments in accordance with ASC 815, Derivatives and Hedging, or ASC 815, as described in note 2(k) below. As a result, the Company must mark the contracts to fair value each reporting period. The change in fair value of the energy-related commodity contracts is recorded to operating revenues. Also see note 4, Accounting for Derivative Instruments and Hedging Activities for further information on the energy-related commodity contracts. Disaggregated Revenues The following table summarizes the Company’s disaggregation of revenue from contracts with customers for the years ended December 31, 2024, 2023, and 2022 (in thousands): 2024 2023 2022 Energy revenues (a) (b) $ 34,969 $ 4,038 $ (658) REC revenues 1,275 1,075 1,364 Other revenues (144) (177) (23) Contract amortization (154) (154) (154) Mark-to-market for derivative instruments (c) (19,706) (6,217) (34,425) Total operating revenues $ 16,240 $ (1,435) $ (33,896) (a) As of December 31, 2024 and 2023, $280 thousand and $391 thousand, respectively, is included in accounts payable - trade related to amounts due to the counterparties of the VPPAs and the qualified scheduling entity. (b) Includes settlement fees of zero, $0.3 million and $3.1 million in 2024, 2023, and 2022, respectively, as described in note 1, Mesquite Sky Agreements (a) ISDA Master Agreement. (c) Represents the losses from the change in fair value of the derivative instruments in accordance with ASC 815. Contract Balances The following table reflects the contract assets in the Company’s consolidated balance sheets as of December 31, 2024 and 2023 (in thousands): 2024 2023 Accounts receivable - contracts with customers $ 2,196 $ 848 Accounts receivable - derivative instruments 38 112 Accounts receivable - other (a) 3,632 8,762 Total accounts receivable - trade $ 5,866 $ 9,722 (a) Amounts as of December 31, 2024 and 2023 include insurance claims, as described in note 5, Property, Plant, and Equipment. Amounts as of December 31, 2024 also include liquidated damages due from Siemens as described in note 1, Mesquite Star Special Agreements (c) Siemens Gamesa Renewable Energy, Inc. Service and Warranty Agreement. Amounts as of December 31, 2023 also include liquidated damages due from Waaree, as described in note 1, TSN1 Agreements (d) Equipment Supply Agreement. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 24

(k) Derivative Financial Instruments The Company accounts for derivative financial instruments in accordance with ASC 815, which requires the Company to recognize all derivative instruments on the balance sheet as either assets or liabilities and to measure them at fair value each reporting period unless they qualify for a normal purchase normal sale exception. The Company is party to long-term energy-related commodity contracts which are not designated as cash flow or fair value hedges. Settlements and changes in the fair value of the energy-related commodity contracts are recognized in operating revenues. The Company uses interest rate swaps to manage its interest rate exposure on long-term debt, which are not designated as cash flow hedges. Changes in the fair value of non-hedge derivatives are immediately recognized in earnings. Cash flows from derivatives not designated as cash flow hedges are classified as operating activities in the consolidated statements of cash flows. See note 4, Accounting for Derivative Instruments and Hedging Activities, for more information. (l) Risks and Uncertainties Financial instruments, which potentially subject the Company to concentrations of credit risk, consist primarily of accounts receivable – trade and derivative financial instruments. Accounts receivable are concentrated with commercial customers and a private university. The concentration of sales to a small group of customers may impact the Company’s overall exposure to credit risk, either positively or negatively, in that the customers may be similarly affected by changes in economic, industry, or other conditions. However, the Company believes that the credit risk posed by such concentrations is offset by the creditworthiness of its customer base. The Company is also exposed to credit losses in the event of noncompliance by counterparties to its derivative financial instruments. Risks associated with the Company’s operations include the performance of the facilities below expected levels of efficiency and output, shutdowns due to the breakdown or failure of equipment, which could be further impacted by the inability to obtain replacement parts, or catastrophic events such as extreme weather, fires, earthquakes, floods, explosions, pandemics, supply chain disruptions, hostile cyber intrusions, or other similar occurrences affecting a power generation facility or its energy purchasers. Should a generation facility fail to perform at the required levels, or other unplanned disruptions occur, the facility may be forced to fulfill an underlying contractual obligation by purchasing electricity at higher prices. In addition, the Company’s facilities may be exposed, based on specific contractual terms, to a locational basis risk resulting from a difference in the price received for generation sold at the location where the power is generated and the price paid for generation purchased at the contracted delivery point, which could lead to potential lower revenues in circumstances where the price received is lower than the price that is paid. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 25

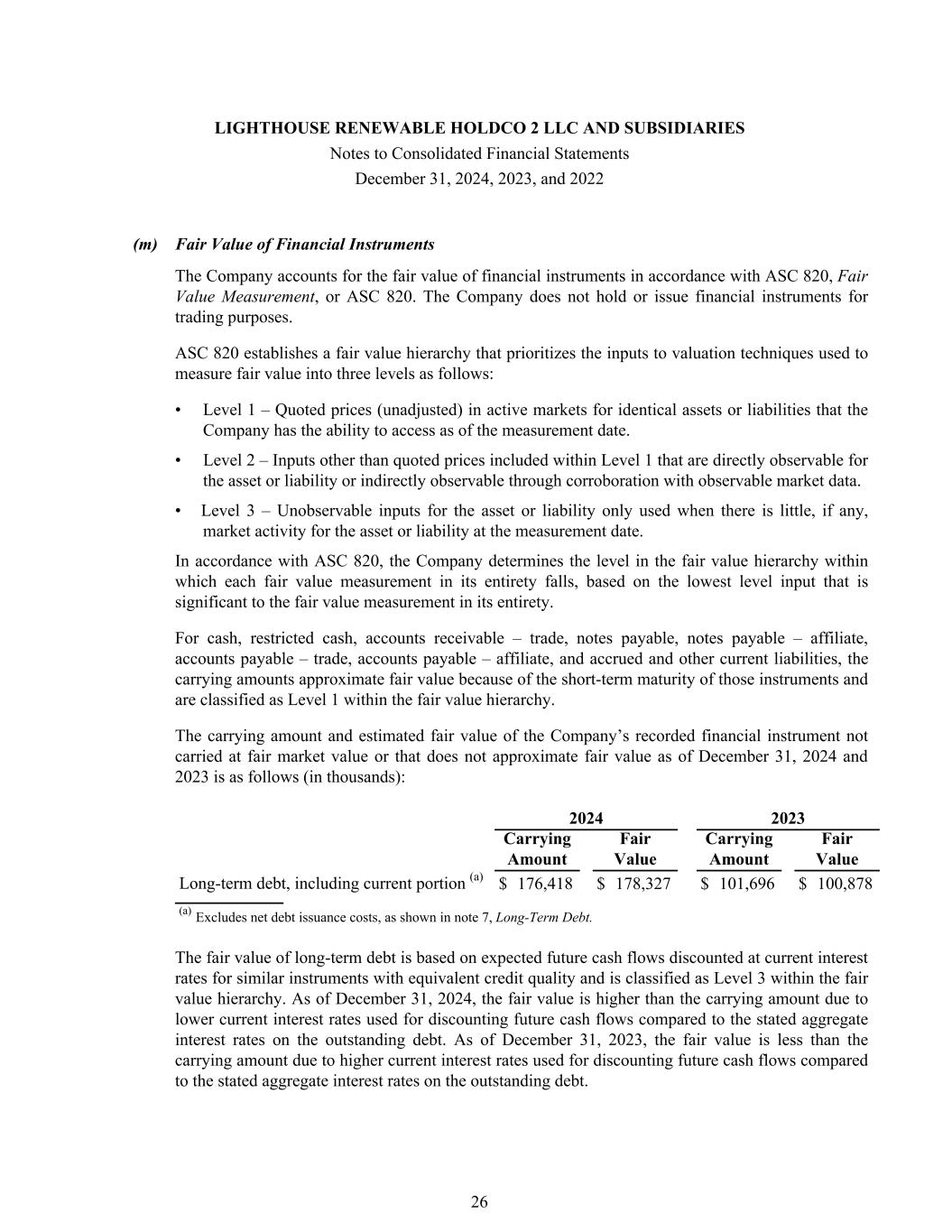

(m) Fair Value of Financial Instruments The Company accounts for the fair value of financial instruments in accordance with ASC 820, Fair Value Measurement, or ASC 820. The Company does not hold or issue financial instruments for trading purposes. ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows: • Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access as of the measurement date. • Level 2 – Inputs other than quoted prices included within Level 1 that are directly observable for the asset or liability or indirectly observable through corroboration with observable market data. • Level 3 – Unobservable inputs for the asset or liability only used when there is little, if any, market activity for the asset or liability at the measurement date. In accordance with ASC 820, the Company determines the level in the fair value hierarchy within which each fair value measurement in its entirety falls, based on the lowest level input that is significant to the fair value measurement in its entirety. For cash, restricted cash, accounts receivable – trade, notes payable, notes payable – affiliate, accounts payable – trade, accounts payable – affiliate, and accrued and other current liabilities, the carrying amounts approximate fair value because of the short-term maturity of those instruments and are classified as Level 1 within the fair value hierarchy. The carrying amount and estimated fair value of the Company’s recorded financial instrument not carried at fair market value or that does not approximate fair value as of December 31, 2024 and 2023 is as follows (in thousands): 2024 2023 Carrying Amount Fair Value Carrying Amount Fair Value Long-term debt, including current portion (a) $ 176,418 $ 178,327 $ 101,696 $ 100,878 (a) Excludes net debt issuance costs, as shown in note 7, Long-Term Debt. The fair value of long-term debt is based on expected future cash flows discounted at current interest rates for similar instruments with equivalent credit quality and is classified as Level 3 within the fair value hierarchy. As of December 31, 2024, the fair value is higher than the carrying amount due to lower current interest rates used for discounting future cash flows compared to the stated aggregate interest rates on the outstanding debt. As of December 31, 2023, the fair value is less than the carrying amount due to higher current interest rates used for discounting future cash flows compared to the stated aggregate interest rates on the outstanding debt. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 26

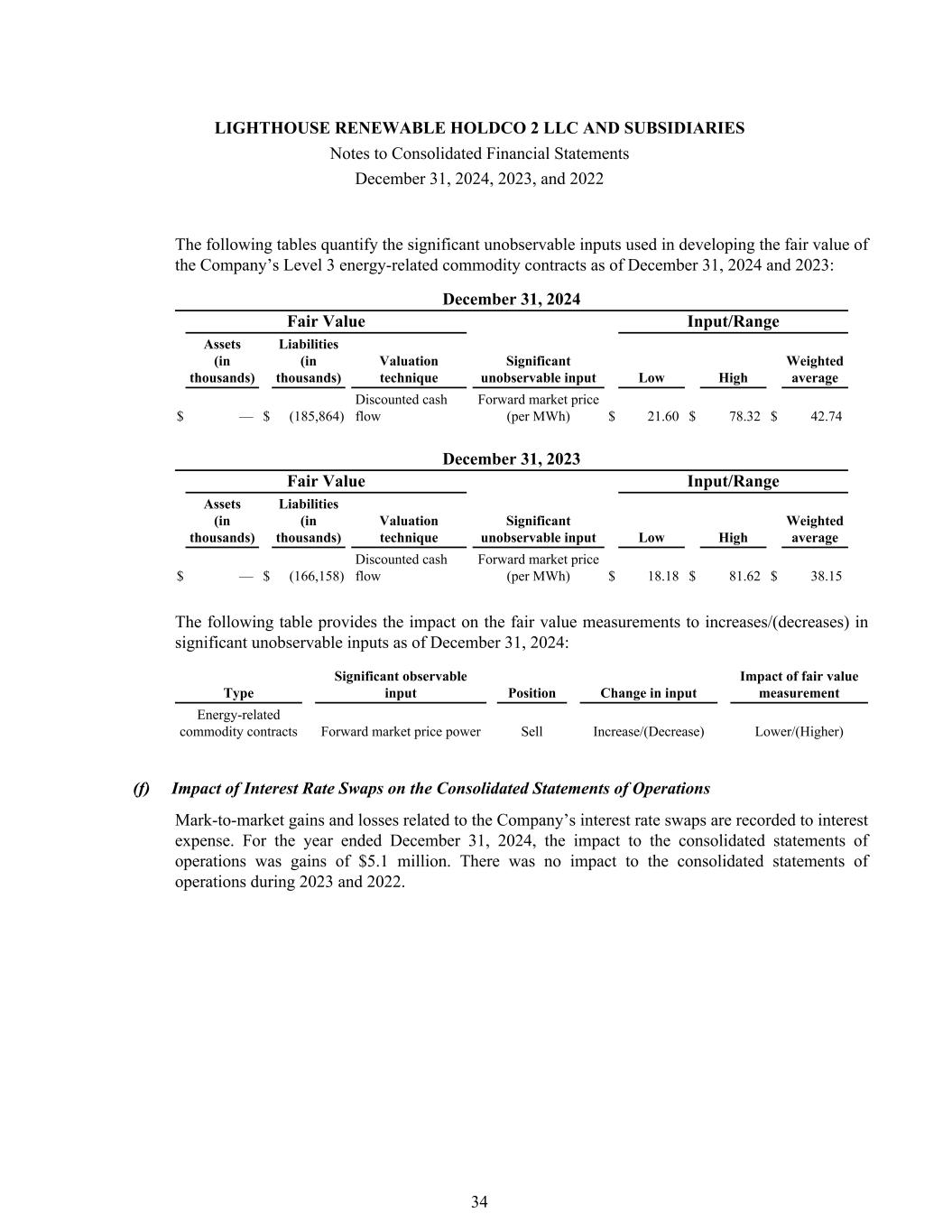

Derivative instruments, consisting of interest rate swaps, are recorded at fair value on the Company’s consolidated balance sheets on a recurring basis and are classified as Level 2 within the fair value hierarchy as the fair value is determined using an income approach, which uses readily observable inputs, such as forward interest rates and contractual terms to estimate fair value. Derivative instruments, consisting of energy-related commodity contracts, are recorded at fair value on the Company’s consolidated balance sheets on a recurring basis and are classified as Level 3 within the fair value hierarchy. Management uses quoted observable forward prices, and to the extent that quoted observable forward prices are not available, the quoted prices reflect the average of the forward prices from the prior year, adjusted for inflation. The Company’s energy-related commodity contracts are executed in illiquid markets. The significant unobservable inputs used in developing fair value include illiquid power tenors and location pricing, which is derived by extrapolating pricing as a basis to liquid locations. The tenor pricing and basis spread are based on observable market data when available or derived from historic prices and forward market prices from similar observable markets when not available. The fair value of each contract is discounted using a risk-free interest rate. In addition, the Company applies a credit reserve to reflect credit risk, which for interest rate swaps is calculated using the bilateral method based on published default probabilities. For commodities, to the extent that the Company’s net exposure under a specific master agreement is an asset, the Company uses the counterparty’s default swap rate. If the net exposure under a specific master agreement is a liability, the Company uses a proxy of its own default swap rate. For interest rate swaps and commodities, the credit reserve is added to the discounted fair value to reflect the exit price that a market participant would be willing to receive to assume the Company’s liabilities or that a market participant would be willing to pay for the Company’s assets. As of December 31, 2024, the non-performance reserve was a $10.1 million gain recorded primarily to total operating revenues in the consolidated statements of operations. For further discussion, see note 4, Accounting for Derivative Instruments and Hedging Activities. (n) Commitments and Contingencies In the normal course of business, the Company is subject to various claims and litigation. Management of the Company expects that these various litigation items will not have a material adverse effect on the results of operations, cash flows, or financial position of the Company. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 27

(o) Asset Retirement Obligations The Company accounts for its asset retirement obligations, or AROs, in accordance with ASC 410-20, Asset Retirement Obligations, or ASC 410-20. Retirement obligations associated with long-lived assets included within the scope of ASC 410-20 are those for which a legal obligation exists under enacted laws, statutes, and written or oral contracts, including obligations arising under the doctrine of promissory estoppel, and for which the timing and/or method of settlement may be conditional on a future event. ASC 410-20 requires an entity to recognize the fair value of a liability for an ARO in the period in which it is incurred and a reasonable estimate of fair value can be made. Upon initial recognition of a liability for an ARO, other than when an ARO is assumed in an acquisition of the related long-lived asset, the Company capitalizes the asset retirement cost by increasing the carrying amount of the related long-lived asset by the same amount. Over time, the liability is accreted to its future value, while the capitalized cost is depreciated over the useful life of the related asset. See note 9, Asset Retirement Obligations, for further information. (p) Tax Equity Arrangements Certain portions of the Company’s noncontrolling interests in subsidiaries represent third-party interests in the net assets under certain tax equity arrangements, which are consolidated by the Company. The Company has determined that the provisions in the contractual agreements of these structures represent substantive profit sharing arrangements. Further, the Company has determined that the appropriate methodology for calculating the noncontrolling interest that reflects the substantive profit sharing arrangements is a balance sheet approach utilizing the hypothetical liquidation at book value, or HLBV, method. Under the HLBV method, the amounts reported as noncontrolling interests represent the amounts the tax equity investor would hypothetically receive at each balance sheet date under the liquidation provisions of the contractual agreements, assuming the net assets of the funding structures were liquidated at their recorded amounts determined in accordance with U.S. GAAP. The tax equity investor’s interest in the results of operations of the funding structures are determined as the difference in noncontrolling interests at the start and end of each reporting period, after taking into account any capital transactions between the structures and the funds’ investors. The calculations utilized to apply the HLBV method include estimated calculations of taxable income or losses for each reporting period. In addition, in certain circumstances, the Company and its partners in the tax equity arrangements agree that certain tax benefits are to be utilized outside of the tax equity arrangements, which may result in differences in the amount an investor would hypothetically receive at the initial balance sheet date calculated strictly in accordance with related contractual agreements. These differences are recognized in the consolidated statements of operations using a systematic and rational method over the period during which the investor is expected to achieve its target return. (q) Comprehensive Loss The Company’s total comprehensive loss is equal to its net loss for the years ended December 31, 2024, 2023, and 2022. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 28

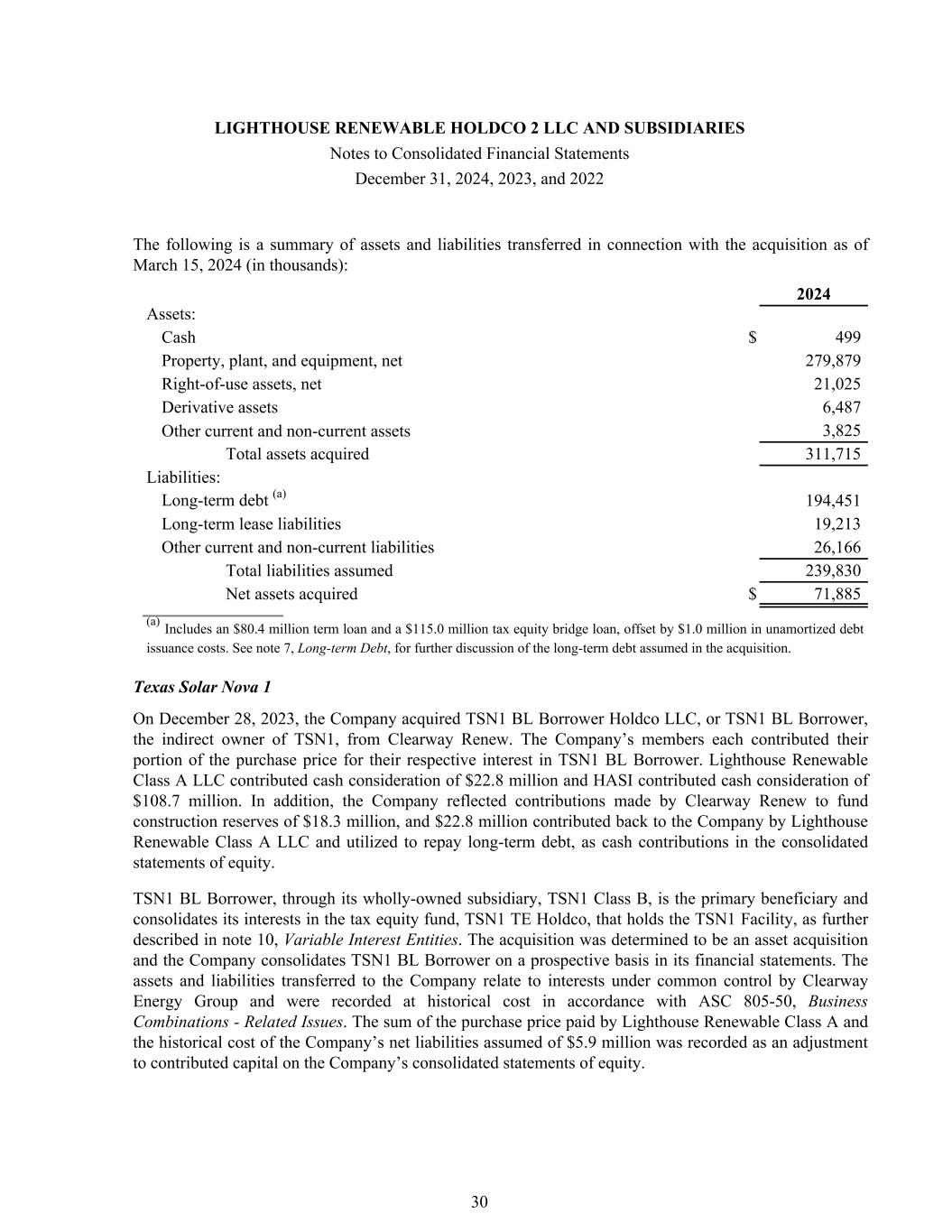

(r) Use of Estimates The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period, including the fair value of the energy-related commodity contract derivatives. Actual results may differ from those estimates. (3) Acquisitions Texas Solar Nova 2 On March 15, 2024, the Company, through its indirect subsidiary TSN1 TE Holdco, acquired TSN2 from Clearway Renew. TSN1 TE Holdco’s purchase price consisted of $111.9 million paid to the seller, $16.7 million of which was contributed by Lighthouse Renewable Class A LLC and $95.2 million was contributed by HASI. In addition, the Company reflected contributions made by Clearway Renew, to fund construction reserves of $16.9 million and to fund transaction related expenses of $6.4 million, as cash contributions in the consolidated statements of equity. The Company, through its indirect ownership of TSN1 Class B, is the primary beneficiary and consolidates its interests in the tax equity fund, TSN1 TE Holdco, that holds the TSN2 Facility, as further described in note 10, Variable Interest Entities. The acquisition was determined to be an asset acquisition and the Company consolidates TSN2 on a prospective basis in its financial statements. The assets and liabilities transferred to the Company relate to interests under common control by Clearway Energy Group and were recorded at historical cost in accordance with ASC 805-50, Business Combinations - Related Issues. The difference between the purchase price paid by Lighthouse Renewable Class A and the historical cost of the Company’s net assets acquired of $71.9 million was recorded as an adjustment to contributed capital on the Company’s consolidated statements of equity. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 29

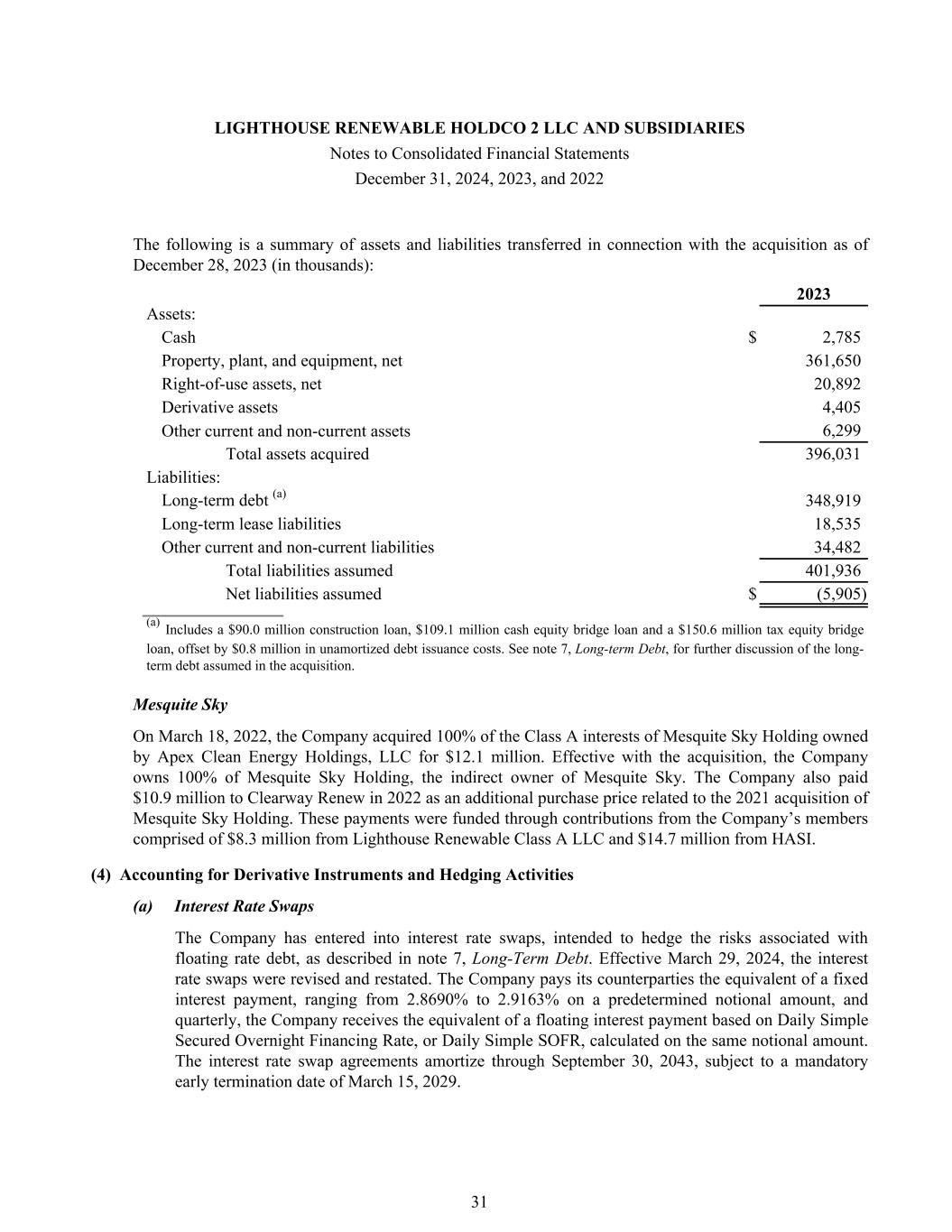

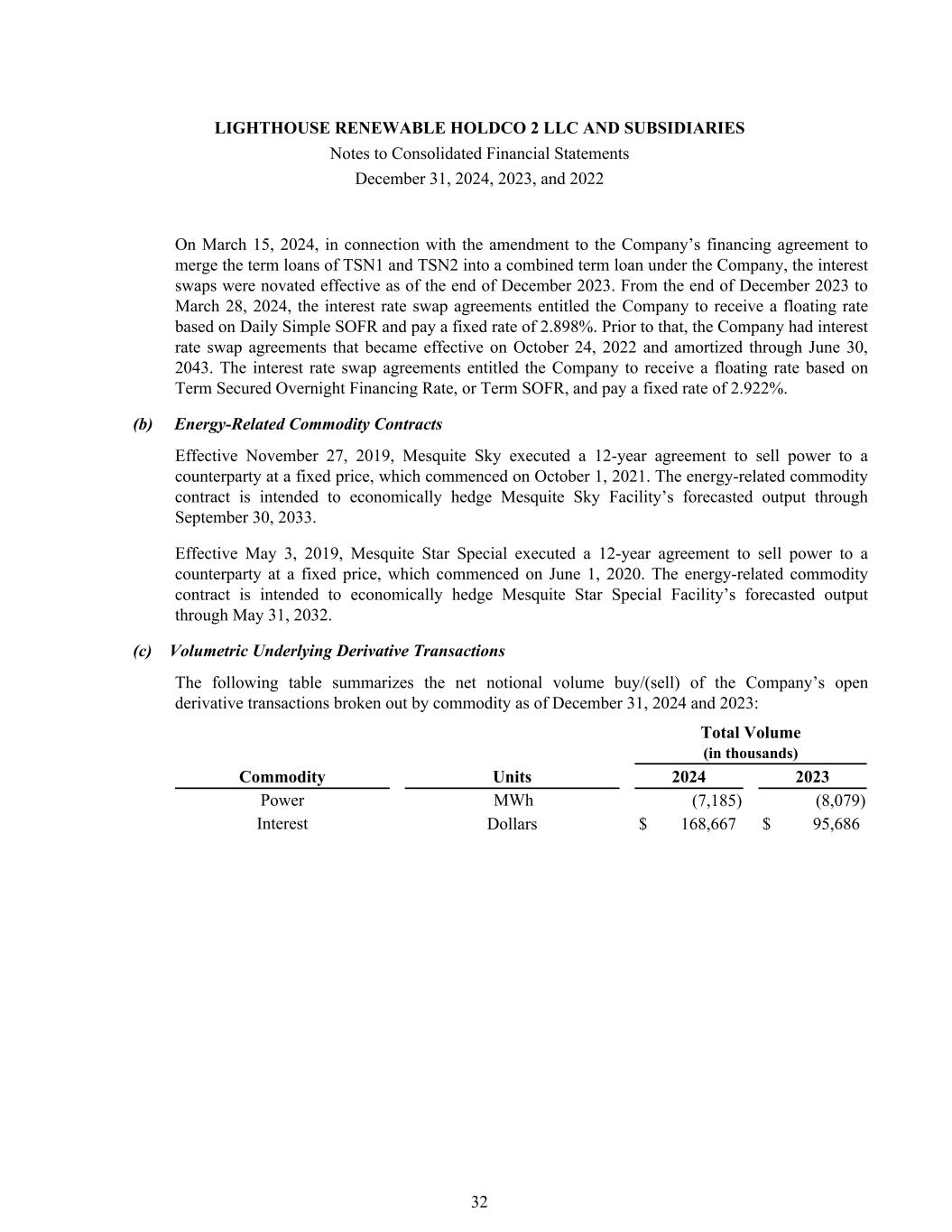

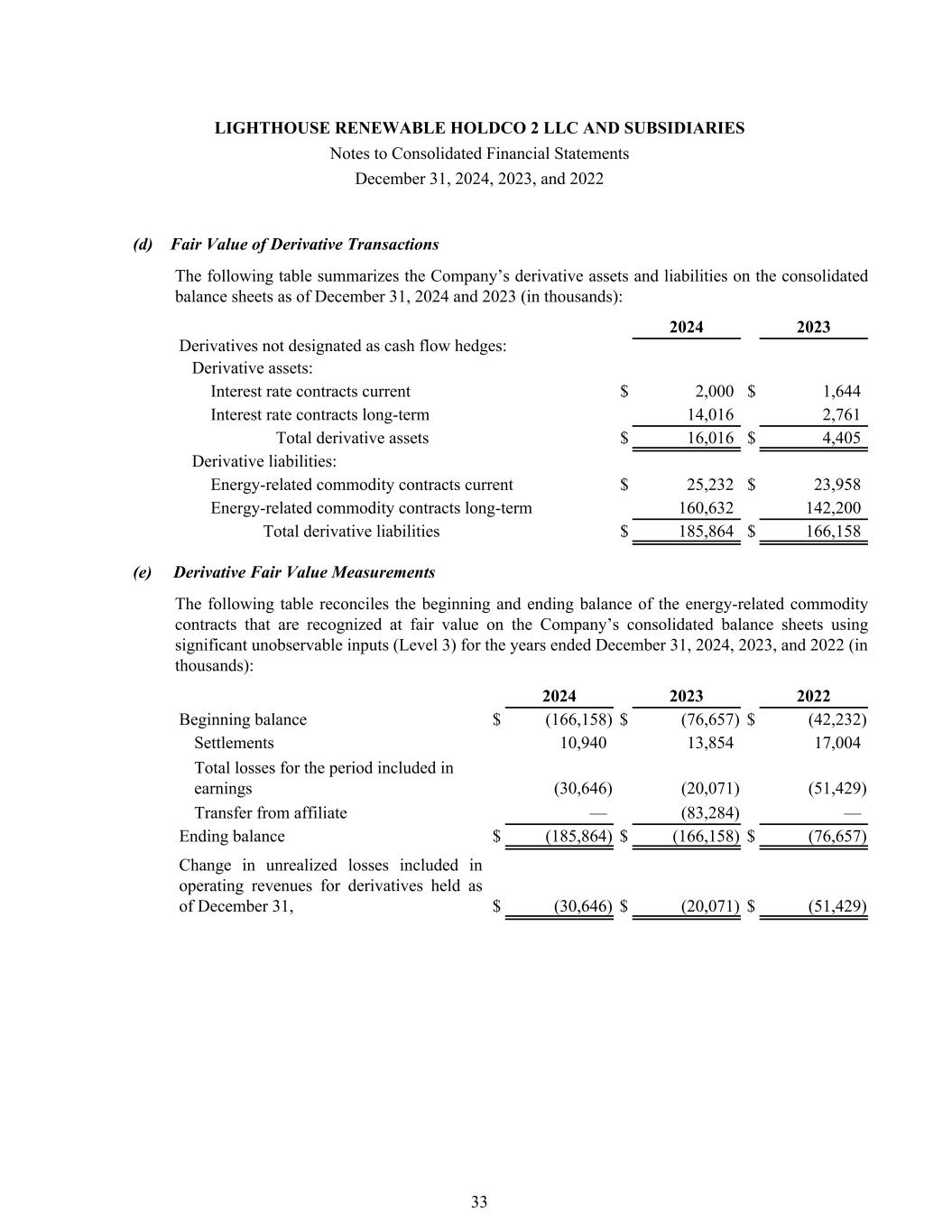

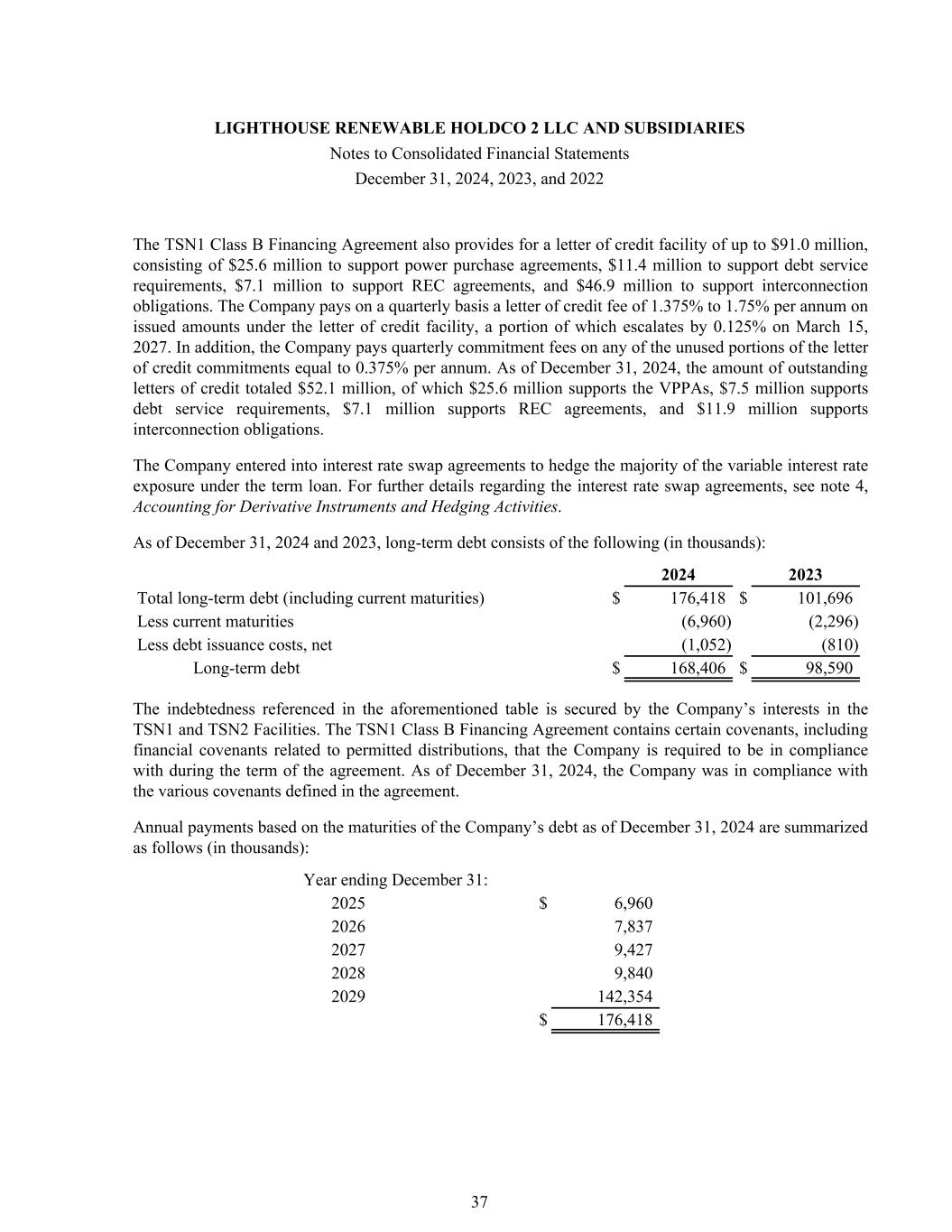

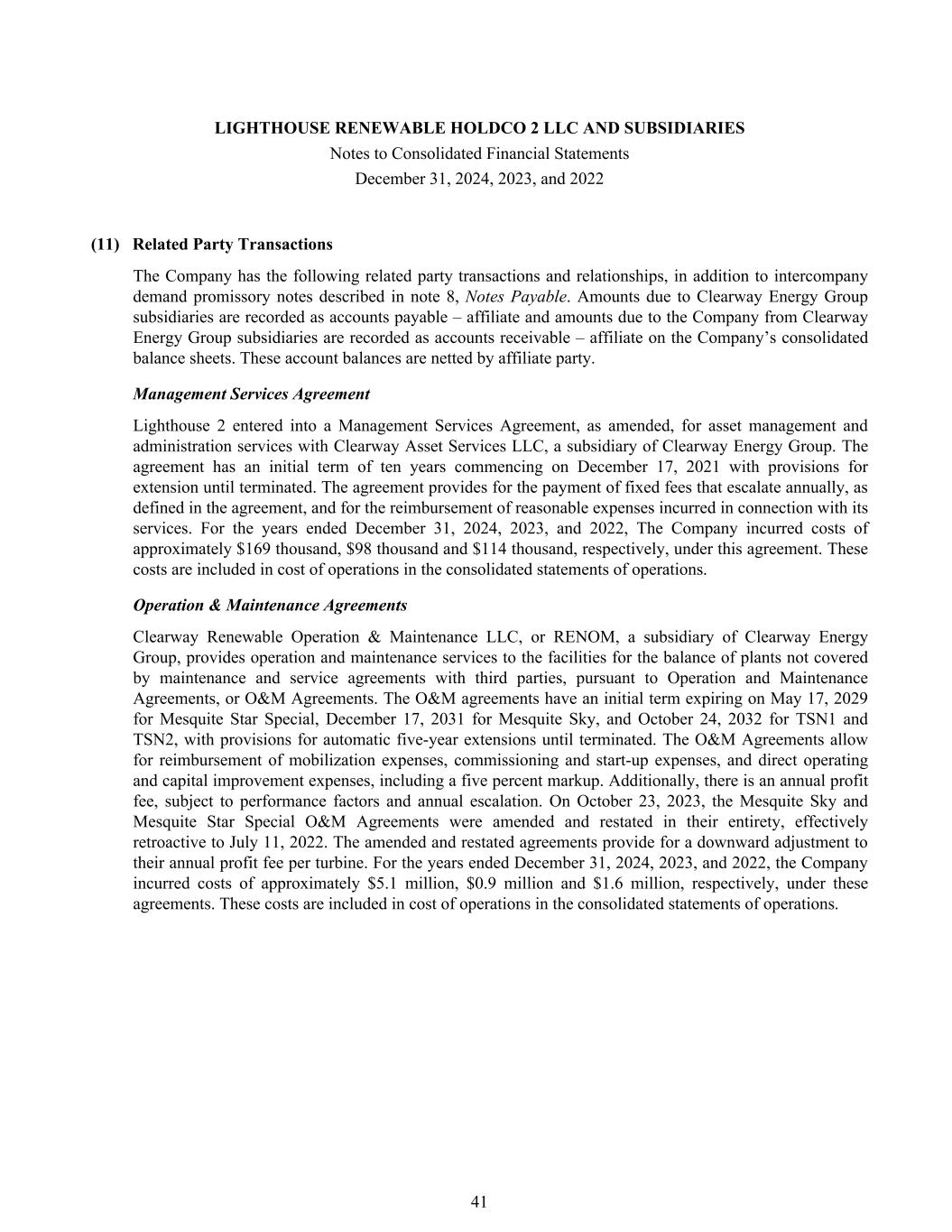

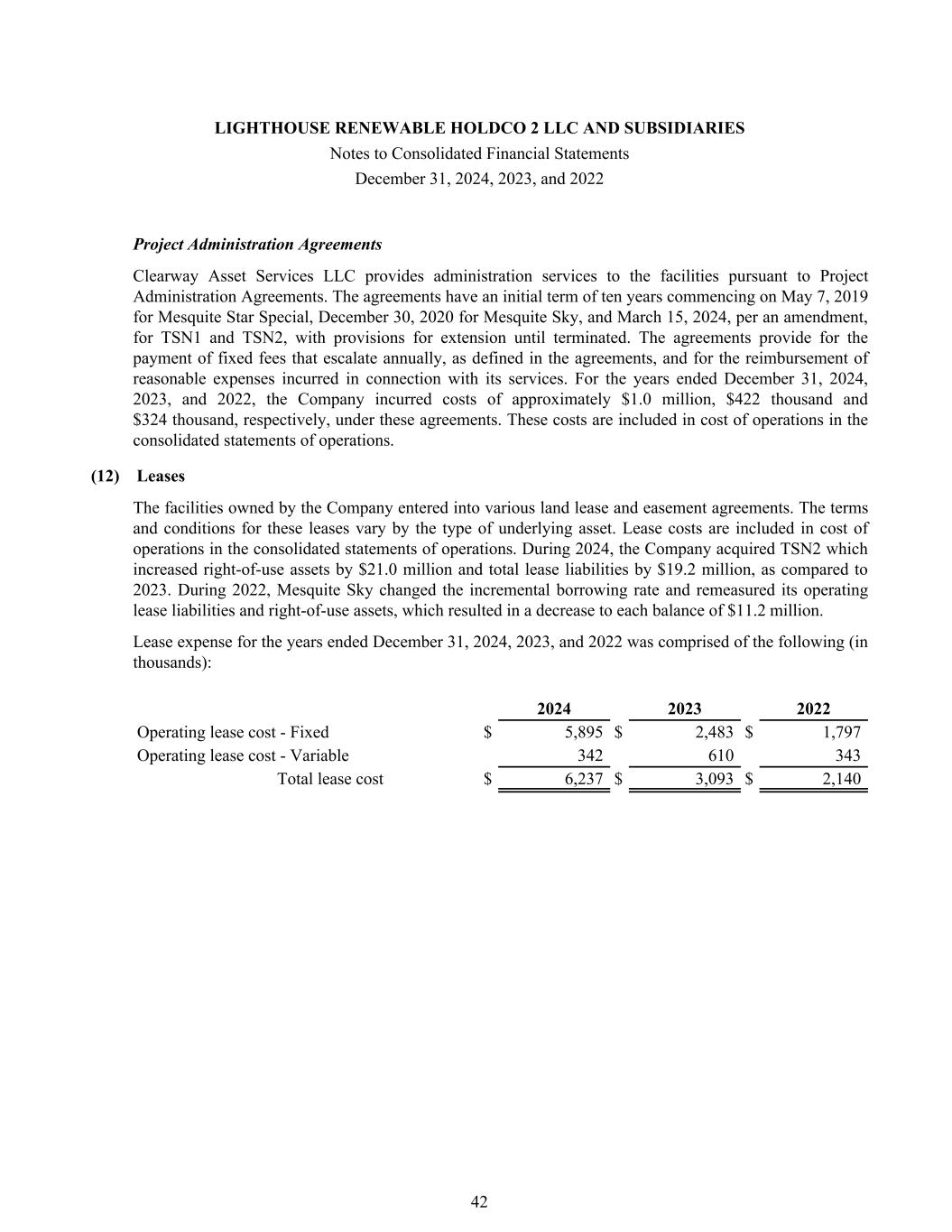

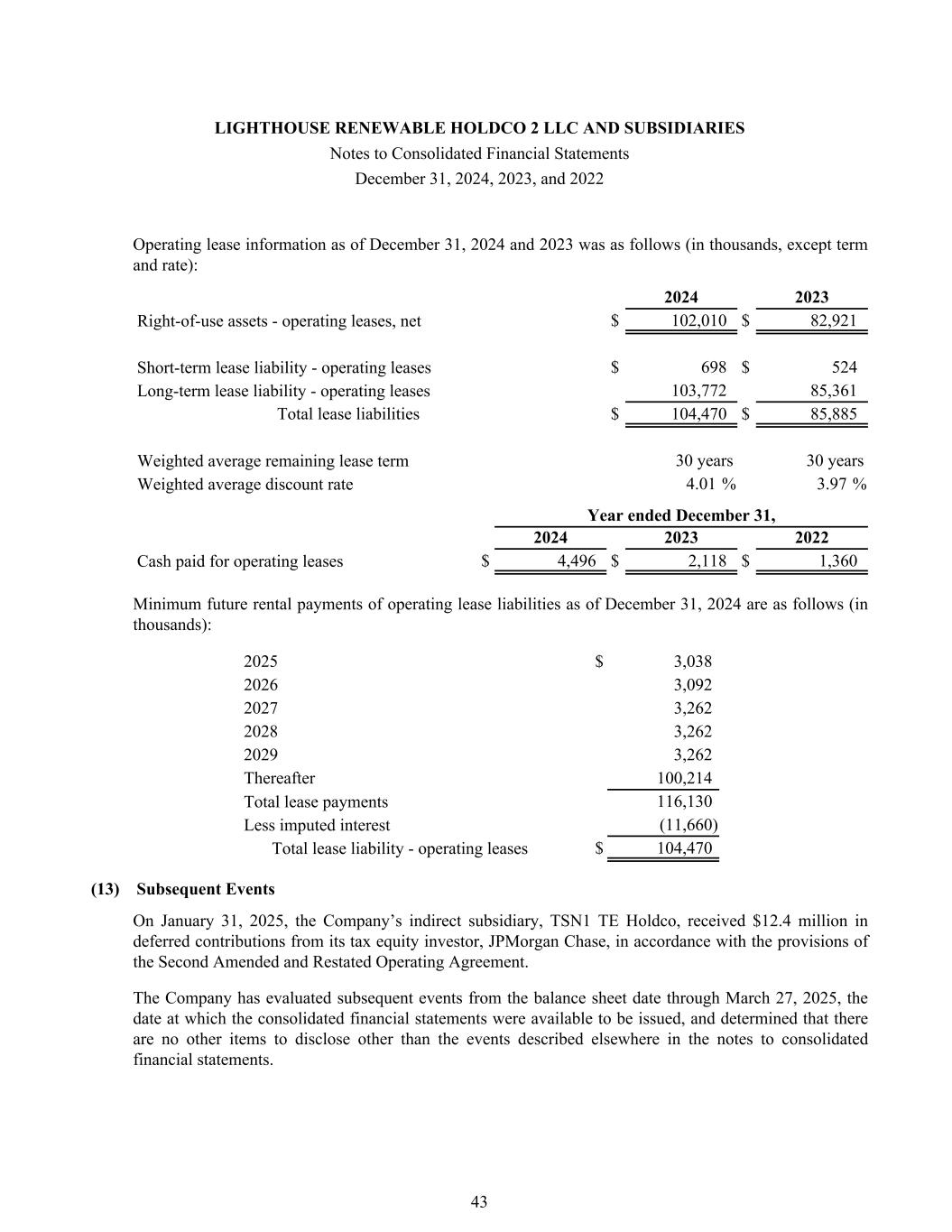

The following is a summary of assets and liabilities transferred in connection with the acquisition as of March 15, 2024 (in thousands): 2024 Assets: Cash $ 499 Property, plant, and equipment, net 279,879 Right-of-use assets, net 21,025 Derivative assets 6,487 Other current and non-current assets 3,825 Total assets acquired 311,715 Liabilities: Long-term debt (a) 194,451 Long-term lease liabilities 19,213 Other current and non-current liabilities 26,166 Total liabilities assumed 239,830 Net assets acquired $ 71,885 (a) Includes an $80.4 million term loan and a $115.0 million tax equity bridge loan, offset by $1.0 million in unamortized debt issuance costs. See note 7, Long-term Debt, for further discussion of the long-term debt assumed in the acquisition. Texas Solar Nova 1 On December 28, 2023, the Company acquired TSN1 BL Borrower Holdco LLC, or TSN1 BL Borrower, the indirect owner of TSN1, from Clearway Renew. The Company’s members each contributed their portion of the purchase price for their respective interest in TSN1 BL Borrower. Lighthouse Renewable Class A LLC contributed cash consideration of $22.8 million and HASI contributed cash consideration of $108.7 million. In addition, the Company reflected contributions made by Clearway Renew to fund construction reserves of $18.3 million, and $22.8 million contributed back to the Company by Lighthouse Renewable Class A LLC and utilized to repay long-term debt, as cash contributions in the consolidated statements of equity. TSN1 BL Borrower, through its wholly-owned subsidiary, TSN1 Class B, is the primary beneficiary and consolidates its interests in the tax equity fund, TSN1 TE Holdco, that holds the TSN1 Facility, as further described in note 10, Variable Interest Entities. The acquisition was determined to be an asset acquisition and the Company consolidates TSN1 BL Borrower on a prospective basis in its financial statements. The assets and liabilities transferred to the Company relate to interests under common control by Clearway Energy Group and were recorded at historical cost in accordance with ASC 805-50, Business Combinations - Related Issues. The sum of the purchase price paid by Lighthouse Renewable Class A and the historical cost of the Company’s net liabilities assumed of $5.9 million was recorded as an adjustment to contributed capital on the Company’s consolidated statements of equity. LIGHTHOUSE RENEWABLE HOLDCO 2 LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2024, 2023, and 2022 30